Bloomberg Indices Based on our Superior Research

The market is missing footnotes, and our research is the first and best at collecting footnotes data that delivers novel alpha – as proven by Core Earnings: New Data & Evidence, published in The Journal of Financial Economics.

We are very excited to partner with Bloomberg to bring more investors access to the proven novel alpha in our proprietary data and research.

Bloomberg New Constructs Ratings VA-1 Index ("The Very Attractive Stocks Index")

The Bloomberg New Constructs Ratings VA-1 Index, aka the “Very Attractive Stocks Index”, tracks the stocks in the Bloomberg 1000 Index that get our Very Attractive Rating. In other words, it’s an index of nearly all our Very Attractive-Rated stocks.

Given the sizeable outperformance of our index, we think it is fair to say that there’s a lot of alpha in our Very Attractive-rated stocks.

Official Docs: Fact Sheet and the Index Methodology.

On the Bloomberg website or terminal, you can track performance with these tickers:

-

- Total Return Index BNCVA1T:IND

- Price Return Index BNCVA1P:IND

- Net Return Index BNCVA1N:IND.

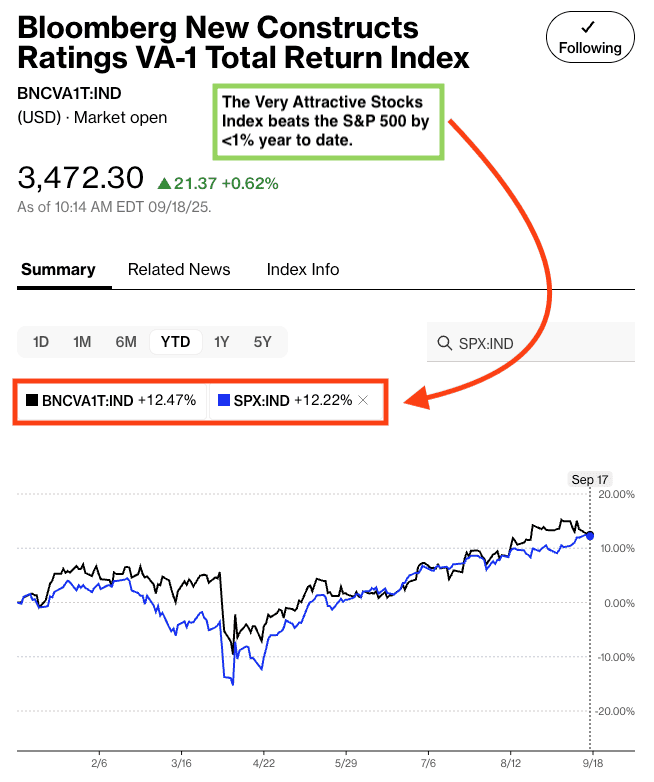

Figure 1: YTD Performance Through September 17, 2025: Beats S&P 500 by <1%

Sources: Bloomberg as of September 17th, 2025.

Note: Past performance is no guarantee of future results.

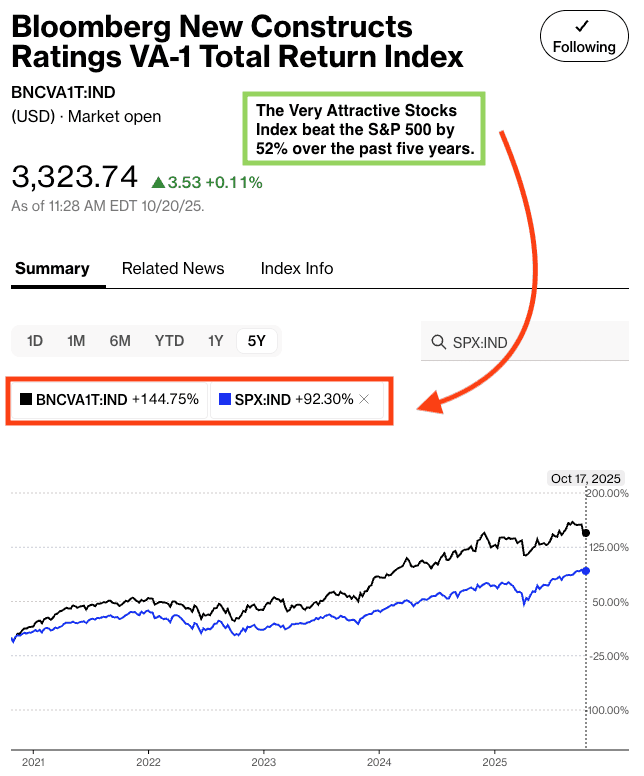

Figure 2: Performance Over Last 5 Years: Beats S&P 500 by 52%

Sources: Bloomberg as of October 17th, 2025.

