Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Amazon.com (AMZN) is in the Danger Zone. The belief that Internet retail is or will be more profitable than traditional retail is untrue. Amazon is in a competitive, low margin business that cannot justify the profit growth implied in its valuation.

Stuck With a Low Margin Business

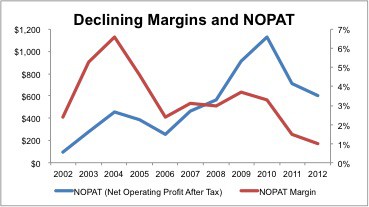

Amazon’s after-tax (NOPAT) margin is a paltry 1%, ranking 1428th out of 1515 US companies that I cover with at least $1 billion in market cap. Out of 178 retail comps, its margin ranks 154th. For comparison, AMZN’s market cap ranks as the 26th largest out of all 3000 stocks I cover and ranks third amongst the 178 retail comps. Can you smell the disconnect?

As Figure 1 shows, back in 2004, Amazon’s NOPAT margin was a robust 6.6%. At that point, Amazon and eBay (EBAY) were fairly dominant players in online commerce. Amazon could price items high enough to maintain a higher margin without sacrificing market share growth. That is not the case anymore, however, as companies like Walmart (WMT), Target (TGT), Walgreens (WAG) and other brick-and-mortar stores have gotten into the online retail game. In the last few years, Amazon’s profits have fallen as margins plummeted. Since 2004, NOPAT has grown only 3% per year on average while revenues have grown 30% compounded annually.

Figure 1: Growing Competition Shrinks Margins

Amazon has always been forthright about its strategy to keep margins low to facilitate market share growth.

The question today is about future margins and whether they will ever be high enough to justify the current stock price. Many Wall Street reports written at the turn of the century praised the superior cash flows and margins of Amazon’s online business model. Amazon broke and continues to break new ground in retailing, and the stock’s valuation has lived up to the hype.

Online Retail Capabilities Are No Longer A Differentiator

Times have changed for Amazon and for retailing, in general.

Amazon’s competitive position is much weaker today as the barriers to entry in online retail are low. There is not much that Amazon can do that its competitors cannot eventually copy. Remember the 1-Click buying capability? I am not sure how much that moved the needle if at all.

There is nothing very special about an online retailing model anymore. Most anyone can do it. Sure, most firms may not do it as well as Amazon, but I do not believe that Amazon’s offerings are superior enough to justify the higher margins that many investors expect.

Competing Only On Price

At the end of the day, Amazon is just another “generic” retailer in a world where content is king. Until Amazon has exclusive access to content for which people are willing to pay a premium, they compete only on price. And that strategy will never yield as high margins as the company must achieve to satisfy investors.

By “generic” retailer, I refer to the fact that Amazon is simply a middleman for other firms’ products, and consumers can get most anything that Amazon sells from another retailer. As a result, Amazon can differentiate itself from all the other retailers in only two ways: better product access and price. I think it is fair to say that Amazon offers better product access than any other major retailer. However, that superiority has not yet translated into the ability to exact premium prices. Indeed, the company has relied upon lower prices as the primary incentive to lure shoppers to their offerings, including cloud services. The new cloud services also are “generic” because they are non-rival goods, which means that no one can have exclusive ownership of them. Unlike petroleum reserves, for example, which only one firm can own because they cannot be replicated, there is a potentially unlimited supply of computing power and storage. So, price will be the primary differentiator for these products and services as well as suggested by the scale Amazon is attempting to create in this space.

The problem with the low-cost provider strategy is that while Amazon is subsidizing the cost of incentivizing consumers and businesses to go online to shop or use cloud services, its competitors are building comparable capabilities. As those capabilities are increasingly easier to build, it is increasingly difficult for Amazon to differentiate its product access. Just about anyone can sell products online, and its only getting easier. The number of cloud services providers is growing too.

Amazon has also attempted to create exclusive products, like its new original TV shows. Whereas Netflix (NFLX) has had success with House of Cards and the much-hyped fourth season of Arrested Development about to be released, Amazon’s highest profile offering, Zombieland, bombed. This attempt shows what can happen when a company moves away from its primary area of expertise in search of better margins.

