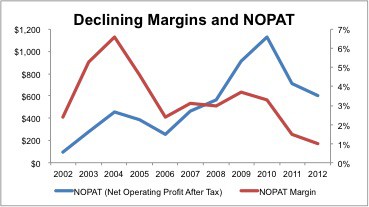

Danger Zone: Value Destroying Buybacks

Companies often buyback shares when their stock is at the highest point, and they sometimes pass up profitable investments or even go into debt to do the buybacks.

Sam McBride