This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

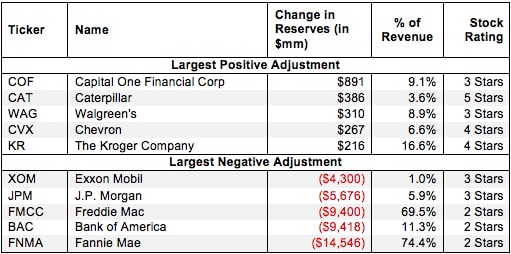

Change in total reserves is the year over year difference in a company’s loan loss and/or inventory reserves. The change in reserves is positive (increased operating profit (NOPAT) vs net income) whenever the loss provisions exceed actual charge-offs or LIFO reserves increase. It is negative (lower NOPAT vs net income) when loss provisions are less than actual loan charge-offs or LIFO reserves decrease.

Loan loss provisions can be manipulated to boost a company’s earnings by bleeding off reserves. Or they can cause problems when companies need to “catch up” and take big provisions to raise reserves to more appropriate levels.

4 replies to "Change in Total Reserves – NOPAT Adjustment"

Why is it better to use FIFO for economic earnings than LIFO?

It’s less that FIFO is absolutely better than LIFO, but it’s important to use the same method for all companies. Our goal is to make economic earnings comparable across all companies, so we want to make sure that inventory accounting is the same for everyone.

What is the best way( or best practice) to adjust for the change of total reserve? I doubt if applying the same total reserve across the comp set, or taking away the reserve all together is an effective way of adjustment. Different companies may have different focus segments/risks thus required different levels of reserve. Thanks

Emma,

Thanks for reading! As the article states, our calculation of NOPAT already adjusts for a change in reserves. There are two benefits in doing this. First, NOPAT cannot be manipulated by management making changes to loan loss provisions. Second, universally applying this adjustment (along with all of our other adjustments) to all companies makes NOPAT comparable across all companies.