My key point is not that Amazon’s website or its fulfillment capabilities are bad. On the contrary, I think they are among the best. My point is that they are not good enough to keep an online shopper from going to another site with a lower price for the same product. I do not think it is possible for Amazon, or any firm, for that matter, to prevent online buyers from taking the lowest prices especially now that shoppers can use Google (GOOG) to get prices from multiple retailers within seconds on most products. Many shoppers will never go to Amazon.com if they see a lower price offered by another site.

Competing With Wal-Mart And All Other Low-Cost Retailers

Competing on price is not where many companies want to be, especially in a world with Wal-Mart (WMT).

Wal-Mart (WMT) has long been the world leader in low pricing. It is one of very few firms with the distribution and fulfillment capabilities required to match or beat Amazon on price. And there is no reason to believe they cannot beat Amazon on price for the products they both sell.

Needless to say, competing with Wal-Mart on price is not a very profitable place to be. Nor is competing with all the other retailers, large or small, online or offline in an increasingly digital world where pricing is so transparent.

To the argument that Wal-Mart’s physical stores handicap it by tying up capital, I reply that its brick-and-mortar presence provides certain types of product access that Amazon cannot offer. For example, returning or exchanging goods bought online is much easier at an actual store. In addition, the stores enable an estimated 8% of American households—and 25% of Wal-Mart’s customers—who do not have a bank account or credit card to pay cash for goods bought online. Maybe the best model is to have both digital and tangible delivery models. Wal-Mart’s success with the tangible model speaks for itself.

Valuation Is The Big Issue Here

Amazon’s competitive position is of concern because of the dangerously high valuation of its stock. As I wrote last week about Apple (AAPL), Amazon is a great company, but that does not mean AMZN is a great stock. It is not. The expectations for future cash flows in AMZN are dangerously high, and investors should sell.

At $267/share, Amazon’s stock price implies future cash flows and margins that even the most ardent bull would have trouble betting on. Allow me to illustrate this point with three scenarios for how Amazon could justify the value of its stock. I would not bet on any of them coming true.

1) Margins stay roughly the same: If we assume that Amazon’s NOPAT margin averages 1.4%, close to its current level, then it would need to grow NOPAT by 25% compounded annually for nearly 25 years. At that point, revenues would be $3.8 trillion, nearly 10x that of Wal-Mart’s in fiscal year 2012. Nothing is impossible, but this scenario seems highly improbable.

2) Margins double: At 2.8% margins, Amazon needs a compounded annual growth rate of 25% for 15 years, at which point revenues would be $605 billion, or 130% of Wal-Mart’s 2012 revenues. That still seem awfully ambitious.

3) Margins rise to Wal-Mart’s level: At Wal-Mart’s 4.1% margin, Amazon would need to grow NOPAT by 20% compounded annually for 20 years, bringing revenues up to $432 billion, or 90% of Wal-Mart’s revenues for 2012. I don’t see Amazon getting its margins to that level as very likely. I doubt they can get their costs below Wal-Mart’s, so Amazon would need to raise prices to achieve these margins. How can they grow market share with prices higher than competitors?

Under the most generous of these scenarios, Amazon has to become nearly as large as Wal-Mart is now. Our economy already has one Wal-Mart: is there room for another?

In many ways, Amazon is a victim of its own success. As the paragon of Internet retailing, Amazon inspired other retailers to build an effective online business or risk going out of business. There was a time when Amazon seemed to have an insurmountable lead in online retailing but not anymore. As the distinction between online and brick-and-mortar retail becomes less meaningful, Amazon becomes just another low-margin generic retailer.

As I wrote above, Amazon is still a great company, and there’s no reason that it cannot remain the largest online retailer in the world. That status is nice for company fans but largely irrelevant to investors.

Stock investors must decide whether they believe that Amazon will grow its cash flows more than what is already baked into the stock price. If so, they should buy. If not, sell. That choice appears obvious to me.

Investors should also avoid these 24 ETFs and mutual funds due to their 7% or more allocation to AMZN and Dangerous-or-worse rating.

Sam McBride contributed to this article

Disclosure: David Trainer owns WMT. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

7 replies to "Danger Zone 5/20/2013: Amazon.com (AMZN)"

I have followed Amazon very closely since October, 2011.

