The market attempted a rally into President Trump’s “liberation day” tariff announcement, but can the momentum continue? Or is this movement just another blip as the market heads lower?

While the media fans the flames of panic, we’re calmly finding the best stocks in the market.

Why does uncertainty have to be a bad thing?

From uncertainty, opportunities spring – which is just another way of saying: be greedy when others are fearful.

Listen folks, now is exactly the time when diligence matters most.

Investors with an edge salivate over markets like what we’ve seen this year. Volatility is a gift that creates more overvalued and undervalued stocks. The best investors make their hay in markets like this.

When you’ve done your diligence, picking the best stocks is as easy as picking the best apples off the shelf at the grocery store.

This week’s new Long Idea is one of those apples. The company is in a great position to take advantage of tailwinds in its industry, has quality fundamentals, provides a strong yield backed by real cash flows, and has a stock that trades at a significant discount.

Below, we present a large excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is.

This stock offers favorable Risk/Reward based on the company’s:

- position to benefit from long-term energy demand,

- diverse business model with operations across the globe,

- new contract wins to drive growth,

- industry leading profitability, and

- cheap valuation.

Energy Demand Indisputably on the Rise

The bullish outlook on energy remains rooted in the understanding that, while an energy transition is inevitable, it will take much longer than expected.

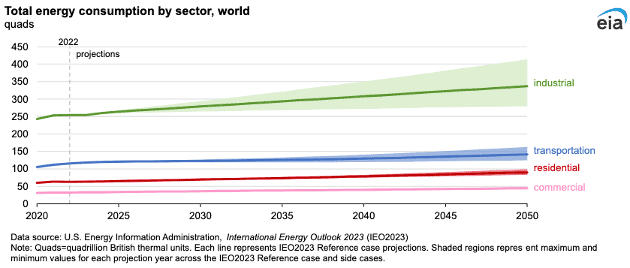

As seen in Figure 1, the U.S. Energy Information Administration (EIA) projects energy consumption to increase across the Industrial, Transportation, Residential, and Commercial sectors through 2050.

This long-term energy demand expansion underscores our belief in the sustained demand for exploration and profitable production of fossil fuels for the foreseeable future.

Figure 1: Energy Consumption by Sector: 2022 – 2050

Source: EIA International Energy Outlook 2023

Increase in Oil & Gas Production in Near- and Long-Term

In its March 2025 Short Term Energy Outlook, the EIA notes that global oil production is expected to grow year-over-year (YoY) in both 2025 and 2026. This outlook comes after OPEC+ countries (the eight countries that produce the most in OPEC) reaffirmed its plan to increase production starting in April 2025.

Long-term, there is one thing multiple different analyses agree on – peak oil demand is also years away.

- The International Energy Agency projects global oil demand to rise through 2030.

- OPEC estimates global oil demand will rise from 102.2 million barrels/day in 2023 to 120.1 million barrels/day in 2050.

- Goldman Sachs notes “peak oil demand is still a decade away”, with oil demand not seeing its first YoY decline until 2035.

As oil demand persists, so too will production rise to meet that demand, which benefits global service and equipment providers like this company.

Quality Fundamentals

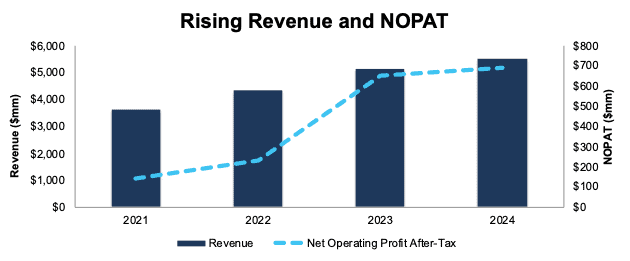

The company has grown revenue and net operating profit after-tax (NOPAT) by 15% and 70% compounded annually since 2021, respectively.

The company’s NOPAT margin improved from 4% in 2021 to 13% in 2024, while invested capital turns rose from 1.2 to 1.8 over the same time. Rising NOPAT margins and invested capital turns drive the company’s return on invested capital (ROIC) from 5% in 2021 to 22% in 2024. See Figure 3.

Figure 3: Revenue & NOPAT: 2021 – 2024

Sources: New Constructs, LLC and company filings

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.