How To Find the Best Sector ETFs 2Q15

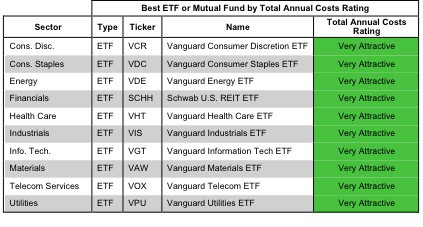

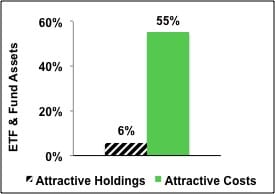

Finding the best ETFs is an increasingly difficult task in a world with so many to choose from. How can you pick with so many choices available?

Max Lee