Artificial intelligence (AI) has been the driving force behind equity markets this year. Whether fueled by investor enthusiasm or genuine technological progress, AI looks poised to drive the next phase in humanity’s technological evolution.

Companies are deploying unprecedented amounts of capital to develop and scale AI capabilities. Big tech companies Alphabet (GOOGL), Microsoft (MSFT), Meta (META), and Amazon (AMZN) recently projected upwards of a combined $380 billion in capital expenditures on AI. One company, OpenAI, has committed to spending over ~$1 trillion on AI infrastructure.

None of these companies can keep up this huge spending forever. Accordingly, investors must ask: who will win or lose the AI arms race?

The answer is simple: companies that can afford to spend the most money have a much better chance of winning. In other words, the companies that generate enough cash to fund large expenditures (think capital as a weapon) have a significant advantage. On the other hand, companies with weaker cash flows have a significant disadvantage and are likely to be forced out of the race because they cannot keep up with the spending of their competitors.

The longer the AI race lasts, the larger this disadvantage becomes. I think the AI race will last for many years, and we are only in the early stages. In fact, we’ve yet to begin the most important and perhaps, expensive, stage of the AI race. But, let’s cut to the chase and talk about winners and losers.

Who Are the Losers?

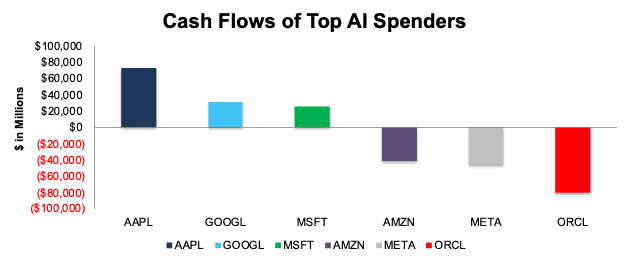

Trailing-twelve-months (TTM) free cash flow (FCF) is the simplest way to identify which businesses do or do not generate enough free cash flow to maintain massive AI expenditures and stay in the race. A review of TTM FCF reveals stark divides between the top AI spenders.

Per Figure 1, Apple (AAPL), Alphabet (GOOGL), and Microsoft (MSFT) each generated tens of billions of dollars in FCF over the TTM period.

This cash generation reinforces each company’s ability to fund future AI investment.

In contrast, Amazon (AMZN), Meta (META), and Oracle (ORCL) burned large amounts of cash over the same time and are the losers in this group.

Figure 1: TTM Free Cash Flow (FCF) of the Top Spenders in the AI Race

Sources: New Constructs, LLC and company filings

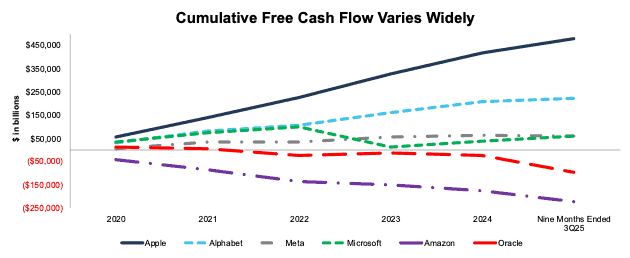

The divergence in free cash flow between the winners and losers has grown in recent years as well.

From calendar 2020 through 3Q25, each of the companies in Figure 1 generated the following in cumulative FCF:

- Apple: $482 billion

- Alphabet: $222 billion

- Microsoft: $59 billion

- Meta: $59 billion

- Oracle: ($94) billion

- Amazon: ($222) billion

See Figure 2.

Simply put, companies that generate strong cash flows year in year out, like Alphabet and Apple, possess a clear advantage in funding long-term AI initiatives over those already burning cash to support the normal (no AI) operations of their business, like Amazon and Oracle.

Figure 2: Cumulative FCF: Calendar 2020 – Nine Months ended 3Q25

Sources: New Constructs, LLC and company filings

*Due to Oracle’s fiscal year, data is from Dec 2019 through Aug 2025. All other data is from Jan 2020 through September 2025

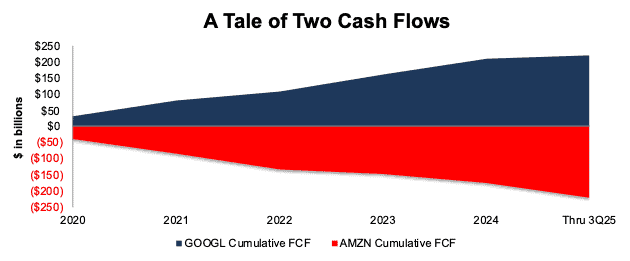

The disparity in cumulative FCF over the last five years between two of the largest AI spenders, Alphabet and Amazon, is particularly stark.

Amazon upped its expected capital expenditures to $125 billion in its latest earnings release. Meanwhile, Alphabet increased its capital expenditure forecast to $91-$93 billion.

However, from 2020 through 3Q25, Alphabet generated a cumulative $222 billion in FCF while Amazon burned a cumulative $222 billion. See Figure 3.

Figure 3: Cumulative FCF: GOOGL vs AMZN: 2020 – 3Q25

Sources: New Constructs, LLC and company filings

Apple, Alphabet, and Microsoft are the clear leaders when it comes to ability to deploy capital in the AI race. They possess a key competitive advantage, not because they spend the most, but because they generate the most cash flow in the current period and across the past five years to fund huge investments into AI.

