Cheap Funds Dupe Investors – 3Q15

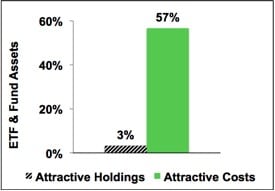

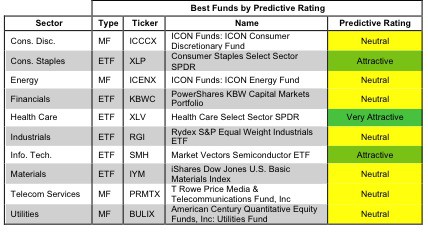

Fund holdings affect fund performance more than fees or past performance. A cheap fund is not necessarily a good fund. A fund that has done well in the past is not likely to do well in the future.

Max Lee