I take great pleasure in recommending investors buy Clorox (CLX) – an attractive-rated stock, not just because of its strong profitability and cheap valuation but also because of the unusually high quality and integrity of its financial reporting.

On profitability and valuation, the key determinants of our stock rating system, Clorox gets our attractive rating because it has positive economic earnings while the market’s expectations for future earnings growth are low. Specifically, the current stock price (~ $68.63) implies that Clorox will grow its net operating profit after tax (NOPAT) just 9% over its remaining life as a company.

Such low growth expectations should be easy for Clorox to surpass considering that Clorox products are staples of most households and businesses. No matter how poor the economic times, people still have to clean and collect trash. As a leading provider of cleaning and basic household products, Clorox should prove not only to be a defensive business in a down economy, but also a good stock in a challenging stock market.

No matter the economic conditions, I am particularly confident in Clorox’s management and its ability to grow profits because I know management is focused on creating shareholder value, not jut near-term earnings growth.

How do I know management is focused on creating value for shareholders? The answer is twofold.

- Management explicitly articulates that the first of its two primary strategic objectives is “to maximize economic profit across its categories, sales channels and countries…” (Exhibit 99.1 in the 2011 10-K. Management backs that statement up by saying: “The Company uses economic profit as the key financial metric in its decisions to drive enhanced performance, make portfolio choices and determine resource allocations” (page 5 of the 2011 10-K).

- Management voluntarily reports the company’s economic earnings in addition to the GAAP-required accounting earnings. Even more impressive is the transparency behind exactly how they calculate economic earnings on pages 67- 69 of their 10-K. They show exactly how they derive the prime components of economic earnings: “adjusted after-tax profit” (aka NOPAT), “adjusted capital employed” (aka invested capital) and the weighted-average cost of capital (WACC).

In an age where financial reporting is wrought by deception and obfuscation, Clorox’s voluntary decision to provide investors with a measure of its economic earnings should be universally applauded.

The transparency and clarity of the strategic focus of Clorox’s management is unprecedented in my experience. In the 50,000 10-Ks reviewed by New Constructs, we have almost never seen as clear an articulation of the focus on economic earnings nor as much detail on the calculations. In terms of corporate governance, Clorox is in a class by itself. Unfortunately, the corporate governance rating systems I know do not recognize or measure capital allocation aptitude. If they did, Clorox would get better ratings. Capital allocation is, after all, the most important responsibility of corporate managers.

Clorox is setting a new standard for corporate financial disclosure. Occasionally, I see companies mentioning “economic profits” or “EVA”, but I have never seen a company provide so much detail about how it measures economic profits.

The main reason companies avoid reporting economic earnings is that they tend to be much lower than accounting earnings mainly because they:

- Take into account all financial data, not just the income statement

- Provide a more accurate measure of the cash flows of companies[1].

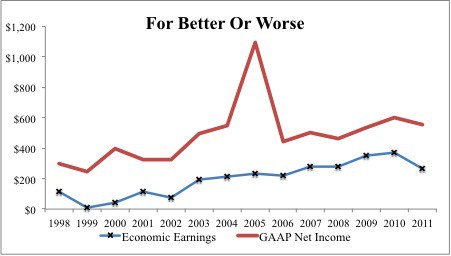

Figure 1: Takes A Brave Manager To Report Economic Earnings vs Accounting Earnings

Rather than voluntarily disclosing more information about the profitability of the business, more often than not, companies manipulate accounting rules to mislead investors about their profitability. For specific company examples, see my articles on Eastman Kodak’s (EK – dangerous rating) pension accounting manipulation and Citigroup’s (C – dangerous rating) overstated deferred tax assets. For broader market analysis on accounting rule manipulations, see my exhaustive reports on corporate disclosure transgressions, off balance-sheet debt, assets write-offs and hidden income and expenses.

If that is not enough, Enron, WorldCom, Tyco and other schemes that cost investors dearly, such as the recent mortgage-backed securities bubble, provide adequate proof that the current corporate financial reporting system does not adequately serve the interests of investors.

On other hand, the corporate financial reporting system serves the best interests of Wall Street and corporate America quite well. For this reason, my attempts to convince Congress or regulators to convince requiring more companies to provide disclosure like Clorox were unsuccessful.

I took my proposal for a better financial reporting system to the SEC, the Senate Banking Committee, the FDIC, the Congressional Oversight Panel and the Public Company Accounting And Oversight Board. Their response: hire a lobbyist. The response from the lobbyists was: sorry we are conflicted….your research would not be met kindly by our other clients in the financial sector[2].

It is not just Wall Street and corporate America that profit from gaming an archaic accounting system. Entire new businesses have sprouted in the last 20 years or so as the popularity of investing has grown, e.g. E*Trade (EFTC – dangerous rating) and Ameritrade (AMTD – neutral rating). Not to mention the growth in media coverage and attendant advertising dollars driven by the rise in prominence of the equity markets. How popular was CNBC 15 years ago? What do you think Ben Graham would think of Jim Cramer’s show Mad Money?

And all of these businesses have a vested interest in a rising stock market. Business is not good when stocks drop. Trading volume declines, people are less interested in the stock market and the businesses listed above make less money.

Do not be surprised when over 60% of all Wall Street research ratings are “buy”.

Much of our economy, for better or worse, depends on the stock market. The slump in housing only heightens the importance of keeping the stock market propped up. After housing, equities are the second-largest asset on American balance sheets. We cannot afford for that asset bubble to pop now too.

Do not be surprised that Federal Reserve Chairman Bernanke and President Obama go out of their way to calm the market when it behaves badly.

At a time when investors need a more reliable accounting system, it seems we are least likely to get it.

All the more reason to buy stocks like Clorox. Not only does the stock get our attractive rating, it has a management team confident enough in the merits of its business to report economic profits.

I also recommend the following ETFs because of their “attractive” rating and exposure to CLX.

- Rydex S&P Equal Weight Consumer Staples ETF (RHS)

- iShares Dow Jones Select Dividend Index Fund (DVY)

- Guggenheim Ocean Tomo Growth Index ETF (OTR)

For more details on Clorox’s economic earnings and its “attractive” rating, see our free report on CLX.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.

[1] Detailed research on the superiority of economic vs accounting earnings is here.

[2] In his April 4, 2010 interview with ABC, Larry Summers states that the financial services sector (i.e. Wall Street) spent, in 2009, about $1mm per congressman while employing four lobbyists per congressman.

6 replies to "Buy Clorox: Management Focused On Shareholder Value"

It is so sad and disappointing that Washington will not listen to you. we created a monster in Washington with no way of knowing how to control it.

After sending a copy of your analysis of the S & P downgrade of the sovereign debt of the U.S. to 5 key contacts, I’m going to urge them to read your work on Clorox, as well. This is not something that I do very often. Keep up the good work.

Keep up the good work evidenced by your analysis of Clorox and the Sovereign debt downgrade of U.S. debt by S & P.

I have been a Senior Managing Partner at two of the Big 4 Accounting Firms and have consulted the other two. I can reassure you that what is said here is completely true. I will not invest in any company I know, from sources, that the Accounting is crooked. Dr. Richard Nolan, Emeritus Professor at the HBS in Accounting and Control has said publicly that Audit Firms are bad for your health, provide nothing good about the past, nothing about the present and future, and Governments should nationalized them.

You get a lot of reespct from me for writing these helpful articles.

CLX up nearly 5% in past week while market up only 1%. CLX now up 90% since the initial publish date in 2011