Breaking news: The Fed cut rates for the third time this year! By now you’ve likely seen this headline plastered across every screen, scroll, and social media account that follows financial markets. As the markets move and traders make their next bet, are you left wondering “where do we go from here?”

That’s where we come in. We leverage our AI-driven Robo-Analyst to find opportunity in any market environment, regardless of the latest headlines and narratives.

In this week’s Long Idea, we feature a well-known business trading at a substantial discount. The company is successfully capitalizing on rising demand, improving profitability, and provides a quality shareholder yield.

The disconnect between the company’s strong fundamentals and the pessimistic expectations in the stock price present excellent opportunity.

We aim to help all our clients become more informed investors by providing real insights that are proven to outperform the market.

We hope you enjoy this excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is. Always let us know how we can provide more value to you.

This stock offers favorable Risk/Reward based on the company’s:

- ability to capitalize on demand,

- strong profitability,

- consistent cash flows and quality shareholder return, and

- cheap valuation.

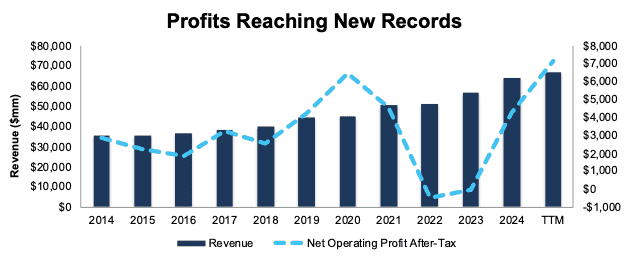

Profits Reaching Record Highs

Figure 2 shows that this company’s net operating profit after-tax (NOPAT) reached $7.2 billion over the trailing-twelve-months (TTM), which is the company’s second highest TTM NOPAT in the history of our model.

The company improved its NOPAT margin from -0.9% in 2022 to 10.7% over the TTM, while return on invested capital (ROIC) improved from -2% to 26% over the same time.

Looking beyond the last few years, the company has grown revenue 6% compounded annually over the past 10 years and 4% compounded annually since 1998. The company has also grown NOPAT 9% and 3% compounded annually over the same timeframes.

Figure 2: Revenue and Core Earnings: 2014 – TTM Ended 3Q25

Sources: New Constructs, LLC and company filings

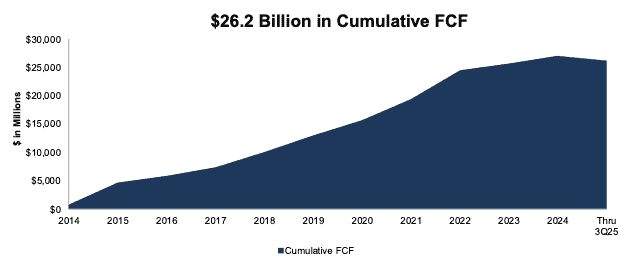

Significant Cash Flow Generation

The company has consistently generated large cash flows for decades. The company generated a cumulative $26.2 billion (47% of enterprise value) in FCF from 2014 through 3Q25. See Figure 5.

Figure 5: Cumulative Free Cash Flow Since 2014

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.