The Bloomberg New Constructs Core Earnings Leaders Index tracks the performance of the top 100 companies that have high Earnings Capture based on our proprietary Core Earnings, which removes unusual gains and losses found in the footnotes and MD&A in company filings. The Earnings Capture metric equals Core Earnings minus reported earnings. Factsheet is here. Index methodology is here.

Given the outperformance of the index shown in Figures 1 and 2, we think it is fair to say that there’s a lot of alpha in our proprietary measure of Core Earnings.

On the Bloomberg website or terminal, you can track performance with these tickers:

- Total Return Index BCORET:IND.

- Price Return Index BCORE:IND.

- Net Return Index BCORENR:IND.

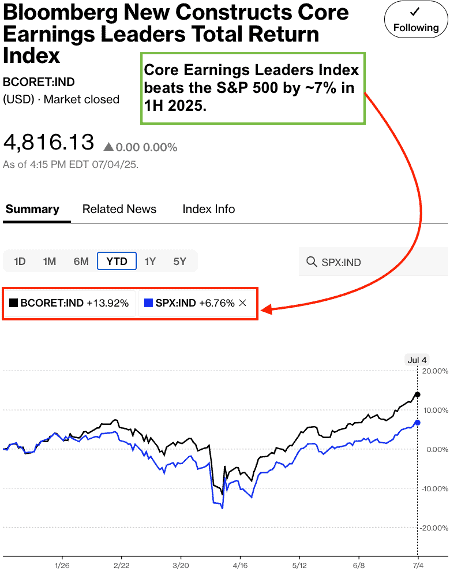

Figure 1 compares the performance of the Bloomberg New Constructs Core Earnings Leaders Total Return Index (ticker: BCORET:IND), managed by Bloomberg, to the S&P 500. In 1H25, the Bloomberg New Constructs Core Earnings Leaders Total Return Index was up 13.9% while the S&P 500 was up 6.8%.

Figure 1: Bloomberg New Constructs Core Earnings Leaders Index Outperforms the S&P 500 in 1H25

Sources: Bloomberg as of July 4, 2025

Note: Past performance is no guarantee of future results.

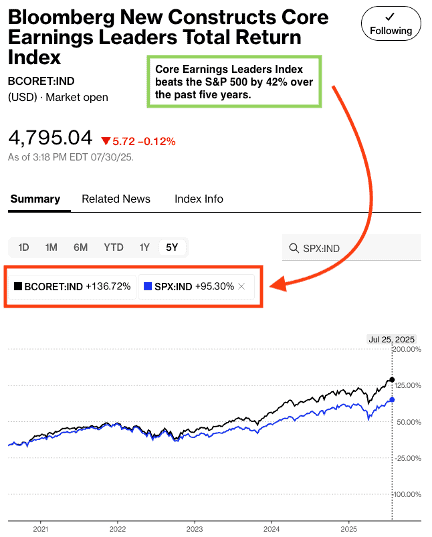

Over the past five years through July 25, 2025, the Bloomberg New Constructs Core Earnings Leaders Total Return Index was up 137% while the S&P 500 was up 95%.

Figure 2: Bloomberg New Constructs Core Earnings Leaders Index Outperforms Over 5 Years

Sources: Bloomberg as of July 25, 2025

Note: Past performance is no guarantee of future results.

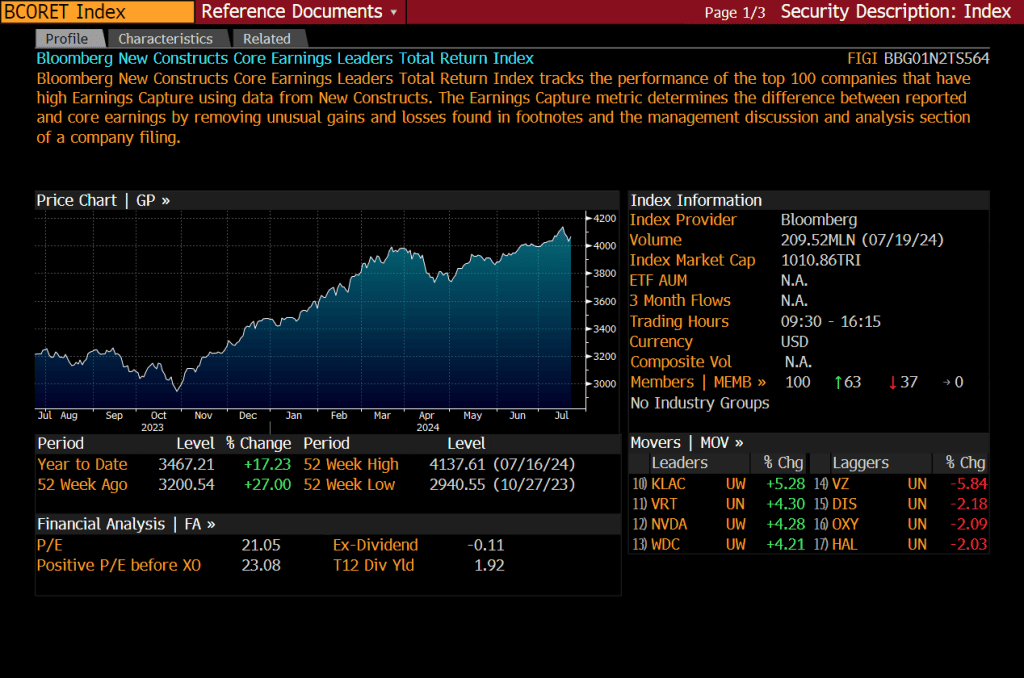

Figure 3 shows the Bloomberg New Constructs Core Earnings Leaders Index on the Bloomberg terminal.

Figure 3: Core Earnings Leaders Index On the Bloomberg Terminal

Sources: New Constructs, LLC & Bloomberg

This article was originally published on July 31, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.