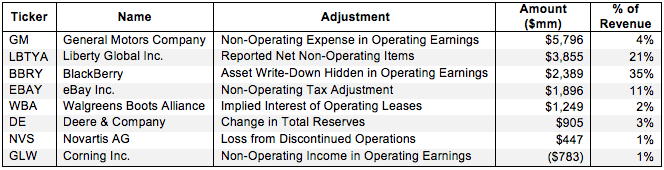

The 8 Largest Adjustments to EPS for 2014

Did misleading GAAP earnings cost you or your clients money in 2014?

GAAP rules were originally designed for debt investors, not equity investors, and are often manipulated by companies to manage earnings. We make over 30 types of adjustments to strip out the effects of the loopholes and tricks companies use to alter their profitability. These adjustments help us calculate net operating profit after tax (or "NOPAT"), the most accurate measure of a company’s recurring cash flows.

For example, Cigna Corporation (CI) reported that its GAAP net income in 2013 declined nearly 10%, causing a sharp selloff in the stock in early 2014. Removing $934 million in non-operating expenses, including over $700 million relating to benefits expense revealed that Cigna's NOPAT was actually 13% greater in 2013 than the previous year. Cigna was up 19% in 2014 after the market adjusted for this accounting hard fake.

There are countless other examples of how footnotes diligence could have made investors money in 2014. We've compiled a "top 8" list of the companies (who have already filed for 2014) with the largest adjustments to GAAP net income.

The Largest Individual $ Value Adjustments  General Motors Company — $5.8 Billion in Hidden Non-Operating Expenses Removed From Net Income Hidden non-operating expenses are unusual charges that don’t appear on the income statement because they are bundled in other line items. Examples of hidden non-operating expenses include: restructuring or severance costs, litigation costs and certain pension costs/income. General Motors’ net income in 2014 was artificially deflated due to these expenses, which included $2 billion related to recall campaigns, $400 million for ignition switch recalls, and over $400 million due to the devaluation of the Venezuelan currency. We remove these items to derive NOPAT because they are non-recurring expenses that do not reflect the continuing, core cash flows of the business.

General Motors Company — $5.8 Billion in Hidden Non-Operating Expenses Removed From Net Income Hidden non-operating expenses are unusual charges that don’t appear on the income statement because they are bundled in other line items. Examples of hidden non-operating expenses include: restructuring or severance costs, litigation costs and certain pension costs/income. General Motors’ net income in 2014 was artificially deflated due to these expenses, which included $2 billion related to recall campaigns, $400 million for ignition switch recalls, and over $400 million due to the devaluation of the Venezuelan currency. We remove these items to derive NOPAT because they are non-recurring expenses that do not reflect the continuing, core cash flows of the business.

Liberty Global Inc. — $3.9 Billion in Reported Non-Operating Expenses Removed From Net Income Net non-operating items are commonly found in a company’s financial statements. Income statement adjustments include financing items like interest expense and income, preferred dividends and minority interest income. These items are related to the financing of a company’s operations, not the operations themselves. Liberty Global included over $2.5 billion of interest expense in non-operating earnings. We remove these non-recurring items for our NOPAT calculation to get a picture of the core profitability of the company. This adjustment, along with others meant Liberty Global’s NOPAT was $2.6 billion, compared to a -$695 million GAAP loss.

BlackBerry — $2.4 Billion in Asset Write-Down Expense Removed From Net Income Asset write-downs are unusual charges that don’t appear on the income statement because they are bundled in other line items. Write-downs are a form of shareholder equity destruction as they artificially reduce the carrying value of assets reported on the balance sheet. In turn, they also artificially boost profitability metrics like return on assets by lowering the denominator. Blackberry wrote down over $2.7 billion in long-term assets on a pre-tax basis in 2014. While removing this charge did increase Blackberry’s NOPAT, we still hold the company accountable for these assets in invested capital. Doing so decreases Blackberry’s return on invested capital (ROIC), which now sits at -13%.

eBay — $1.9 Billion in Non-Operating Taxes Removed From Net Income The removal of income and expenses has an effect on the taxes a company should pay. Without removing the tax impact of non-operating items, one still gets a distorted picture of a company’s operating profitability. We calculate the true operating taxes by removing the tax benefit from non-operating expenses and income from reported income tax. Adding these non-recurring items back to income reveals the operating tax rate, which can then be multiplied by pre-tax operating profit to determine true operating taxes. eBay’s taxes were adjusted downward by $1.8 billion in 2014.

Walgreens Boots Alliance — $1.2 Billion in Implied Interest Expense Removed From Net Income Operating leases are a form of off-balance sheet debt. Two companies with identical operations would have very different financial statements if one funds asset purchases with debt while the other utilized operating leases. Our models make the financials of the two companies comparable. We deduct the implied interest expense (based on the present value of the operating leases) from NOPAT in an effort to capitalize the operating leases on the balance sheet. This adjustment ensures the NOPAT and balance sheets of the two companies are comparable. We removed interest expense from NOPAT because NOPAT is an unlevered measure of a business’ recurring cash flows. In 2014, we removed over $1.2 billion in implied interest expense, which increased WBA’s NOPAT to $3.7 billion compared to its $1.9 billion in GAAP net income.

Deere & Company — $905 Million in Loan Loss Provision Expenses Removed From Net Income Change in total reserves is the year over year difference in a company’s loan loss and/or inventory reserves. The change in reserves is positive (increased NOPAT vs. net income) whenever the loss provisions exceed actual charge-offs or LIFO reserves increase. Deere added $905 million to loan loss reserves in 2014, thereby lowering its net income. GAAP net income understated Deere’s true NOPAT by this $905 million. Taking into account other adjustments we make, such as those mentioned above, Deere’s NOPAT in 2014 was $4.4 billion compared to its $3.1 billion reported GAAP net income.

Novartis AG — $447 Million Loss From Discontinued Operations Removed From Net Income When a company designates a portion of its business as held for sale, the company is required under GAAP to account for any income/loss from these divisions or from the sale of these divisions as income/loss from discontinued operations. We remove all income and losses from discontinued operations in calculating operating profit because this income/loss will not recur in the future. We removed $447 of income from discontinued operations in 2014 thereby lowering Novartis’ NOPAT. However, when coupled with other adjustments, Novartis’ NOPAT was actually higher than its GAAP net income.

Corning Inc. — $783 Million in Non-Operating Income Removed From Operating Earnings Non-operating items in operating income are unusual gains that don’t appear on the income statement because they are bundled in other line items. Just as with non-operating expenses, we also remove non-operating income, an example of which would be lawsuit settlements or other legal settlements. In 2014, we removed $783 million in non-operating income, which included $365 million from the reduction of liability, a gain on derivatives, foreign tax credits, and an energy tax credit. Removing these non-recurring incomes revealed Corning’s NOPAT to be $1.5 billion, well below the company’s $2.4 billion GAAP net income.

If you liked this report, get more free research by signing up below

Downloads

Due Diligence Done Right

We’re focused on getting to the bottom of earnings numbers. Analyzing the footnotes and MD&A is the only way to get a clear picture of a company. We read the fine print so you don’t have to.