Recap from September’s Picks

Our Most Attractive Stocks (-1.6%) underperformed the S&P 500 (-1.4%) last month. Most Attractive Large Cap stock Weingarten Realty Investors (WRI) gained nearly 8% and Most Attractive Small Cap stock Universal Insurance Holdings (UVE) was up 18%. Overall, 21 out of the 40 Most Attractive stocks outperformed the S&P 500 in September.

Our Most Dangerous Stocks (-3.6%) outperformed the S&P 500 (-1.4%) last month. Most Dangerous Large Cap stock Tenet Healthcare Corp (THC) fell by 24% and Most Dangerous Small Cap Stock Nationstar Mortgage Holdings (NSM) fell by 16%. Overall, 23 out of the 40 Most Dangerous stocks outperformed the S&P 500 in September.

The successes of the Most Attractive and Most Dangerous stocks highlight the value of our forensic accounting. Being a true value investor is an increasingly difficult, if not impossible, task considering the amount of data contained in the ever-longer annual reports. By analyzing key details in these SEC filings, our research protects investors’ portfolios and allows our clients to execute value-investing strategies with more confidence and integrity.

12 new stocks make our Most Attractive list this month and 12 new stocks fall onto the Most Dangerous list this month. October’s Most Attractive and Most Dangerous stocks were made available to members on October 5.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stock Feature for October: Cisco Systems (CSCO: $28/share)

Cisco Systems (CSCO), provider of networking and communication products and services, is one of the additions to our Most Attractive stocks for October. Cisco was also our Stock Pick of the Week in November 2014.

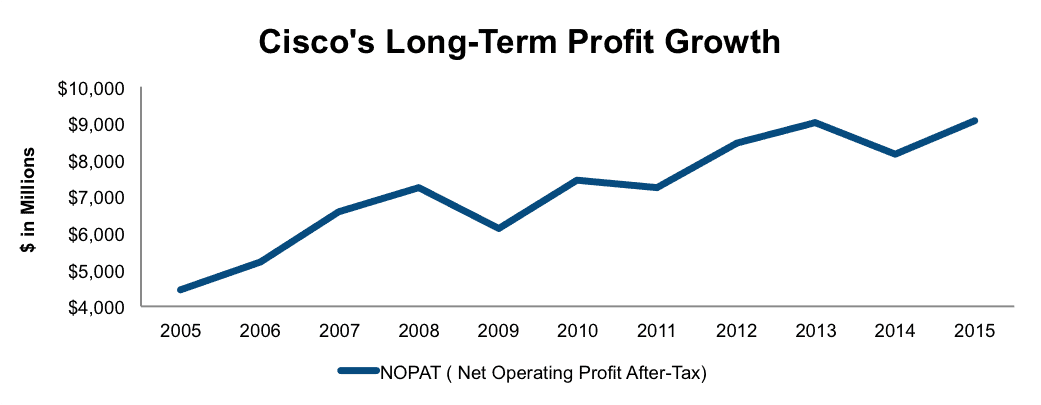

While bears contemplate whether Cisco can adapt to the new technological world we live in, the company continues to grow its profits. Over the past decade, Cisco has grown after-tax profits (NOPAT) by 7% compounded annually as shown in Figure 1.

Figure 1: Cisco’s Profit Growth Remains Intact

Sources: New Constructs, LLC and company filings

In addition to growing profits, Cisco maintains a consistently high ROIC. Over the past decade, Cisco has generated no less than 14% ROIC and currently earns a top quintile 16% ROIC. The efficiency with which Cisco runs its business helped the company generate nearly $32 billion in cumulative free cash flow since 2011.

Impacts of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Cisco’s 2015 10-K:

Income Statement: we made $2.1 billion of adjustments with a net effect of removing $92 million in expenses (<1% of revenue). We removed $1.1 billion related to non-operating expenses and $1 billion related to non-operating income.

Balance Sheet: we made $67 billion of adjustments to calculate invested capital with a net decrease of $32 billion. The largest adjustment was the removal of $59.7 billion (66% of net assets) of excess cash.

Valuation: we made $88.6 billion of adjustments with a net effect of increasing shareholder value by $32 billion. One of the most notable adjustments was the $1 billion (1% of market cap) decrease to shareholder value for off balance-sheet operating leases.

