A New Paradigm For Fundamental Stock Analysis

Fundamental financial data for 5,000+ U.S. stocks and bonds, 700+ ETFs and 7,000+ mutual funds with history back to 1998.

Core Earnings & Earnings Distortion Data

Address the flaws in traditional data with a cleaner, better measure of earnings.

- Problem: Legacy data providers miss material unusual gains/losses.

- Solution: Cutting-edge technology collects data - better, faster, cheaper.

- Idiosyncratic alpha: Our proprietary Earnings Distortion data provides a new source of alpha.

Better Fundamental Stock Analysis Data Drives Better Stock Picking

Our Core Earnings are a proven-superior measure of profits compared to legacy providers.

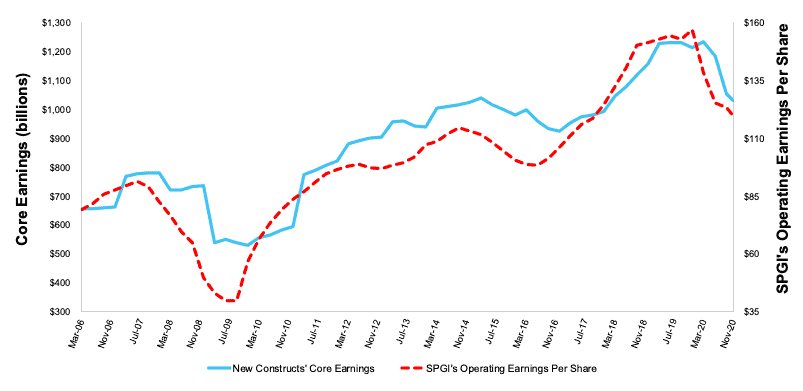

Core Earnings vs. SPGI’s Operating Earnings: 3/31/05 – 11/17/20

Sources: New Constructs, LLC, company filings, and S&P Global.

Note: the most recent periods’ data for SPGI’s Operating Earnings is based on consensus.

Our Core Earnings analysis is based on aggregated TTM data for the S&P 500 constituents in each measurement period.

Get an advantage with our other datasets.

from traditional metrics to deep dives into our adjustments data.

Net Income to NOPAT Reconciliation

The adjustments data to convert Reported Net Income to NOPAT.

Traditional Value Screens - with better data

Get better data for your models.

Price-to-Earnings

Price-to-Book

ROE

Return on Assets

...and more

Enhanced Value Screens

Try our enhanced factors in place of traditional screens.

Earnings

Book Value

ROE, ROA, RNOA

Cash Flow from Ops

Economic Earnings

Invested Capital

ROIC

NOPAT

Investment Ratings

Overall and Component Risk/Reward Investment Ratings on stocks, ETFs and mutual funds. Ratings are updated daily.

Revenue to Adjusted EBITDA Reconciliation

Get the data behind this calculation.

Total Assets to Adjusted Book Value (Invested Capital) Reconciliation

Get the adjustments data we use to convert reported total assets to invested capital.

Accounting Book Value to Adjusted Book Value (Invested Capital) Reconciliation

Get the adjustments data we use to convert accounting book value to invested capital.

Market Value to Enterprise Value Reconciliation

Get the adjustments data we use to convert equity market value to enterprise value.

ROIC – Variations

We empower clients to calculate ROIC however they wish - with the best possible data.

Economic Book Value Details

Get the data behind this calculation.