We leverage our Robo-Analyst technology to monitor 3,000 stocks across all sectors and issue Danger Zone reports to help clients avoid portfolio blowups. Position Update reports serve as notification that a previous investment idea’s risk/reward profile has shifted and the position has been “closed”.

Celadon Group (CGI: $5/share) – Closing Short Position – Down 68% vs. S&P +19%

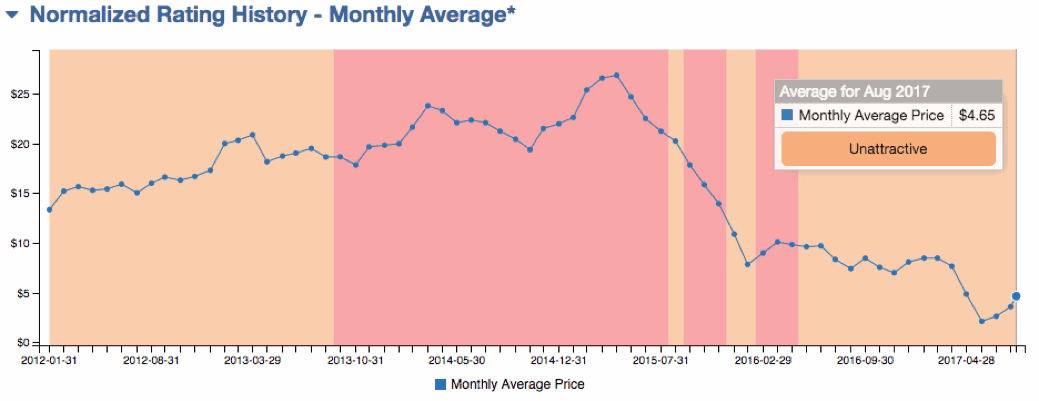

Celadon Group was selected as a Danger Zone pick on 11/9/15. At the time of the report, the stock received a Very Unattractive rating. Our investment thesis highlighted: 1) a negative divergence between GAAP and economic earnings; 2) acquisitions destroying shareholder value; 3) low profitability relative to competitors; and 4) the company’s overvalued stock and unlikely buyout due to its high debt load.

During the subsequent 639 day holding period, CGI outperformed as a short position, falling 68% compared to an 18% gain for the S&P 500. The tipping point occurred in early May 2017, when CGI disclosed that its financial statements for the fiscal year ended June 30, 2016 and quarters ended September 30 and December 31, 2016 could no longer be relied upon. Since May, CGI has amended its primary credit facility and chosen a replacement for the retiring CEO, alleviating two key unknowns.

Figure 1: CGI Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings

Since our original Danger Zone report, CGI has been upgraded in our system to Unattractive from Very Unattractive according to our Stock Rating Methodology. The significant reduction in stock price and embedded market expectations diminishes the downside risk and we are closing the position. We hope investors avoided this portfolio blowup or participated in the 68% short return.

This article originally published on August 14, 2017.

Disclosure: David Trainer, Kyle Guske II, and Kenneth James receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.