This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

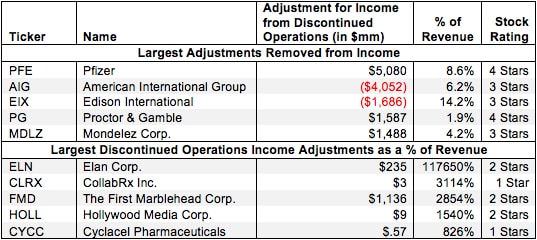

When a company designates a portion of its business as held for sale, the company is required under GAAP to account for any income/loss from these divisions or from the sale of these divisions as income/loss from discontinued operations. Because this data is included on the income statement and in net income, investors receive a distorted view of a firm’s operating profitability by only looking at GAAP earnings.

We remove all income and losses from discontinued operations in calculating operating profit because this income/loss will not recur in the future, and we are looking for the true profitability of the continuing and core operations of a company.

4 replies to "Income and Loss from Discontinued Operations – NOPAT Adjustment"

Interesting final caveat for REITs. Just wondering if this would also apply to the casual dining industry in which companies mostly lease their physical facilities and show a large discontinued operations expense when they close some of their locations. The leases are structured as operating leases. Given that unprofitable operations led to the closures, these discontinued operations charges could reasonably be written against current period pre-tax income. One could also argue that the closures represent reductions in operating capital and thus should reduce retained earnings but not operating income. Any thoughts?

Thanks for reading and commenting Bill! It’s true that big discontinued operations charges can indicate significant problems in the casual dining industry, but these charges can distort the true operating profits of the core business, which is what we’re trying to measure with these adjustments.

To fully capture the impact of discontinued operations on ROIC, shall we adjust the denominator (i.e. investment capital) by adding the expected cash received from the sale of the discontinued operation? otherwise, will we risk distorting the ROIC by only adjusting the numerator but not the denominator of the ROIC formula? Thanks

Emma,

For details on how we treat discontinued operations in our calculation of invested capital click here. Thanks for reading!