Notably, Apple has taken a more modest approach to AI spending. As noted in the company’s latest earnings call, Apple buys compute capacity from third parties, rather than billions worth of AI chips. Additionally, the company uses its own chips for its Private Cloud Compute service.

However, should the company move away from this approach, it is fully capable of being a major force in the AI race. Apple generates the most TTM FCF, at $73.4 billion, not just among its AI peers, but among the entire S&P 500. For context, NVIDIA (NVDA), at $51.4 billion, generates the second most TTM FCF in the S&P 500.

In summary, when it comes to TTM FCF, Amazon, Meta, and Oracle are the losers. Amazon and Oracle stand out since they have burned billions in FCF not only in the TTM but also over the past five years.

With no free cash to reinvest, these companies must rely on outside funding sources (or cut their spending) to sustain their massive AI spending ambitions.

It’s a Marathon, Not a Sprint

Unlikely to slow anytime soon, the first wave of AI spending has focused on the infrastructure required to power next-generation AI systems. While infrastructure spending currently dominates AI-related capital expenditures, it is not the most important factor in determining the winners and losers of the AI race in the long run. Don’t get me wrong, I think infrastructure is very important, and companies will likely have to perpetually invest in it. But, there’s an even more important factor: high-quality data.

The Next Stage of AI Spending: Higher-Quality Data

The most essential ingredient in building reliable AI systems is high-quality data. As the saying goes “garbage in, garbage out”. No matter how large the infrastructure or sophisticated the model, an AI system trained on unreliable data will be unreliable.

We’ve written extensively on why high quality training data is an inarguably essential input for building truly reliable AI. So, I will trust this point has been made.

The only open question is: what’s the upside of marrying higher quality data with AI?

Because there are precious few examples of the successes of marrying AI with high quality data, I must point to the failings of AI based on poor quality data to make this point. Fortunately, there are plenty of examples of other AI models failing in the form of the numerous hallucination people experience daily with Chat GPT, Claude, Perplexity, Grok, etc. I would bet that anyone who’s used AI a decent amount has experienced an alarmingly incorrect hallucination. As a result, users limit how much they trust and rely on the AI. The bottom-line is that, when AI hallucinates, it is more costly for experts to try and use AI to help them than it is to do the work on their own. Experts are accustomed to developing their own insights. The time lost on dealing with hallucinations drives experts to ignore AI until they know they can trust it to be truly accretive to their work.

Hence, the importance of high-quality data to support an AI’s ability to give correct, truthful answers to questions that experts would ask or that require deep subject matter expertise is paramount.

I do not think it’s controversial to assert that the companies that can add the highest quality training datasets to their AI infrastructure will be the best positioned to win the AI race.

This kind of marriage is not some distant “dream” scenario. We’ve demonstrated the unrivaled power of AI when high quality datasets are married with cutting-edge technology. See what we created with Google Cloud: FinSights. To get access, sign up here.

AI Hallucinations Are a Feature, Not a Bug

Rather than tell users that it does not have an answer or admit it lacked data to provide a reliable answer, AIs and chatbots are programmed to give an answer no matter what. This practice, aka “bad data is better than no data,” is not uncommon in the investment research business. How often do Bloomberg Terminal, FactSet (FDS), S&P Capital IQ (SPGI) tell you that they have no data, stock prices or cannot answer a question?

Having been in the data business, I have had many clients say “I am ok with bad data as long as everyone else is using the same bad data” many times. In fact, the Harvard Business School Case Study on New Constructs includes a quote just like that.

My point is that people build AIs to please users so that the users keep using them. This practice is no different from any other sales practice. Sellers make the experience with their product or service as pleasant as possible with the goal of winning your business in the future. No one expects to be successful by giving clients an unpleasant experience. Why should we expect AI to act any differently?

So, tread carefully anytime you use an AI that is not built on 100% reliable data.

What Does all this Mean for Your Portfolio

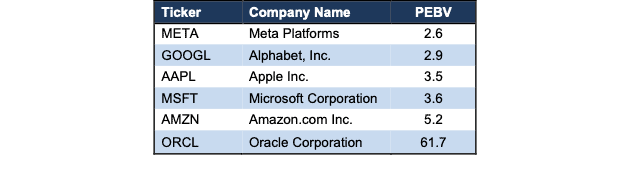

While there are clear leaders and laggards in terms of FCF, each of the stocks analyzed above look expensive. They all trade well above their respective economic book values, or no-growth values, which means the market is giving them all at least a decent chance of winning the AI race. I think it’s fair to say that the chances of all of them winning is very low. Hence, the goal of this report is to help you avoid the losers and invest in the winners.

Per Figure 4, I’d note that two of the cash burners, Amazon and Oracle, have the highest PEBV ratios and are the most expensive of the group. Being the most highly valued makes them the riskiest stocks even before we account for their negative FCF. That makes them twice the losers.

The other FCF loser, Meta, has the lowest price-to-economic book value (PEBV) ratio among AI peers. There’s less risk of valuation implosion with META, but given it’s lower FCF and attendant ability to last as long as others in the AI race, we think it’s a loser, too.

Figure 4: AI Race PEBV Valuation Comparison: Trailing Twelve Months (TTM)

Sources: New Constructs, LLC and company filings

This article was originally published on November 10, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.