Low Share Price Provides Excellent Entry Point

While CSCO has performed marginally better than the market so far in 2015 (-1% compared to -3% S&P 500), shares remain significantly undervalued. At its current price of $28/share, CSCO has a price to economic book value (PEBV) ratio of 0.8. This ratio implies the market expects Cisco’s NOPAT to permanently decline by 20%. If Cisco grows NOPAT by 5% compounded annually over the next decade, the stock is still worth $41/share today – a 46% upside.

Most Dangerous Stock Feature: Scholastic Corporation (SCHL: $41/share)

Scholastic Corporation (SCHL), a worldwide book publisher and distributor, is one of the additions to our Most Dangerous stocks for October.

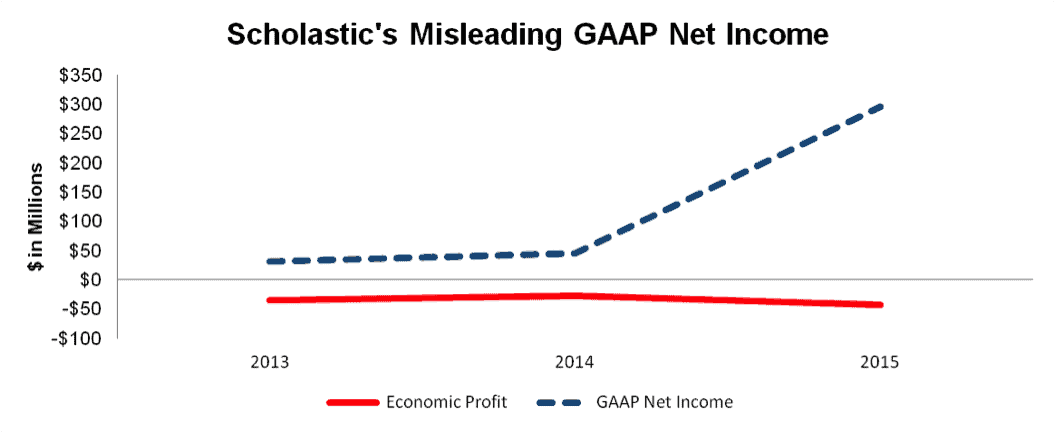

Scholastic is the perfect example of why investors need to look past GAAP earnings numbers to understand the health of a business. While Scholastic has been reporting positive and increasing GAAP EPS since 2010, the company’s economic earnings, or the true cash flows available to shareholders, have been declining. As seen in Figure 2, 2015 is particularly alarming as net income soared despite declining economic earnings.

Figure 2: Net Income Doesn’t Tell The Whole Story

Sources: New Constructs, LLC and company filings

So what caused GAAP net income to rise while economic earnings further declined? Accounting loopholes. 2015 GAAP net income was inflated in large part due to $279 million in earnings from discontinued operations. In order to get true picture of Scholastic’s recurring cash flows, this income must be removed. After making this adjustment, along with many others, we find that Scholastic’s economic earnings were -$1.30/share compared to $8.82 GAAP EPS.

The real numbers reveal that Scholastic’s business has become less efficient over the years as its ROIC has fallen to a bottom quintile 1%, well below the 10% earned in 2010.

More Accounting Adjustments Reveal Overstated EPS

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Scholastic’s 2015 10-K:

Income Statement: we made $370 million of adjustments with a net effect of removing $240 million in non-operating income (15% of revenue). We removed $65 million related to non-operating expenses and $305 million related to non-operating income.

Balance Sheet: we made $1.1 billion of adjustments to calculate invested capital with a net increase of $55 million. The largest adjustment was the inclusion of $155 million (12% of net assets) due to accumulated asset write-downs.

Valuation: we made $338 million of adjustments with a net effect of decreasing shareholder value by $10 million. One of the most notable adjustments was the $92 million (1% of market cap) decrease to shareholder value related to off balance-sheet operating leases.

After Adjustments It’s Clear That Scholastic Is Overvalued

Year-to-date, SCHL has outpaced the returns of the market and is up 12% on the back of its misleading GAAP numbers. To justify its current price of $41/share, Scholastic must grow NOPAT by 7% compounded annually for the next 13 years. While this expectation may not seem overly optimistic, keep in mind that since 2011 Scholastic’s NOPAT has actually declined by 8% compounded annually.

Even if we assume a scenario in which Scholastic is able to turn around years of profit decline and grow NOPAT by 4% compounded annually for the next decade, the stock is only worth $30/share today – a 27% decline from today’s price. It’s easy to see why Scholastic lands on October’s Most Dangerous Stocks list.

Disclosure: David Trainer, Kyle Guske II, and Blaine Skaggs receive no compensation to write about any specific stock, style, or theme.