Invested Capital

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics. Here’s proof from some of the most respected public & private institutions in the world.

Invested capital equals the sum of all cash that has been invested in a company over its life with no regard to financing form or accounting name. It’s the total investment in the business from which operating profit is derived.

As the denominator in our return on invested capital (ROIC) calculation, invested capital is a very important value, and we place a great deal of importance on getting it right.

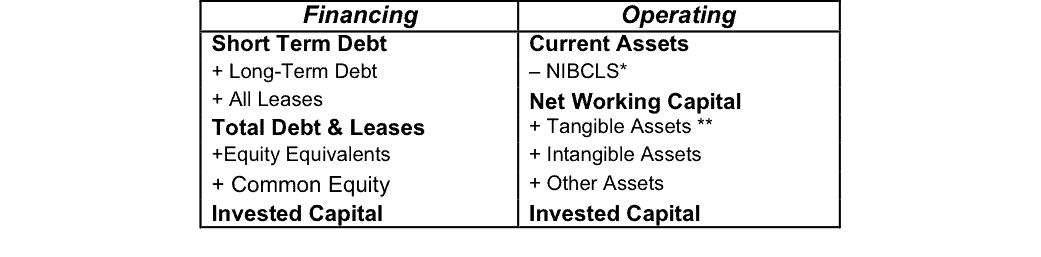

We calculate invested capital in two mathematically equivalent ways: financing and operating approach. Figure 1 provides the simplified formula for calculating invested capital.

Figure 1: How To Calculate Average Invested Capital - Simplified

* Non-Interest-Bearing Current Liabilities

** Includes leased assets

Sources: New Constructs, LLC and company filings

When we calculate invested capital, we make numerous adjustments to close accounting loopholes and ensure apples-to-apples comparability across thousands of companies. A company shouldn’t be able to hide from its history, for instance, through write-downs or impairments.

Want To Learn More?

Sign up to receive free alerts about all our new research reports including Long Ideas and Danger Zone picks.

See our webinar on the importance of ROIC and how to calculate it.

Get our report on "ROIC: The Paradigm For Linking Corporate Performance to Valuation."