The Alpha Stocks 2.0 Bundle: 3,350+ Stocks Analyzed. Less than 0.2% Make the Cut.

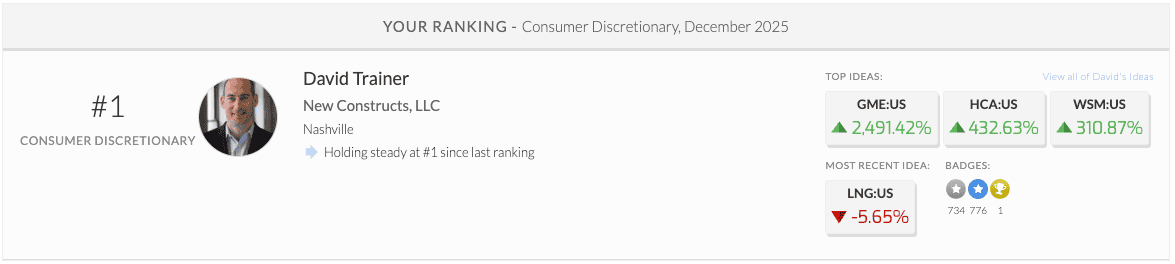

Access the proprietary "Earnings Distortion" data that has ranked #1 against 16,000 professional investors for 54 straight months.

The game is rigged. But not in the way you think.

Do you think people should get paid when they are not doing their job?

What if I told you that ~100% of active managers underperform their benchmarks over a 10-year period?

It's true.

Most Wall Street analysts and fund managers have stopped reading the footnotes.

They miss critical details buried in the footnotes - the off-balance-sheet liabilities, the pension adjustments, the stock-based compensation schemes that distort true profitability.

Worst of all, because they are all using the same flawed data, they all get the same mediocre results.

But their failure is your opportunity.

Your Edge: Economic Earnings > GAAP Earnings

At New Constructs, we do the work Wall Street refuses to do.

Our Robo-Analyst AI has processed over 200,000 financial filings. It reads the footnotes. It extracts the hidden items. It calculates the truth.

We find the companies where Economic Earnings (the true cash flows) are significantly higher than GAAP Earnings (the accounting fiction).

When you combine that with our Reverse Discounted Cash Flow (DCF) model, you can identify stocks where the market's expectations are too pessimistic.

We call these “Alpha Stocks.”

They are the 0.2% outliers - the companies that are mathematically undervalued and poised for explosive upside.

Last year's Alpha Stocks outperformed the S&P 500 by an average of 600+ basis points, even as the market hit all-time highs.

A few specific picks delivered individual returns of:

122% gain in a Consumer Discretionary Company:

38% gain in a Health Care company:

28% gain in a Consumer Discretionary Company:

And for 54 straight months, our stock picking has been ranked #1 on SumZero, beating out over 16,000 professional peers.

The Offer: Alpha Stock 2.0 Bundle

We have just completed our latest screen of 3,350+ stocks.

Less than 0.2% of all stocks met our strict "Alpha" criteria:

-

- Economic Earnings > GAAP Earnings (True Profitability)

- Market-Implied GAP of less than 10 years (Undervalued)

We have packaged these high-conviction ideas into the Alpha Stock 2.0 Bundle.

You also get the exact same research reports that our institutional clients pay $12,000/year to access - delivered directly to your inbox.

Option 1: 3 Alpha Stock Picks

-

- 1 Alpha Stock delivered immediately upon purchase.

- 2 Additional Alpha Stocks delivered within the next 30 days.

- Includes institutional-grade stock reports, Economic Earnings breakdown, and valuation analysis for each pick.

- Investment: $699

Option 2: 5 Alpha Stock Picks

-

- 1 Alpha Stock delivered immediately upon purchase.

- 2 Additional Alpha Stocks delivered within the next 30 days.

- 2 Final Alpha Stocks delivered within 60 days.

- Includes institutional-grade stock reports, Economic Earnings breakdown, and valuation analysis for each pick.

- Investment: $899 (Best Value)

BONUS: Alpha Stock 2.0 Members-Only Call.

To ensure you get off to a swift and successful start, I’ll be throwing in a BONUS Alpha Stock 2.0 Members-only call with me - no matter which tier you select. I’ll show you how to read the detailed report and analyze the data behind the Alpha Stock 2.0 picks, and you can ask me questions on the call.

Why Now

Alpha is time-sensitive.

These stocks are mispriced right now. But as headlines shift, economic data comes out, and the market digests the information, that gap closes.

We are releasing these picks in real-time to give you the "Speed to Edge."

You are not paying for a newsletter. You are paying for the 500,000+ hours of labor it took to analyze over 200,000 filings and learn how to find these needles in the haystack.

The cart closes on Tuesday, December 23rd at 11:59 pm Eastern.

After that, access to this specific bundle disappears.

Don't let the 90% failure rate be your future. Use the data that wins.

Diligence matters,

David Trainer

Founder & CEO, New Constructs

P.S. Remember the persistence stat: Only 8.3% of funds that win in year one manage to win in year two and three. The only way to win consistently is to have a structural data advantage. This bundle is that Alpha advantage.