Bloomberg Indices Based on our Superior Research

The market is missing footnotes, and our research is the first and best at collecting footnotes data that delivers novel alpha – as proven by Core Earnings: New Data & Evidence, published in The Journal of Financial Economics.

We are very excited to partner with Bloomberg to bring more investors access to the proven novel alpha in our proprietary data and research.

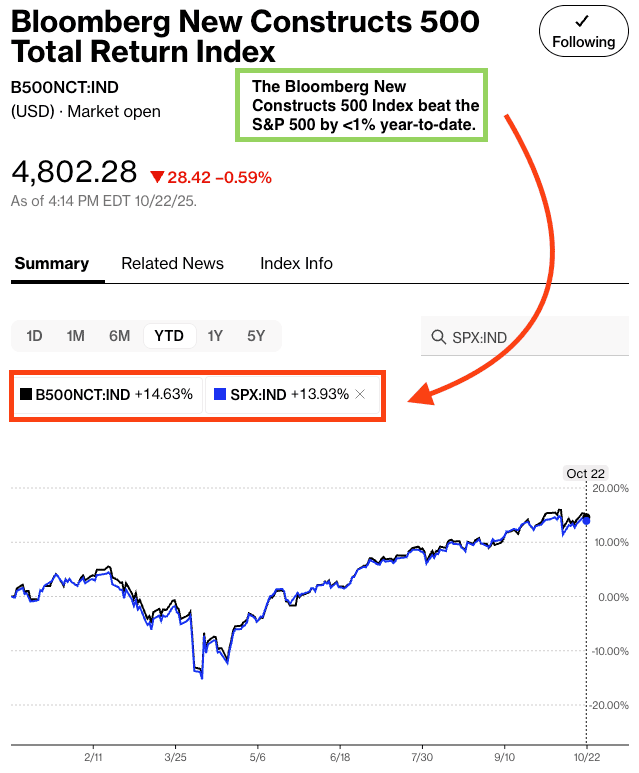

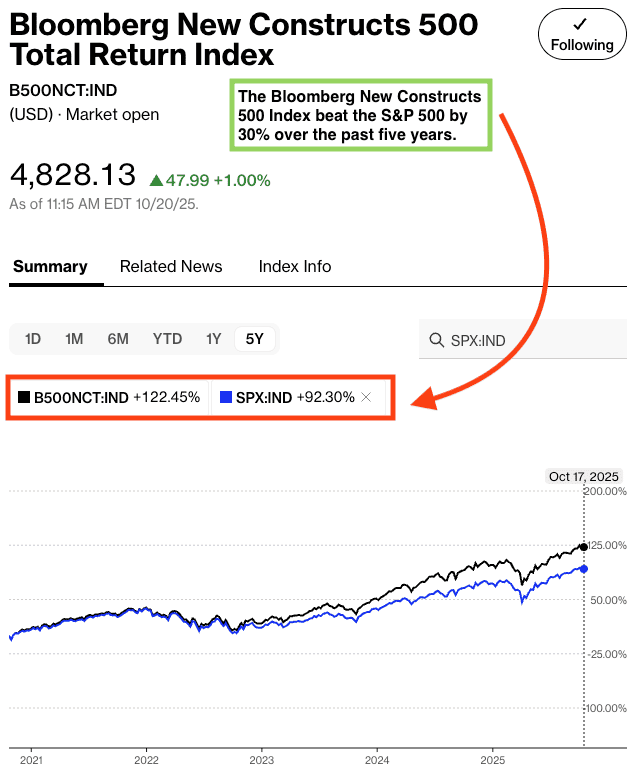

Bloomberg New Constructs 500 Index

Is there a better way to prove the alpha in our research than a live, actively-traded index that outperforms the market?

The only difference between this index and the S&P 500 index is how the holdings are weighted. Our index weights the holdings based on our proprietary Core Earnings while the legacy S&P 500 index weights based on market cap.

Consequently, it is fair to say that the performance of this index shows that weighting stocks based on Core Earnings adds alpha.

Official description of this index: The Bloomberg New Constructs 500 Index, aka Core Earnings-Weighted S&P 500 Index, takes the top 500 stocks by market cap and tilts toward the companies with high Earnings Capture, based on our proprietary Core Earnings data. We like to think of this index as an enhanced version of the S&P 500, and it is enhanced by weighting the holdings based on Core Earnings instead of market cap.

Official docs: Fact Sheet and the Index Methodology.

On the Bloomberg website or terminal, you can track performance with these tickers:

-

- Total Return Index B500NCT:IND

- Price Return Index B500NCP:IND

- Net Return Index B500NCN:IND.

Figure 1: YTD Performance Through October 22, 2025: Beats S&P 500 by <1%

Sources: Bloomberg as of October 22, 2025.

Note: Past performance is no guarantee of future results.

Figure 2: Performance Over Last 5 Years: Beats S&P 500 by 30%

Sources: Bloomberg as of October 17, 2025.

Note: Past performance is no guarantee of future results.

Figure 3: View on the Bloomberg Terminal

Sources: Bloomberg & New Constructs, LLC.

Note: Past performance is no guarantee of future results.