Reducing quarterly and yearly earning estimates at different percentages

If you check Analyst Estimates for Amazon on Yahoo, you will see that last month the 37 analysts estimated earnings for Q2 at 22 cents. Today those 37 analysts have a 7 cent (a 70% drop) earnings estimate for that same quarter.. If you do the same thing for Q3, you will see the drop was from 15 cents to 11 cents (a 27% drop). And if you look at the estimates for 2013, the analysts dropped the earnings estimate from $1.48 to $1.32 (an 11% drop).

So let us do some simple math to see how they can earn that $1.32 in 2013.

The company earned 18 cents in Q1 so that is in the books. The combined estimate of Q2 and Q3 is now 18 cents (7 cents + 11 cents). So if estimates are correct the company will earn 36 cents in the first three quarters. So to earn the 2013 earnings estimate of $1.32, the company would have to earn 96 cents in the 4th quarter.

Here are the quarterly earnings between 2005 and 2012. While you are looking at the table, take a side look at the 2010 – 2012 earnings trend.

Year…… Q1…… Q2…… Q3…… Q4…. Annual Earnings

2005… $0.12.. $0.12.. $0.07.. $0.47.. $0.78

2006… $0.12…$0.05.. $0.05… $0.23.. $0.45

2007… $0.26.. $0.19.. $0.19… $0.48…$1.12

2008… $0.34.. $0.37.. $0.27… $0.52.. $1.49

2009 …$0.41.. $0.32.. $0.45… $0.85…$2.04

2010 …$0.66.. $0.45.. $0.51… $0.91…$2.53

2011 …$0.44.. $0.41.. $0.14… $0.38…$1.37

2012… $0.28.. $0.01.. -$0.60.. $0.21.. $0.09

The most the company has ever earned in the 4th quarter was 91 cents in 2010, but in 2010 the company earned $1.62 in the first three quarters. So how is the company going to earn 96 cents in the 4th quarter of this year, having earned only 36 cents in the first three quarters?

What Wall Street is doing to keep this stock up may be quite effective. The stock’s market cap is $117 billion yet the tangible book is $6 billion. Let us assume, based on the calculations above for the first three quarters, the company may earn 75 cents in 2013. At 75 cents of annual earnings the company would have to sell at 48 times earnings (471 million shares) to be worth $17 billion; which would create a market cap loss of $100 billion and obviously a huge drop in the price of a share of stock. And one way to prevent this price drop would be for an analyst to raise the stock’s target price (now averaging $314), even as they decrease the earnings estimates, and hope most investors do not look too closely at the earnings trend.

This is where historical metrics diverge from forward-looking strategy.

Amazon’s goal with regards to retail is to be a primary platform for vendor’s online sales. The analytics and recommendations engine behind this platform is something Walmart is not close to matching. Amazon doesn’t have to sell shelf space – they literally show people the best items available that match what the customer is looking for. Either directly through search, or by algorithms derived by the person’s behavior in interactions with Amazon. The fact that Amazon can actually manage the base data required to produce these complex algorithms is a feat in itself.

In addition, the company excels at platforming and monetizing those platforms. They have heavily backended equity payouts, and hire at lower cost than the industry in general.

How does fulfillment by amazon, amazon web services, amazon keyword search, or any of the other myriad programs that the company owns fit into this analysis?

It really comes down to execution – can the company execute on their strategy to be the primary set of platforms in e-commerce? The question is not whether they can compete with Walmart in retail.

Imagine if you viewed a customer as an asset, and are willing to pay $0 margin to acquire that asset. And then monetize that customer-asset into sales for other companies and search advertising demand? Imagine you can then provide enterprise level service for vendors to be able to host their websites, manage their data AND market to, sell to, fulfill to, and manage customer service for the people that buy their products?

The reason this company is valued where it is, is because there are people that believe the company can execute on THAT vision, not retail sales profitability. Thus, the question to answer, is do you believe it?

Kiran:

Thanks for your excellent comment. Great to hear from you!

1. Platform for online sales – how is this different from eBay, which we now know to a low-margin business at risk of being replaced if they ever raise prices/margins.

2. Fulfillment, keyword search – these feats are no longer a big deal. Much of distribution and fulfillment is being automated by robots. The website capabilities are no longer that unique. They are easy to copy as well.

3. The e-commerce execution point is good. However, I am not sure they are not the only ones who could execute on that. When if Wal-Mart bought eBay, then what would AMZN do? That merger may be unlikely…my point is the barriers to entry to replicate AMZN’s model are low.

