Bloomberg Indices Based on our Superior Research

The market is missing footnotes, and our research is the first and best at collecting footnotes data that delivers novel alpha – as proven by Core Earnings: New Data & Evidence, published in The Journal of Financial Economics.

We are very excited to partner with Bloomberg to bring more investors access to the proven novel alpha in our proprietary data and research.

Bloomberg New Constructs Core Earnings Leaders Index

The Bloomberg New Constructs Core Earnings Leaders Index tracks the performance of the top 100 companies that have high Earnings Capture based on our proprietary Core Earnings, which removes unusual gains and losses found in the footnotes and MD&A in company filings. The Earnings Capture metric equals Core Earnings minus reported earnings.

Official docs: Fact Sheet and the Index Methodology.

On the Bloomberg website or terminal, you can track performance with these tickers:

-

- Total Return Index BCORET:IND

- Price Return Index BCORE:IND

- Net Return Index BCORENR:IND

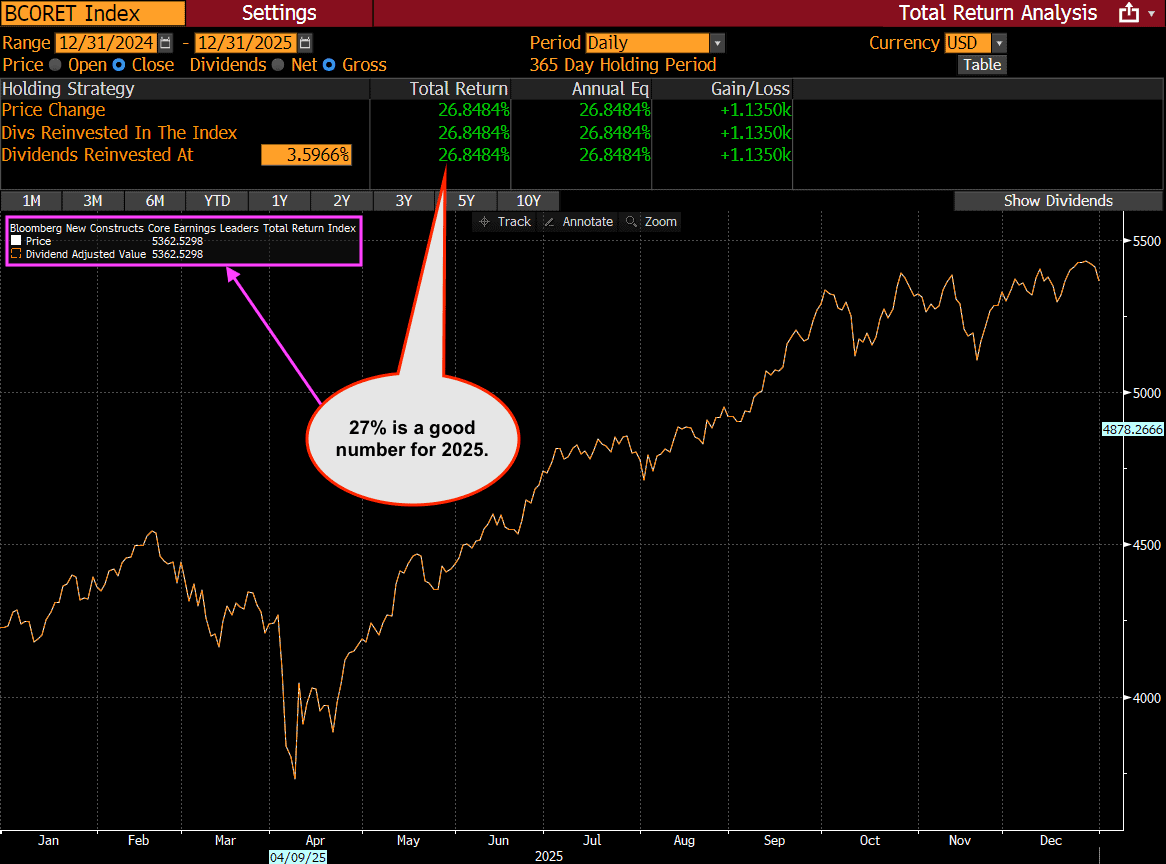

Figure 1: 2025 Performance: Beats S&P 500 by 897 Basis Points

Sources: Bloomberg as of December 31, 2025.

Note: Past performance is no guarantee of future results.

