This report is one of a series on the adjustments we make to convert GAAP data to NOPAT and economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

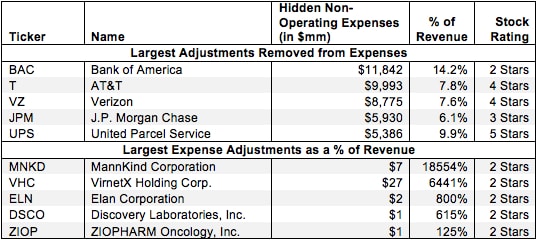

Non-operating expenses are unusual charges that don’t appear on the income statement because they are bundled in other line items. Without careful footnotes research, investors would never know that these non-recurring expenses distort GAAP numbers by lowering operating earnings. Examples of hidden non-operating expenses include: restructuring or severance costs, litigation costs and certain pension costs/income. Another hidden non-operating item is asset write-downs to which we dedicate a separate report.

Our models remove this distortion to reveal a company’s recurring, core, net operating profit after tax: NOPAT.

2 replies to "Adjusting NOPAT for Non-Operating Expenses Hidden in Operating Earnings"

This type of hidden cost adjustment doesn’t include a related adjustment to the balance sheet like an asset-write down would have.

For companies that have a habit of non-operating expenses, what can one glean about management or strategy quality and how it would affect the decision to rank the company favorably or unfavorably since NOPAT would obviously be boosted. Is there a noticeable pattern of some kind?

Beans – that is a great question! The issue with recurring non-recurring charges has been around since the beginning of company reporting. We have yet to discern any remarkable patterns in this area. We did an extensive study on this topic over the first few months of 2022. Given our unrivaled, proprietary database of non-operating items, we should be able to gleans as much insight on this topic as anyone. I regret to report that there’s not enough consistency, lots of random noise, in the disclosure of non-recurring/non-operating items to derive much insight. But, we had a few takeaways:

1. Material non-operating gains/charges are more likely to recur after a company has reported them 3 years in a row

2. There is no way to know if a company will disclose non-operating gains/charges before that 3-year track record is established.

3. Nevertheless, there are some companies who regularly disclose large non-recurring gains/charges to the extent that one should treat them as recurring. These instances are rare but quite obvious when you come upon them.