Finding the best ETFs is an increasingly difficult task in a world where a new ETF seems to be born every 10 seconds.

You Cannot Trust ETF Labels

There are at least 45 different financial sector ETFs. There are at least 176 ETFs across all sectors. Do investors need 45 different financial sector ETFs or 176 ETFs for 10 sectors? How different can they be?

Those 45 financial sector ETFs are very different. With anywhere from 23 to 519 holdings, many of these ETFs have drastically different holdings, which creates drastically different investment implications.

I am sure that most of them hold the big names in the sector such as Citigroup (C), Bank of America (BAC) and JP Morgan (JPM). However, investors need to know what else those ETFs hold before they can gain a fair understanding of the ETF.

The same is true for the ETFs in any sector as each sector offers a very different mix of good and bad stocks. Some sectors have lots of good stocks and offer lots of good ETFs. The opposite is true for some sectors. And some sectors lie somewhere in between with a fair mix of good and bad stocks. For example, the financial sector, per my 4Q Sector Ratings report, ranks last out of the 10 major sectors when it comes to providing investors with quality ETF. The consumer staples sector ranks first. The energy and materials sectors are in the middle. Details on the Best & Worst ETFs in each sector are here.

The bottom line is that investors simply cannot trust the ETF labels. You simply do not know what you are getting when you buy any particular sector ETF, based on name/label alone.

Paralysis By Analysis

I firmly believe ETFs for a given sector should not all be that different. I think the large number of financial (or any other) sector ETFs hurts investors more than it helps because too many options can be paralyzing. It is simply not possible for the majority of investors to properly assess the quality of so many ETFs. Analyzing ETFs, done with the proper diligence, is far more difficult than analyzing stocks because it means analyzing all the stocks within each ETF. As stated above, that can be as many as 519 stocks for one ETF.

Nevertheless, any investor, worth his salt, knows that knowing the holdings of an ETF is critical to finding the best ETF.

The Danger Within

Why do investors need to know the holdings of ETFs before they buy? They need to know to be sure they do not buy an ETF that might blow up. Buying an ETF without analyzing its holdings is like buying a stock without analyzing its business and finances. As Barron’s says, investors should know the Danger Within. Put another way, research on ETF holdings is necessary due diligence because an ETF’s performance is only as good as its holdings’ performance. No matter how cheap, if it holds bad stocks, the ETF’s performance will be bad.

PERFORMANCE OF ETF’s HOLDINGs = PERFORMANCE OF ETF

Finding the Sector ETFs with the Best Holdings

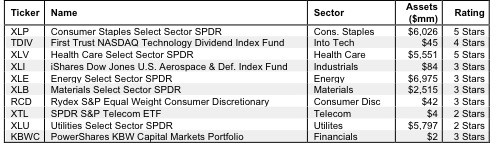

Figure 1 shows my top rated ETF for each sector. Importantly, my ratings on ETFs are based primarily on my stock ratings of their holdings. My firm covers over 3000 stocks and is known for the due diligence we do for each stock we cover. Accordingly, our coverage of ETFs leverages the diligence we do on each stock by rating ETFs based on the aggregated ratings of the stocks each ETF holds.

Health Care Select Sector SPDR (XLV) is not only the top-rated health care sector ETF, it is the overall top-rated ETF of the 176 sector ETFs I cover. Most of the top-rated ETFs for a given sector are not very good. For example, Energy Select Sector SPDR (XLE) is the top-rated energy sector ETF and it only gets three out of five stars. Same is true for Materials Select Sector SPDR (XLB) and Utilities Select Sector SPDR (XLU).

Worse yet are the ETFs that rank as the best for their sector but have very little in assets. For example, First Trust NASDAQ Technology Dividend Index Fund (TDIV) is the best tech sector ETF but it only has $45 million in assets. I recommend investor only buy ETFs with more than $100 million in assets. In which case, the next best tech sector ETF is Technology Select Sector SPDR (XLK). Fortunately, it gets 4 stars like TDIV.

You can find more liquid alternatives for the other funds on my free ETF screener.

Figure 1: Best Sector ETFs

Covering All The Bases, Including Costs

My ETF rating also takes into account the total annual costs, which represents the all-in cost of being in the ETF. This analysis is simpler for ETFs than funds because they do not charge front- or back-end loads and transaction costs are incurred directly. There is only the expense ratio, which is normally quite low. However, my ratings penalize those ETFs with abnormally high expense ratios or any other hidden costs.

Top Stocks Make Up Top ETFs

Johnson & Johnson (JNJ) is one of favorite holdings in XLV, one of two ETFs in Figure 1 to get my 5-star rating. This stock gets my Very Attractive rating. JNJ has a return on invested capital (ROIC) of 17%, which places it in the top quintile of all companies. Usually that kind of profitability comes at a price. In this case, the valuation of JNJ’s stock price implies the company’s profits will permanently decline by over 25%. XLV’s large allocation to a highly profitable, yet undervalued stock, exemplifies why XLV is one of the few ETFs that gets a Very Attractive rating or 5 star rating.

One of my favorite holdings in XLP, one of two ETFs in Figure 1 to get my 5-star rating, is Altria Group (MO). Like JNJ, MO has a top-quintile ROIC of 15% and has an excellent history of economic earnings growth. In fact, in its last fiscal year, MO’s economic earnings per share grew over 9% while the diluted GAAP EPS fell over 13%. Consequently, I think most investors are underestimating the profitability of this company, which is why its stock valuation is unduly depressed. The current valuation of the stock (~$34/share) implies the company’s profits (i.e. NOPAT) will permanently decline by nearly 15%. That is a big discount for such profitable business. High profit growth and low valuation create excellent risk/reward in a stock.

Disclosure: I own JNJ. I receive no compensation to write about any specific stock, sector or theme.