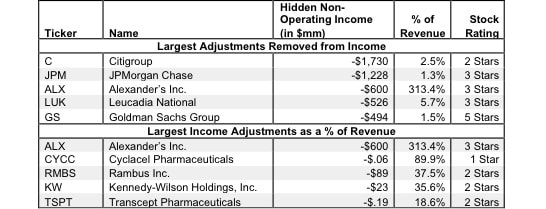

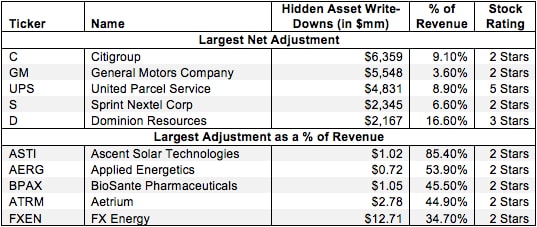

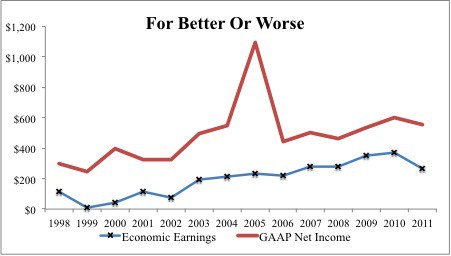

Non-Operating Income Hidden in Operating Earnings – NOPAT Adjustment

Non-operating items in operating income are unusual gains that don’t appear on the income statement because they are bundled in other line items. Without careful footnotes research, investors would never know that these non-recurring income items distort GAAP numbers by artificially raising operating earnings.

David Trainer, Founder & CEO