With the recent downgrade of the U.S. credit rating adding to market uncertainty, safeguarding your investment portfolio is crucial.

Leveraging high-quality fundamental data makes this task far more manageable. Through our rigorous research, we gain insight into the true earnings and cash flows of companies – enabling us to identify overvalued firms with weak business fundamentals, a.k.a. our Danger Zone picks.

This week’s Danger Zone pick highlights a company with a large cash burn, unprofitable business model, misleading earnings metrics, and a valuation that requires far too optimistic growth rates. For instance, the stock’s current price implies the business will simultaneously achieve huge profit margin improvement and grow revenue at twice the industry rate.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing the name of the company because that’s for our paying clients. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and warnings. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on:

- declining take rates,

- consistent cash burn,

- falling economic earnings,

- persistent unprofitability in a profitable industry, and

- a stock valuation that implies the company will become one of the largest in the industry.

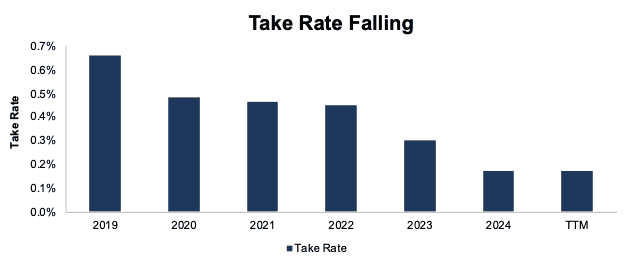

Deteriorating Take Rates

This company generates revenue when consumers make transactions on its payment cards. The percentage of revenue the company generates from each transaction is known as its take rate. If the company’s take rate is steady, or ideally rising, growing TPV would result in higher revenues.

However, despite growing its TPV, this company’s take rate has been declining YoY since 2019 (even before the company’s IPO). The company’s take rate fell from 0.66% in 2019 to 0.17% over the TTM ended 1Q25. See Figure 2. In 1Q25, the company’s take rate was 0.16%, which is down from 0.18% in 1Q24.

Figure 2: Take Rate: 2019 – TTM ended 1Q25

Sources: New Constructs, LLC

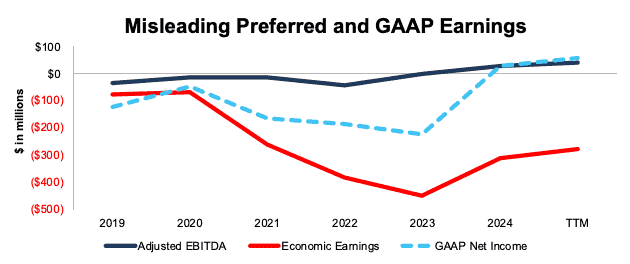

Profits Are Less Than They Would Have You Believe

This company’s management provides a misleading view of the company’s profitability when it directs investors to its “Adjusted” EBITDA. From 2019 to the TTM, the company’s Adjusted EBITDA improved from -$34 million to $40 million. Similarly, the company’s GAAP net income rose from -$122 million in 2019 to $55 million in the TTM.

However, over the same time, the company’s economic earnings, the true cash flows of the business, fell from -$75 million to -$278 million. It is a big red flag when the company’s preferred non-GAAP and GAAP metrics are rising while its economic earnings are declining.

The discrepancy between metrics should come as no surprise as the company openly admits in earnings releases that its adjusted EBITDA calculation excludes “share-based compensation expense, executive chairman long-term performance award, restructuring costs, due diligence and transaction costs related to potential or successful acquisitions” and more. We further detail the issues with Adjusted EBITDA here.

Figure 3: Adjusted EBITDA vs. Net Income vs. Economic Earnings: 2019 – TTM

Sources: New Constructs, LLC and company filings.

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

I’ll keep sending information on low quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this Danger Zone pick to underperform.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.