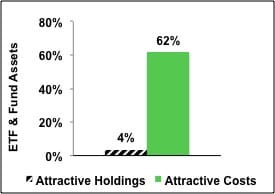

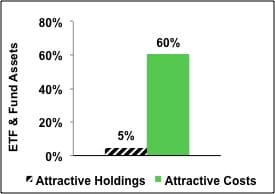

Cheap Funds Dupe Investors – 2Q17

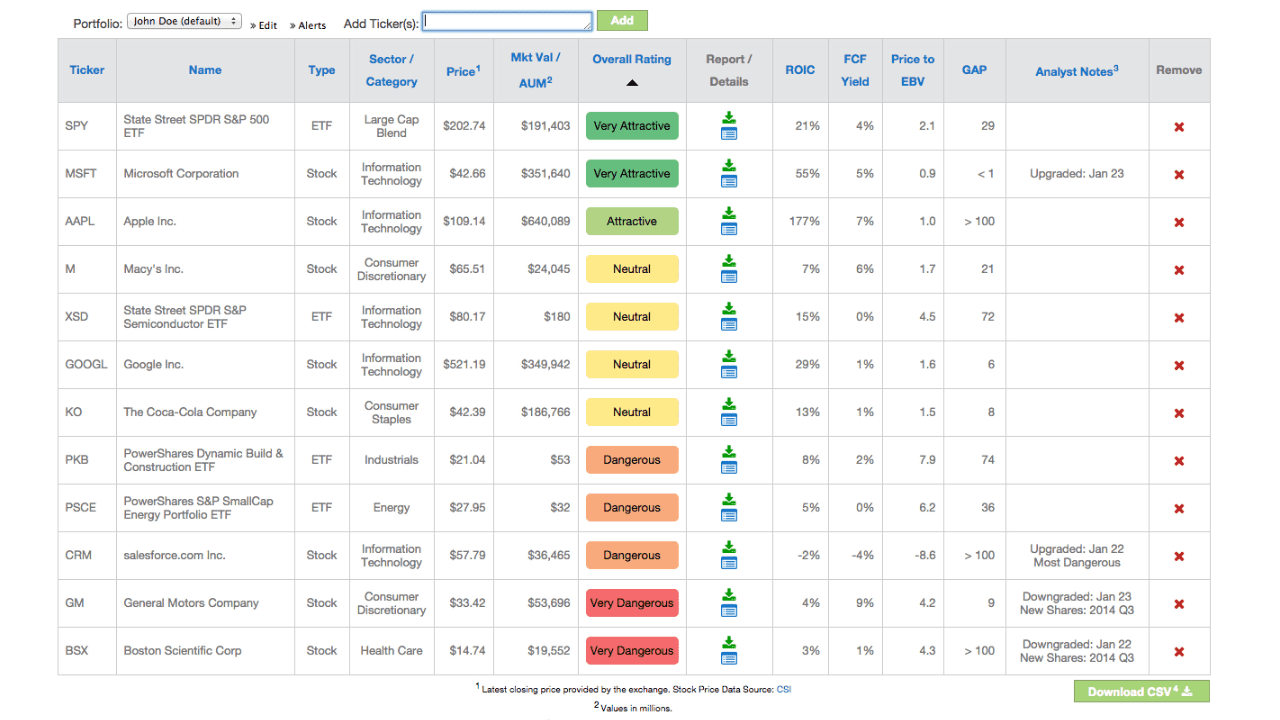

Investors are good at picking cheap funds. We want them to be better at picking funds with good stocks. Both are required to maximize success.

Kyle Guske II, Senior Investment Analyst, MBA