We closed this position on August 14, 2017. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

Because P/E ratios are dependent upon earnings, which we know can be manipulated, they can be quite misleading. This week’s Danger Zone is a perfect of example of just how misleading those P/E ratios can be. With a P/E ratio less than half that of its industry average, this week’s Danger Zone stock, Celadon Group Inc. (CGI: $14/share) would appear cheap because of strong EPS when, in fact, its cash flows are in decline and the stock is highly overvalued.

GAAP Income Paints A False Picture

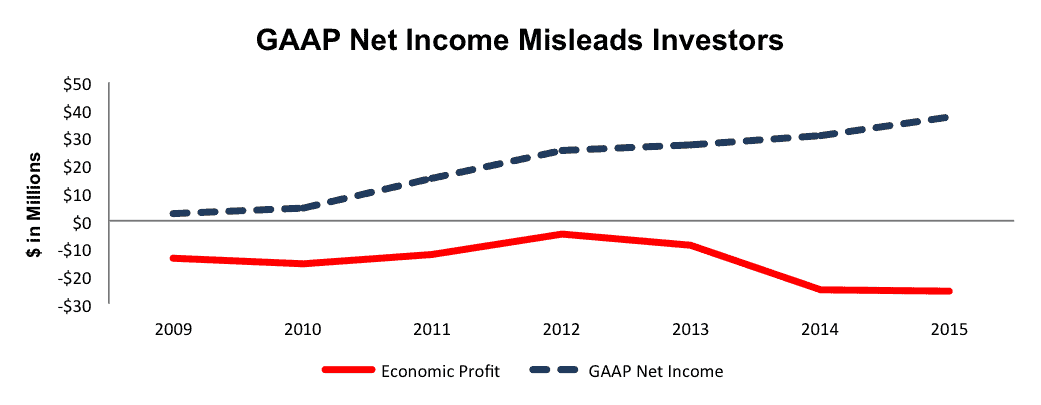

Since 2009, Celadon’s GAAP net income has grown from $3 million to $37 million, or 56% compounded annually. Over the same timeframe, the company’s economic earnings, or true cash flows available to equity shareholders, have declined from -$13 million to -$25 million. This discrepancy can be seen in Figure 1 and has only gotten more misleading since 2012.

Figure 1: Revenues Fail To Be Converted Into Profits

Sources: New Constructs, LLC and company filings

How can this be? The problem with using GAAP net income is that it fails to account for the drag on earnings created by off-balance sheet liabilities and equity capital. In 2015, the cost of Celadon’s invested capital was $53 million, or $1.90/share that we deduct from reported earnings. After removing this cost we see that Celadon’s economic EPS are -$1.07 compared to GAAP EPS of $1.52 for 2015.

The key point for investors is that Celadon has not made good use of the capital invested in its business. As we have pointed out many times before, growing by acquisition can be a bad strategy even though accounting EPS suggest otherwise (the hi/lo fallacy). With 34 acquisitions since 1995, Celadon is clearly an aggressive acquirer. The strategy worked from 2001-2007 because return on invested capital (ROIC) rose from 3% to 10%, but it has not worked since, as ROIC has steadily declined to a bottom-quintile 3% on a trailing twelve months basis. Management seems oblivious to this decline as it touts EPS growth, which directly influences their compensation, and has credited the growth of its freight mix, customer diversity, and tractor count directly to acquisitions.

Celadon’s Profitability Lags Its Competitors

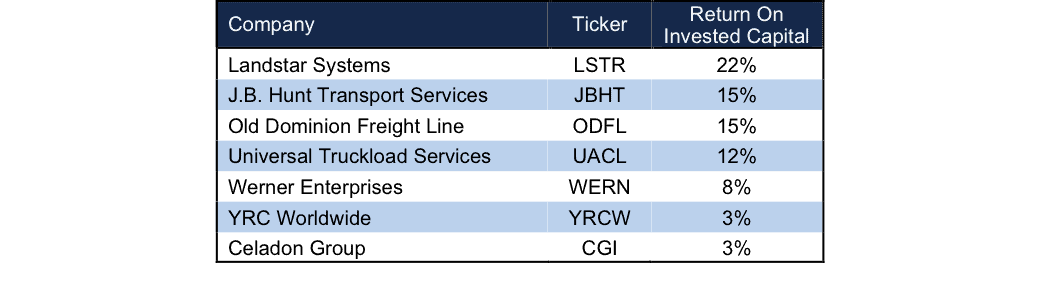

Figure 2 shows that Celadon’s 3% ROIC is much lower than competition. In an industry where freight carriers are willing to undercut one another to win loads, Celadon’s low profitability creates significant competitive challenges, mainly the lack of pricing power.

Figure 2: Celadon’s Poor ROIC

Sources: New Constructs, LLC and company filings

Bull Case Assumes Stock Price Has Bottomed

Celadon’s stock price is down over 30% in 2015, and its current P/E of 9 is well below the industry average of 20. Because of this seemingly “cheap valuation”, investors might think now is the time to scoop up CGI while it’s at a discount, especially since GAAP net income growth has created the illusion of profit growth. However, as shown above, buying CGI would certainly not be buying a profitable business, and as we’ll show below, the stock is anything but cheap.

