We recommend investors avoid all utility sector ETFs. There are no ETFs in the utility sector with an attractive-or-better rating. None of the ETFs rank better than the S&P500.

Investors should sell the following dangerous-rated utility sector ETFs:

- ProShares Ultra Utilities (UPW)

- First Trust Utilities AlphaDEX Fund (FXU)

- PowerShares S&P SmallCap Utilities Portfolio (PSCU)

- PowerShares Dynamic Utilities (PUI)

- Rydex S&P Equal Weight Utilities ETF (RYU)

Investors seeking to outperform the market with exposure to the utility sector should invest only in the attractive-or-better rated stocks in the sector. Currently, there are only two: DPL, Inc. (DPL) and Public Service Electric and Gas Company (PEG).

The utility sector is one of four sectors to earn our “dangerous” rating. For our predictive ratings on all ten sectors, see our 3Q11 Sector Roadmap report. Last quarter, the utility sector got a “neutral” rating. As valuations rose and the economics of utility companies declined, the investment merit of companies in the sector deteriorated.

The “dangerous” rating for the sector does not necessarily mean there are no good stocks or ETFs in the sector, It means the likelihood of them is low. So, investors must read carefully.

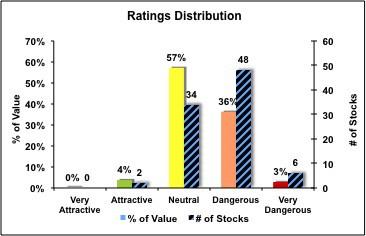

Figure 1 shows the investment merit landscape for utility stocks according to our rating system.

Figure 1: Utilities Sector – Allocation & Holdings by Risk/Reward Rating

There are simply not a lot of good stocks to choose from in the utility sector. The utility sector has only 4% of its value in attractive-or-better-rated stocks and 39% of its value in dangerous-or-worse-rated stocks.

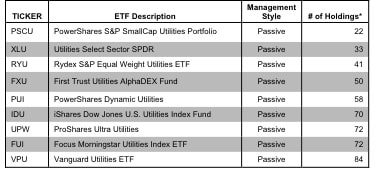

Figure 2: Holdings Count of Utilities Sector ETFs

Figure 2 shows clearly that utility sector ETFs are not all made the same. Different ETFs have meaningfully different numbers of holdings and, therefore, different allocations to holdings. Given the differences in holdings and allocations, these ETFs will likely perform quite differently.

Consequently, it is important to derive a predictive rating for ETFs based on analysis of the underlying quality of earnings and valuation of the stocks in each ETF.

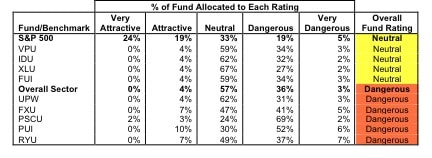

Figure 3 shows how the 9 utility sector ETFs stack up versus each other, the overall sector and the S&P 500 based on their risk/reward ratings and the allocation of their holdings by rating.

Figure 3: Investment Merit Based on Holdings and Allocations

Attractive ETFs:

We find no attractive-or-better-rated utilities ETFs.

Neutral ETFs:

VPU, IDU, XLU, and FUI allocate their value in a way that earns them a neutral overall risk/reward rating. We recommend investors buy the attractive stocks in this sector before buying any of the U.S. equity utilities ETFs.

Dangerous ETFs:

We recommend investors sell UPW, FXU, PSCU, PUI, and RYU because of their dangerous overall risk/reward rating.

Methodology

Our analysis is based on aggregating results from our models on each of the companies included in every ETF and the overall sector (90 companies) based on data as of July 12, 2011. We aggregate results for the ETFs in the same way the ETFs are designed.

Our goal is to empower investors to analyze ETFs in the same way they analyze individual stocks.

Given the success of our rating system for individual stocks, we believe its application to groups of stocks (i.e. ETFs and funds) helps investors make more informed ETF and mutual fund buying decisions. Barron’s featured our uniquely predictive ETF research in “The Danger Within”.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.

1 Response to "Five Utility Sector ETFs To Sell"

[…] Five Utility Sector ETFs To Sell – Hidden Gems and Red Flags in … […]