For a Limited Time: Front-Run Wall Street with AI-Powered Earnings Predictions

You've seen the headlines. Earnings season is underway. Some companies will beat. Some will miss. The market will react violently to both.

Our research reveals a different picture than consensus Street Earnings.

Reliance on Street Earnings - easily manipulated numbers Wall Street prefers - is an out-of-date approach.

At New Constructs, we do not hope. We predict.

Our proprietary Robo-Analyst AI Agent does what no human can: it reads millions of pages of SEC filings, including the footnotes where the real truth is buried. We uncover a company's true Core Earnings, not the easily manipulated GAAP numbers.

That is why, for a limited time, we are offering The Earnings Distortion Power Pack: 9 Beat/Miss Picks + 2 Model Portfolios.

It's a complete system for both offense and defense, giving you an essential playbook to navigate the remainder of Q3 earnings season and beyond.

Inside Your Power Pack: A Two-Part Strategy for Positioning & Protection

Part 1: Your Offensive Edge – The Q3 Beat/Miss Predictions:

4 Stocks Most Likely to Beat Q3 Earnings

These are companies where our Robo-Analyst found Core Earnings significantly higher than Street Earnings. Last quarter, we correctly predicted 4 out of 5 beats: Synchrony Financial (SYF), DaVita Inc. (DVA), Arch Capital Group (ACGL), and NVR Inc. (NVR).

5 Stocks Most Likely to Miss Q3 Earnings

These are companies where Street Earnings are overstated relative to Core Earnings. Last quarter, we correctly flagged Truist Financial (TFC) and Caesars Entertainment (CZR), with 4 out of 5 miss picks underperforming the market.

Every report includes the forensic breakdown: what we found in the footnotes and the fundamental quality assessment.

Part 2: Your Portfolio Strategy — Most Attractive & Most Dangerous Stocks:

Most Attractive Stocks Model Portfolio:

This portfolio identifies companies with high-quality earnings and cheap valuations. Rising ROIC. Positive Core Earnings and Free Cash Flow. You get roughly 20 large/mid-cap and 20 small-cap stocks, updated monthly.

Performance since inception through 2Q25: +587% vs. S&P 500's +351%.

Most Dangerous Stocks Model Portfolio:

This portfolio identifies companies with misleading GAAP earnings, falling Economic Earnings, and expensive valuations. You get roughly 20 large/mid-cap and 20 small-cap stocks, updated monthly. This is your early-warning system for portfolio risk.

Performance since inception through 2Q25: -77% vs. short S&P 500/Russell 2000 -89%.

BONUS: Members-Only Live Training with David Trainer (A $1,000 Value)

To ensure you can apply this research with confidence, you get exclusive access to a live training session where we go deeper on implementation, walk through specific examples, and take ticker requests from attendees.

Select Your Plan and Secure The Earnings Distortion Power Pack Today

The combined value of these reports, Model Portfolios for one year, and training is over $5,000. However, for this limited-time promotion, you can gain access for a fraction of that cost.

OPTION 1: 6-Month All-Access

$3,594!

Only $799

OPTION 2: 9-Month All-Access

$4,641

Only $999

OPTION 3: 12-Month All-Access

$5,034

Only $1,299

Proof Our Methodology Works

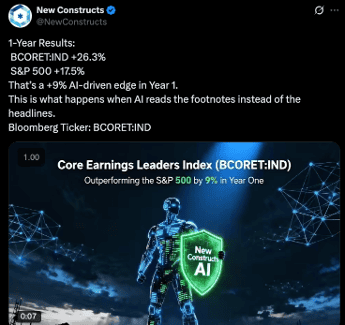

Real-Time Validation: The Bloomberg New Constructs Core Earnings Leaders Index (BCORET:IND) beat the S&P 500 by 9 percentage points in its first year (+26.3% vs. +17.5%). This is the same Core Earnings methodology that powers the Power Pack.

Superior Research Trusted By The World's Top Financial Institutions

The data behind The Earnings Distortion Power Pack is the same that we provide to institutional clients who trust our research to make critical investment decisions:

-

- Goldman Sachs

- Merrill Lynch

- Morgan Stanley

- Raymond James

- UBS

The SumZero Validation: We've been ranked #1 on SumZero out of 16,000+ buyside professionals for 52 straight months.

The Academic Validation: MIT Sloan, Harvard Business School, Ernst & Young, and the Journal of Financial Economics have all confirmed that Core Earnings forecasts performance better than GAAP or Street Earnings.

The Q3 prints are rolling in. Every day that passes locks in moves you can't front-run.

This is your opportunity to equip yourself with institutional-grade research at a promotional price.

You have until Sunday, October 26th at 11:59 pm EST to select your plan and get immediate access to the Power Pack.