This report is one of a series on the adjustments we make to convert GAAP data to economic earnings. This report focuses on an adjustment we make to convert the reported balance sheet assets into invested capital.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rules provide numerous loopholes that companies can exploit to hide balance sheet issues and obscure the true amount of capital invested in a business.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

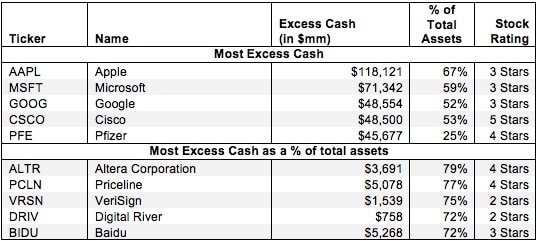

Companies require a certain amount of cash on hand to pay bills, buy raw materials, pay employees, etc. Investors should demand a return on the “required cash” for use in operations. Cash that is not required for operations is excess cash.

For most companies, we estimate the amount of required cash to be 5% of sales. We increase this amount for companies with large operating losses and decrease it for companies with large operating profits to better reflect the cash needs of those companies.

Most companies hold some cash—or cash equivalents in the form of investments—above this required amount. Companies hold excess cash in order to cushion against economic downturns, prepare for acquisitions, or any number of other reasons. Sometimes, past profits pile up on balance sheets and are a form of excess cash. Excess cash is not needed for the operations of a company. It is removed from our calculation of invested capital because it is not part of the investment required for a company to grow its business. We want our calculation of return on invested capital (ROIC) to reflect the operations of the business and not be distorted by past profits.

2 replies to "Excess Cash – Invested Capital Adjustment"

Thanks for the insight.How about good will? Should it be deducted from invested. Again, are we talking of deducting Cash n cash equivalents or Excess cash?

Hi Peter:

Thanks for your comment! You can see our article on invested capital here. Figure 2 shows a detailed breakdown of our invested capital calculation.