A picture is worth a thousand words and so is Figure 1. Figures 2 is good too. The inescapable truth behind AAPL’s valuation is that market expectations are way too high.

Apple’s ROIC Is An Ephemeral Aberration

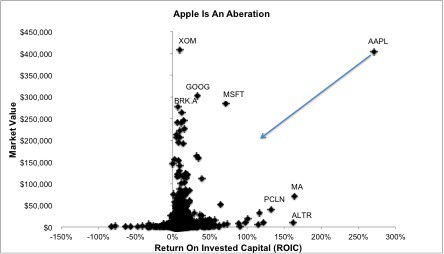

This article provides some empirical evidence behind my putting Apple (AAPL) in the Danger Zone last week because its return on invested capital (ROIC) is outrageously high. That fact underscores why valuing this company or any other with the expectation that such a high ROIC was sustainable would be a mistake.

Figure 1 plots the market value of the top 1500 companies by market cap that I cover against ROIC. This figure illustrates just how far out there APPL’s ROIC is. It also illustrates the expected impact on the stock’s market value when the ROIC comes back to earth.

Betting on Apple’s ROIC continuing to be an outlier is foolish. I see AAPL’s ROIC rejoining the pack within the next few years, and the market will reflect that mover even sooner.

In my last article on AAPL, I explained why I think AAPL’s ROIC would fall to at least as low as Google (GOOG) or Microsoft’s (MSFT) ROIC, which are 34% and 71% respectively. I think, given the competitive markets in which AAPL competes, the company’s ROIC will eventually be much lower than both GOOG and MSFT.

Figure 1: Declining ROIC Leads to Decline in Market Value

I also believe that AAPL’s market value will be lower than GOOG and MSFT’s because Apple’s business has nowhere near the scale of Google or Microsoft. It certainly has nowhere near the long-term competitive advantages of Google or Microsoft either.

And please try not to compare AAPL to Exxon (XOM) in order to justify AAPL’s valuation. Those two businesses are not on the same page when it comes to scale and competitive advantage. XOM had nearly $500 billion in revenue last year, while AAPL had $150 billion. The value of AAPL until now is driven by its unsustainably high margins. Until Apple delivers the next iPhone-like revolutionary product, it is going to be slaughtered by lower-cost competitors. As I wrote in this week’s Danger Zone article on Amazon (AMZN), selling a non-rival product, e.g. smart phones that others can replicate, means you are stuck in a low margin business. No one can replicate the petroleum reserves that XOM owns.

My Metrics Matter

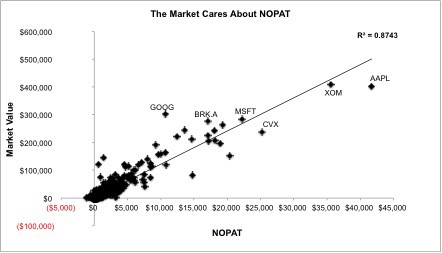

In case you are wondering about whether or not my analysis on 3000 stocks is worth its salt, I submit Figure 2. This figure, based on the same 1500 companies as Figure 1, plots my net operating profit after-tax (NOPAT) against market values with an r-squared of 88%.

Figure 2: High Correlation Between Market Value and NOPAT

Such a high correlation coefficient shows that market values are very sensitive to changes in NOPAT. This figure also suggests that the market already expects AAPL’s NOPAT to fall as AAPL is below the trend line. Being below the trend line means the market values AAPL’s NOPAT less than firms that are closer to or above the trend line.

NOPAT is the numerator in my ROIC calculation. The assertion that AAPL could just grow NOPAT by increasing invested capital, the denominator in my ROIC calculation, is naïve. Growing invested capital adds value in AAPL’s case only if the returns on that capital are above 124%, the perpetual ROIC implied by $441/share.

Otherwise, the level of NOPAT generated by any additional invested capital is lower, the company is not as efficient and NOPAT grows at a slower rate.

Growing a business with a 120%+ ROIC is very difficult to do at any stage and even more so for a company is markets as mature and competitive as the markets Apple is in.

This analysis is just another way to articulate the thesis I provided in my last article.

Sam McBride contributed to this article

Disclosure: David Trainer owns MSFT. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

2 replies to "The Truth Behind AAPL’s Numbers"

The problem with the “overvalued” argument is that even if AAPL’s ROIC fell substantially, they are so far ahead of GOOG, MSFT, etc. on an ROIC basis that they would still be undervalued per share in comparison to most of their competitors. GOOG & MSFT are well under 100% ROIC. If AAPL fell 150%, they’d still be outperforming nearly everyone else.

you are absolutely correct.