This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

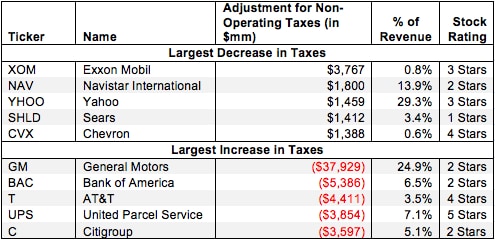

In the reports we’ve done so far, we’ve gone through several of the adjustments we make to reveal a company’s core operating profit, or NOPAT. It’s important to understand, however, that the removal of income and expenses has an effect on the true taxes a company pays as well. Without removing the tax impact of non-operating items, one still gets a distorted picture of a company’s operating profitability.

4 replies to "Non-Operating Tax Adjustment – NOPAT Adjustment"

Hi,

I understand how Cash Operating Taxes are calculated as (NOPBT – the Change in Total Reserves) * Cash tax rate.

But would you mind discussing a little more the formula you use to compute the cash tax rate?

I have not been able to match your numbers.

Sincerely

Thanks for your question. Our cash tax rate calculation uses a company’s reported effective tax rate and then adjusts for any non-operating income/expense for which the company provides both a pre and post-tax amount. These non-recurring items can often generate tax benefits/liabilities at a much different level than normal operating income, so it’s important to account for them to calculate a company’s real recurring tax rate. Finally, we account for any unusual standalone tax benefits/charges (especially relevant this year and last with the impact of tax reform).

Hi,

In an earlier document (https://www.newconstructs.com/wp-content/uploads/2020/12/UpdatingHistoricalCashTaxRates_2020-12-11-1.pdf) you spoke about cash tax rates, and you have also computed “normalized changes in deferred taxes”. It’s not clear to me whether the three year average is an average of cash tax rates for those three years, or an average of changes of deferred taxes across three years, assuming that is what is meant by normalized changes in deferred taxes.

Hi Rupert,

Thanks for your question. The three year average is an average of cash tax rates for those three years, yes. We use a three-year normalized rate based on reported taxes adjusted for annual changes in reserves. Don’t hesitate to let us know if you have any follow up questions. You can also reach out to support@newconstructs.com at any time.

Best,

Tam