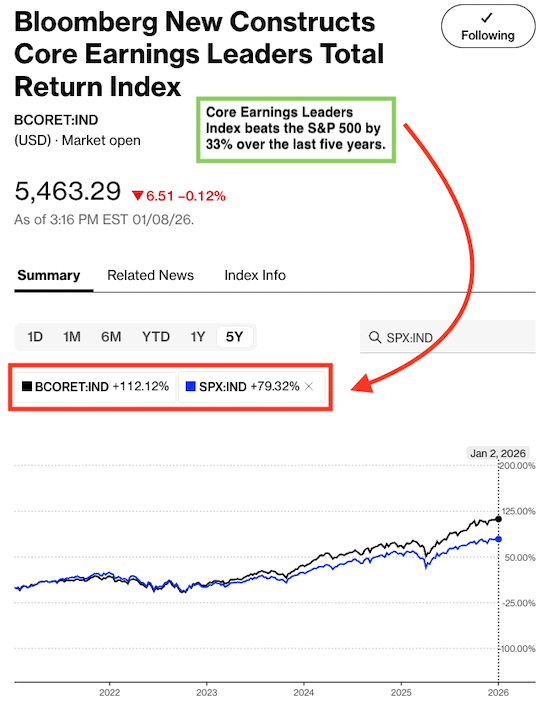

Figure 2: Performance Over Last 5 Years: Beats S&P 500 by 33%

Sources: Bloomberg as of January 2, 2026.

Note: Past performance is no guarantee of future results.

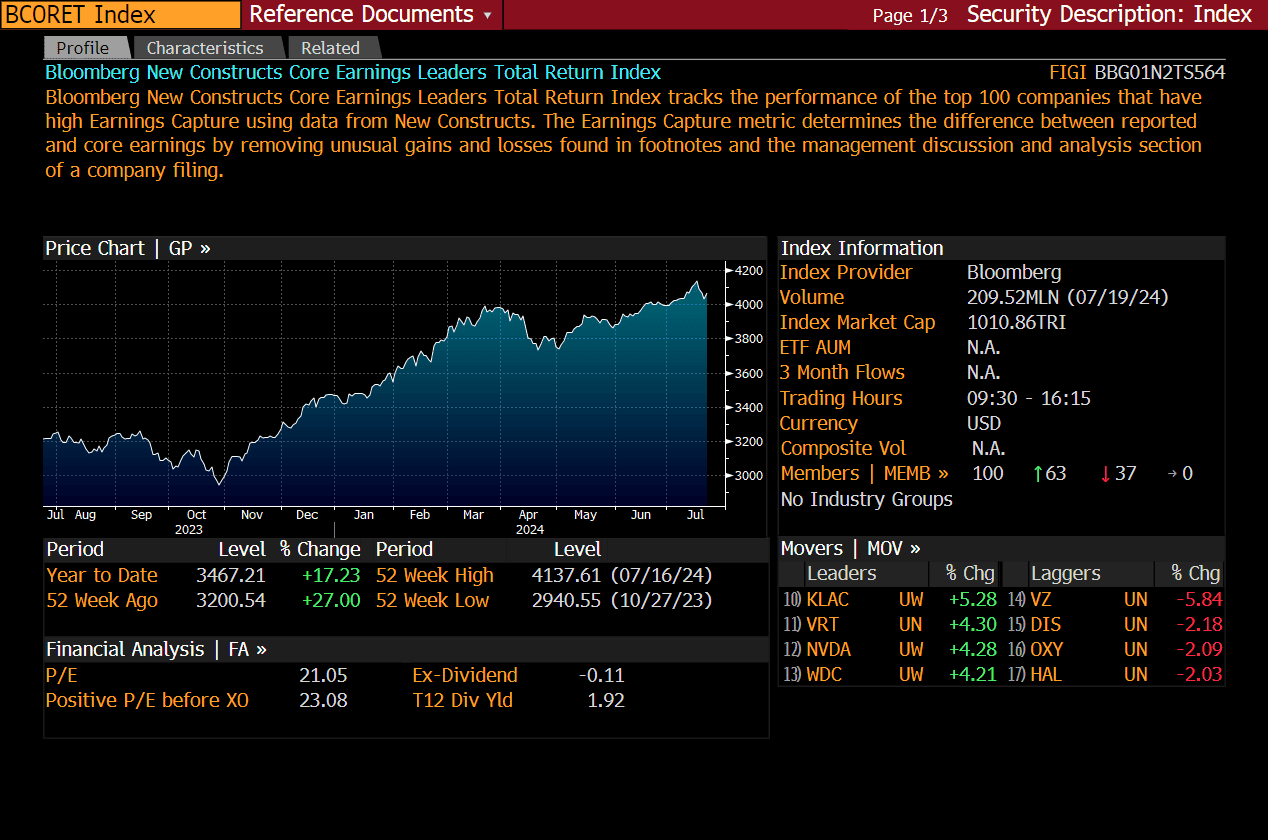

Figure 3: Core Earnings Leaders Index On the Bloomberg Terminal

Sources: Bloomberg & New Constructs, LLC.

Note: Past performance is no guarantee of future results.