How To Find the Best Sector ETFs

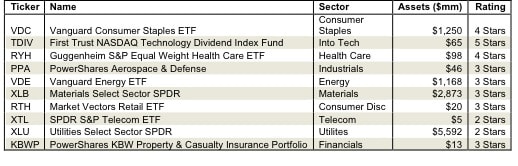

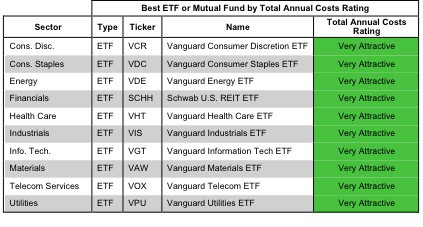

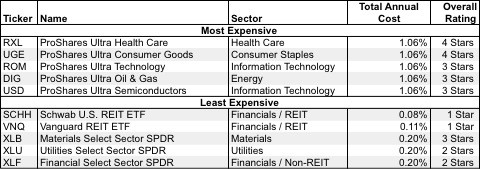

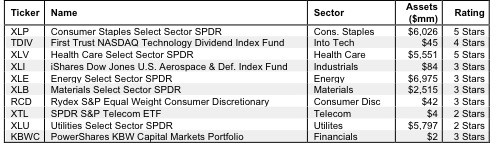

With so many ETFs out there, investors cannot simply look at ETF labels. They need in-depth research of the ETFs holdings and costs. New Constructs offers this kind of research.

David Trainer, Founder & CEO