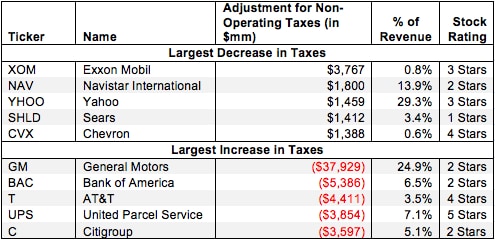

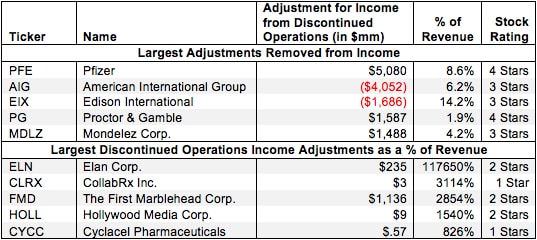

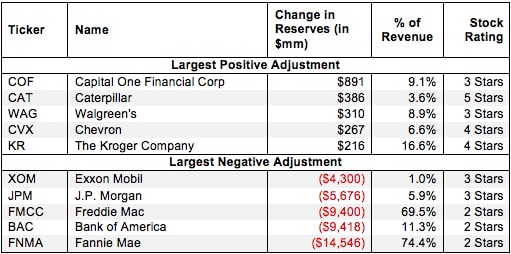

30+ Accounting Adjustments to Get the Truth About Earnings & Valuation

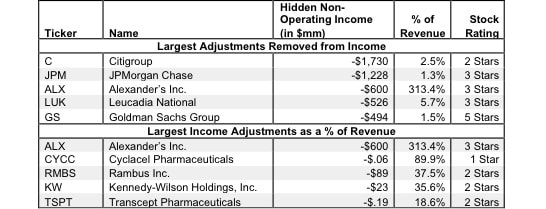

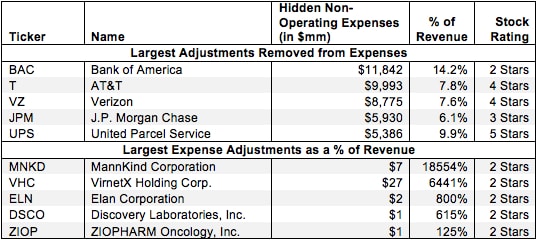

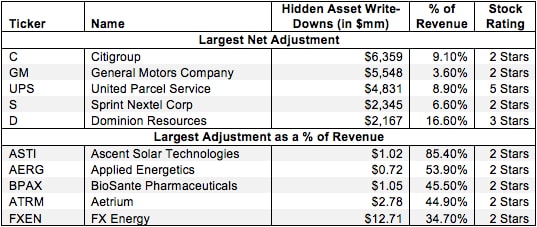

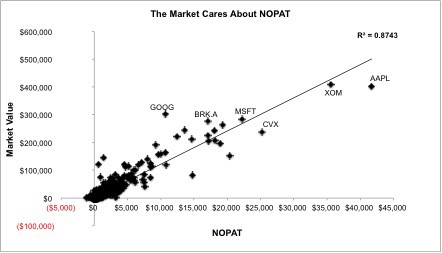

Reported earnings don’t tell the whole story of a company’s profits. They are frequently manipulated by companies to manage earnings.

David Trainer, Founder & CEO