4. Hosting other vendors’ site is/will become a commodotized service in my opinion. The only question there is who has the biggest network/traffic and therefore the most matching capabilities. But the marketplace concept is a commodity too. Anyone can set up the market place and provide a “storefront” for vendors.

I do not think AMZN will ever be in the business of fulfillment for the vendors.

Honestly, and maybe I lack the imagination, I do not see any way that AMZN can create a model that will generate the cash flows embedded in the stock price.

Wal-Mart’s acquisitions include Kosmix, a social-media firm, and iPhone app creator Small Society. The company hopes the newcomers can find a way to stop shoppers from engaging in scan and scram. That’s when would-be customers use their smartphones in stores to scan an item’s bar code and then buy it online from a rival merchant. The chain’s tech team also is working on a concept called Endless Aisle, which would let shoppers immediately order from Walmart.com via smartphone if an item is out of stock. “You can’t ask people to leave their phones at the door. So you have to give them value and an experience,” says Venky Harinarayan, @WalmartLabs’ senior vice president of global e- commerce. The former Amazon executive joined from Kosmix.

1. Platform for online sales – how is this different from eBay, which we now know to a low-margin business at risk of being replaced if they ever raise prices/margins.

>>> eBay doesn’t fulfill, for vendors to customers, definitely not at Amazon’s scale. eBay doesn’t have Amazon Web Services (Cloud, Elastic Map Reduce, Amazon Redshift, etc). eBay doesn’t have “Login with Amazon”. It doesn’t have any of these platforms. In addition, if online retailers end up being forced to pay sales tax, eBay will be meaningfully impacted. Amazon will not, given that it, like brick and mortar retailers already pays sales tax in the large majority of states.

2. Fulfillment, keyword search – these feats are no longer a big deal. Much of distribution and fulfillment is being automated by robots. The website capabilities are no longer that unique. They are easy to copy as well.

>>> Search is a big deal and a very high margin business. Google has been rightfully concerned and is launching it’s own offensive : http://www.wired.com/business/2013/05/amazon-stealing-search-from-google/

Distribution and fulfillment is being automated by robots in a few fulfillment centers – but that’s not the full story. Kiva, the company that actually produces the robots, is actually owned by Amazon. Launching fulfillment centers of your own is a high upfront cost and high management cost proposition – significant barriers to entry. 3rd party fulfillment is an option for some, but most 3PLs are notoriously bad at managing shipping/logistics. Amazon is an exception to that.

3. The e-commerce execution point is good. However, I am not sure they are not the only ones who could execute on that. When if Wal-Mart bought eBay, then what would AMZN do? That merger may be unlikely…my point is the barriers to entry to replicate AMZN’s model are low.

>>> You know better than most that just acquiring another company, especially one with a meaningfully different culture and massive size, is not an easy undertaking. Once again, high barriers to entry.

4. Hosting other vendors’ site is/will become a commodotized service in my opinion. The only question there is who has the biggest network/traffic and therefore the most matching capabilities. But the marketplace concept is a commodity too. Anyone can set up the market place and provide a “storefront” for vendors.

>>> Building recommendations engines, and the high-difficulty algorithms that run them is extremely difficult. Building a culture completely driven on analytics is also not an easy task. A large share of people at Amazon can write/run SQL queries, and this is just not true of WalMart. And even if Walmart could produce this culture and hire the right people, it doesn’t mean that every other e-commerce firm will do the same.

I do not think AMZN will ever be in the business of fulfillment for the vendors.

>>> They already are.

>>> My point is that there’s a lot more scuttlebutt involved in analyzing large companies that continuously operate in startup mode like Amazon. You can’t value startups in the exact same way as companies with more established investment decision processes – the required growth will always look higher than it should be.

David, I agree with your analysis of Amazon’s overvaluation, especially after doubling from the 2013 price point when this analysis was first published.

However, while the reasoning may be valid and the assumptions most probably true, it may still take the market a very long time to start agreeing with the analysis.

So my question is: how do you manage the risk of market prices disagreeing with your analysis for an extended period of time?

Invest long and prosper,

Xen

Xeno, that’s a very good question and a difficult one to answer. For companies like Amazon with a lot of growth and momentum, the best thing to do is generally just to stay away unless there’s a clear catalyst to send shares lower. Amazon’s clearly a stock to stay away from due to its high valuation, but it’s hard to predict when the market’s going to start caring more about its profitability, making it risky to short.