Poor Corporate Governance Makes These Companies Potential Targets for Activist Investors

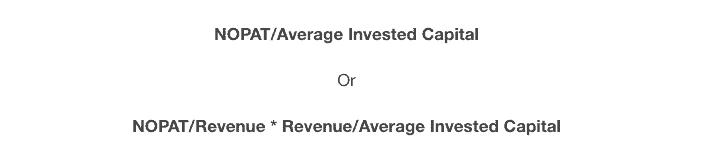

CEO’s That Focus on ROIC Outperform and the corollary to that argument is that the opposite is also true: CEO’s that don’t focus on ROIC underperform.

Sam McBride