Will The Fed’s rate decision take the cheer out of December’s Santa Claus Rally? Or will traders push right past any concerns of overvaluation and send markets to new record highs, as they’ve done many times this year.

In this week’s Danger Zone, we feature a company whose stock has benefitted greatly from the market’s rally this year, even though the underlying business keeps losing money. Beneath the surface, the business still faces structural challenges, competitive pressures remain intense, and the lofty stock price implies a growth and profitability trajectory that simply isn’t supported by rational thinking.

In fact, its current valuation implies it will take over 60% share of its global market, despite ongoing cash burn and lack of profitability.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing the name of the company because that’s for our Professional and Institutional members. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and warnings.

Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on:

- lack of economies of scale and competitive advantages in its industry,

- higher costs and lower margins,

- large cash burn,

- ongoing shareholder dilution, and

- stock price that implies the company will own over 60% of its global market.

Reported Results Are Misleading

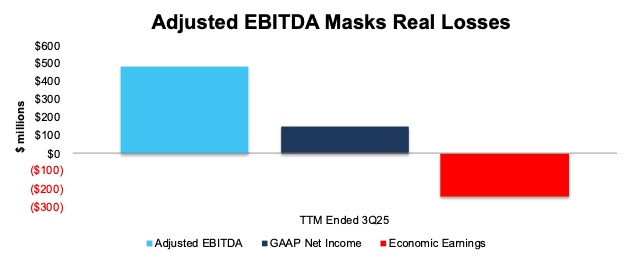

Investors that don’t look beyond the surface may think this company is more profitable than it actually is.

The company’s preferred earnings metric, adjusted EBITDA, and even its GAAP net income, paint a much rosier picture of its underlying business.

When we analyze the company’s economic earnings, the true cash flows of the business, we see just how misleading this non-GAAP metric is.

In the TTM ended 3Q25, the company reported adjusted EBITDA of $488 million and GAAP net income of $151 million. Over the same time, its economic earnings were -$244 million. Figure 3 shows the discrepancy between the three earnings metrics.

In the first nine months of 2025, management removed $286 million in net expenses to calculate adjusted EBITDA. The largest adjustment removes $242 million in stock-based compensation to calculate adjusted EBITDA. This expense alone is 272% of the company’s reported GAAP net income in the same period.

Figure 3: Economic Vs. GAAP and Adjusted EBITDA: TTM ended 3Q25

Sources: New Constructs, LLC and company filings

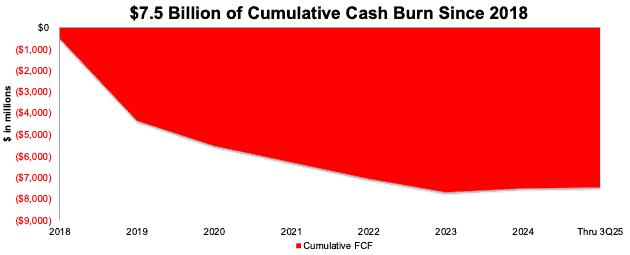

Cash Burn Tells a Similar Story

This company certainly knows how to burn cash. From 2018 through 3Q25, the company burned through a cumulative $7.5 billion (78% of enterprise value) in free cash flow (FCF).

After generating positive FCF for the first time on an annual basis in 2024, FCF is once again negative. In fact, over the TTM, the company has burned -$133 million in FCF. The company has enough cash on hand to avoid the Zombie Stocks list, but if cash burn rises or cash balances fall, it could find itself added to the list as it meets the other criteria with a negative interest coverage ratio.

Figure 4: Cumulative Free Cash Flow: 2018 through 3Q25

Sources: New Constructs, LLC and company filings

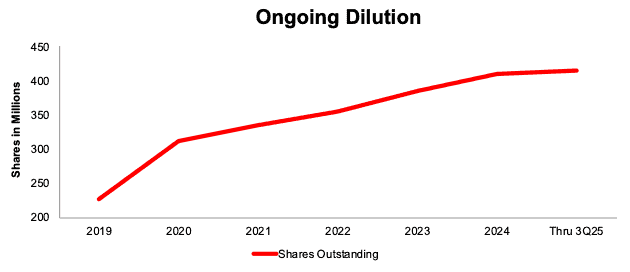

Shareholders Diluted Amidst Cash Burn

The company has consistently diluted existing shareholders to fund its large cash burn since it went public in 2019.

The company’s shares outstanding have increased YoY in every year since its IPO. Per Figure 5, the company’s shares outstanding increased from 228 million in 2019 to 415 million in 3Q25.

Figure 5: Shares Outstanding Since 2019

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.