Note: Past performance is no guarantee of future results.

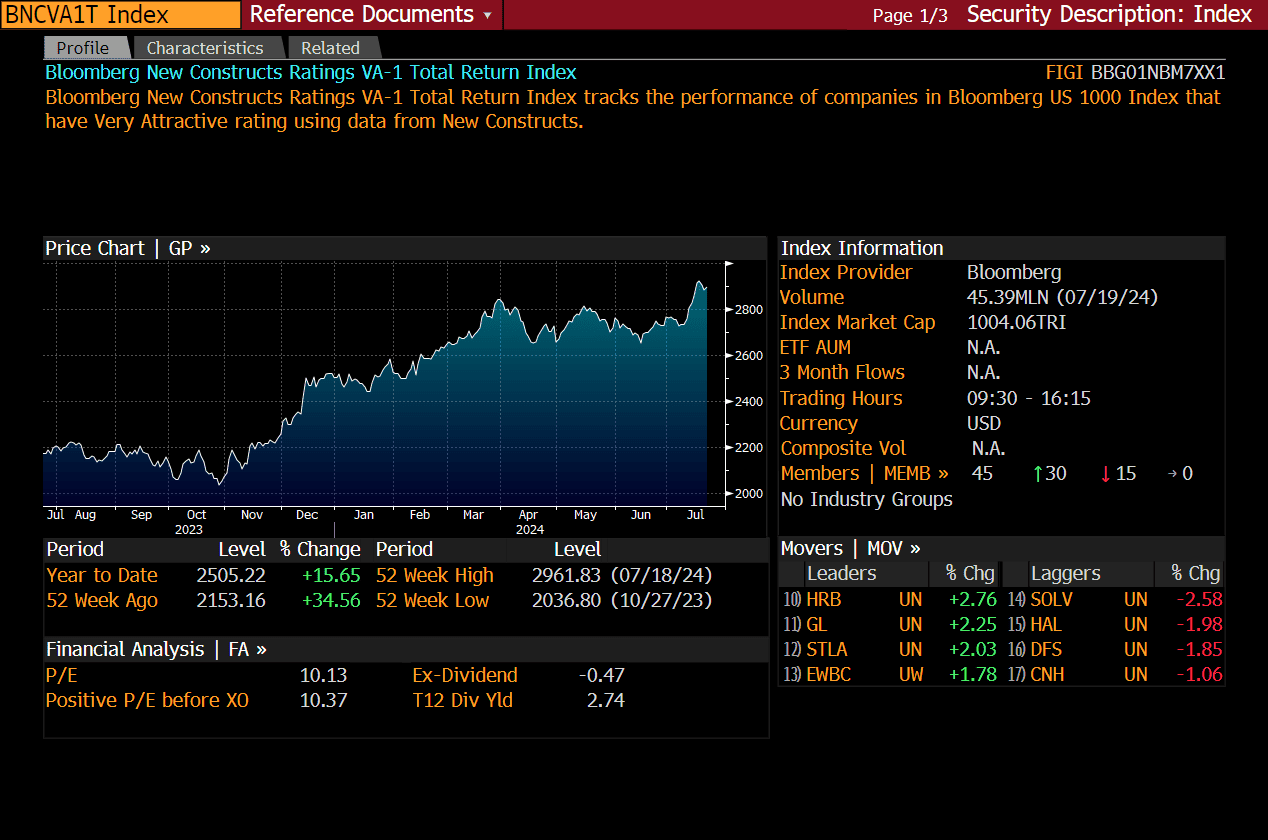

Figure 3: View on the Bloomberg Terminal

Sources: Bloomberg & New Constructs, LLC.

Note: Past performance is no guarantee of future results.