Adding further scrutiny to the bull case is that it is unlikely Celadon will be able to change its shareholder destructive ways anytime soon. Operating, maintaining, and replacing a freight fleet is extremely capital intensive, i.e. expensive. Since Celadon made the strategic decision to keep the average age of its fleet very low in an effort to minimize repair time and costs, the company’s cash flow will suffer under the burden of lowering the age of its fleet and the ones it acquires. The cycle of having to integrate and replace old equipment will not end as long as Celadon continues its acquisition approach to growth. EPS overlook these costs, but we do not. It manifests in all of our metrics, most glaringly in the cumulative -$511 million of free cash flow (FCF) in any year since 2012. Cumulative FCF since 1998 is -$489 million so the decline in FCF is accelerating.

Meanwhile, the current share price implies the company will achieve significant after-tax profit (NOPAT) and free cash flow growth moving forward.

Valuation Has Nothing But Downside Risk

Despite CGI being down over 30% year-to-date, shares still have significant downside risk. Investors attempting to “buy the dip” should steer clear. To justify its current price of $14/share, Celadon must grow NOPAT by 9% compounded annually for the next 17 years. This expectation seems awfully optimistic when Celadon has only grown NOPAT by 3% compounded annually over the past decade.

Even if we believe Celadon can double its historical profit growth and grow NOPAT by 6% compounded annually for the next decade, the stock is only worth $2/share today – an 85% downside.

It should be clear that despite CGI’s drastic decline in 2015, shares still have significant downside risk.

High Debt and Overvalued Shares Make Buyout Unlikely

The trucking industry is highly fragmented with numerous small operators presenting acquisition targets. With only a $400 million market cap, it’s certainly not out of the realm of possibility that a larger competitor could view Celadon as a buyout target. However, any potential acquirer might think twice as Celadon currently has over $584 million in debt (146% of market cap), which includes $21 million in off balance sheet operating leases. The company also has $101 million (25% of market cap) in deferred tax liabilities. With such a large amount of senior claims on cash flows, any acquirer hoping to integrate Celadon’s fleet would be better off waiting for shares to fall to more reasonable levels.

Acquisition Fueled Earnings Growth Has To End

If you believe that interest rates are more likely to rise than fall in the future, then you have to agree that it is only a matter of time before CGI disappoints investors. Given the company’s already large debt load (146% of market cap), it could face problems borrowing the money required to fuel its cash-flow-burning acquisition strategy. If it cannot acquire, it cannot keep EPS rising. Even if it can borrow, the cost of borrowing (new and old) stands to rise precipitously as the Fed moves rates higher. If the company wishes to continue its destructive acquisitions, but finds additional debt too expensive, it may dilute current shareholders through stock offerings. In any of those scenarios, EPS growth will, at a minimum, slow.

Moreover, using acquisitions to artificially boost reported earnings is not a sustainable business strategy, as we’ve recently seen with Danger Zone stock, Jarden Corporation. Celadon’s reported earnings are at risk of decline as acquisitions become harder to come by and more costly.

Note that the problems with Celadon’s operations are not an industry-wide issue either. They are specific to Celadon as many of its competitors are much more profitable. One competitor, Landstar Systems (LSTR), earns our Attractive rating and is on November’s Most Attractive Stocks list. Investors would be wise to avoid CGI before the company misses earnings and shares move even lower.

Insider Sales/Short Interest Raise Red Flags

Over the past 12 months 106,000 shares have been purchased and 795,000 shares have been sold for a net effect of 689,000 insider shares sold. These sales represent 2% of shares outstanding. Additionally, there are 956,000 shares sold short, or 3% of shares outstanding. It looks like insiders and some short sellers already see the writing on the wall.

Executive Compensation Is Misaligned With Shareholder Value Creation

Celadon Group’s executive compensation system awards cash bonuses and equity units for meeting earnings per share targets. Despite shareholder value destruction, executives’ salary and bonuses have only increased in recent years. Herein lies the problem with executives basing their pay on metrics that don’t truly measure business success, a red flag we raised in a recent report. We would much rather see executive compensation tied to ROIC rather than a metric that can rise while the company is destroying value.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Celadon Group’s 2015 10-K. The adjustments are:

Income Statement: we made $38 million adjustments with a net effect of removing $10 million in non-operating income. We removed $24 million in non-operating income and $14 million in non-operating expenses.

Balance Sheet: we made $377 million of balance sheet adjustments to calculated invested capital with a net decrease of $129 million. The largest adjustment the removal of $143 million due to midyear acquisitions. This adjustment represented 15% of reported net assets.

Valuation: we made $789 million of shareholder value adjustments with a net decrease of $585 million. The most notable adjustment to shareholder value was the removal of $101 million in deferred tax liabilities. This adjustment represented 25% of Celadon’s market cap.

Dangerous Funds That Hold CGI

The following fund receives our Dangerous rating and allocates significantly to Celadon Group.

- Advisors’ Inner Circle Fund: Rice Hall James Micro Cap Portfolio (RHJSX) – 1.4% allocation and Dangerous rating

- Investment Managers Series Trust II: Panther Small Cap Fund (PCGSX) – 1.3% allocation and Very Dangerous rating

- Touchstone Strategic Trust: Touchstone Small Cap Value Opportunities Fund (TSOYX) – 1.1% allocation and Dangerous rating

Disclosure: David Trainer, Kyle Guske II, and Blaine Skaggs receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: TruckPR (Flickr)

2 replies to "Danger Zone: Celadon Group (CGI)"

CGI falls 9% as markets open, now down 41% since Danger Zone publication

CGI falls 65% as the company announces its financial statements for more than a year cannot be relied upon. Now down 90% since original Danger Zone report was published