Most investors know us for our Core Earnings research, a proprietary measure of earnings that adjusts for accounting tricks that mislead investors about corporate profits. The Core Earnings Leaders Index (ticker: BCORET:IND) beat (up 27% vs 18%) the S&P 500 by 9% in 2025 and provides solid evidence that there’s alpha in our Core Earnings research.

Today, we’re sharing our proprietary measure of Free Cash Flow (FCF) and delivering unrivalled insights into the winners and losers of the AI race. Our FCF, like Core Earnings, is proprietary and incorporates critical data from footnotes. Unlike Core Earnings, FCF accounts for capex and balance sheet changes and, therefore, provides a comprehensive assessment of cash flow available to all stakeholders.

Our FCF research shows that some companies are using accounting tricks to hide how much capital they are risking to stay in the AI race. We think certain companies do not want investors to know just how much money they’re spending on AI because the numbers are huge, and at least two companies cannot keep up the pace for much longer.

In other words, they will have to drop out of the race in as little as a few months, unless they plan to seriously dilute current investors, a message that would likely knock a few percentage points off their stock price. So, we can see why they want to keep the numbers hidden. And, we’re here to give them to you anyway.

Below is a free excerpt from our latest Danger Zone report, published to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing all the details in the report because that’s for our Professional and Institutional members. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and warnings.

We hope you enjoy it. Feel free to share with friends and family.

Don’t Trust the Media’s Version of Free Cash Flow

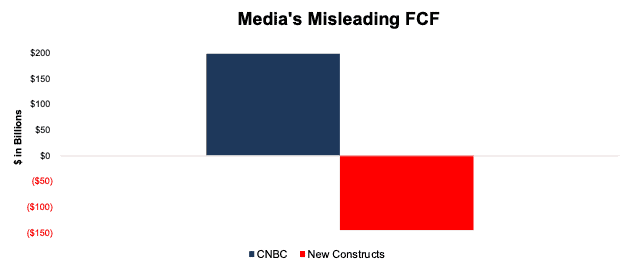

Before we get into our numbers, let’s take a look at what the media says about FCF. Those investors that trust the media are probably not aware of the tech giants’ heavy cash burn in 2025. For example, CNBC reported that four tech giants “generated a combined $200 billion in free cash flow” in 2025.

Meanwhile, our more comprehensive calculation of FCF reveals these four companies burned a combined $146 billion in FCF in 2025. See Figure 1. We’re able to get the true FCF results because of our careful footnotes research. The results are not as positive as what you see from other sources.

Figure 1: Media’s 2025 FCF For Tech Giants Is Off by $346 Billion

Sources: New Constructs, LLC and company filings

What’s the Problem?

Last November, our AI Winners & Losers report posited that the early winners of the AI arms race were the companies that generate the most cash to fuel continued AI spending. Since then, AI competition has heated up considerably and spending plans have ramped up, to say the least!

Big tech companies Alphabet, Microsoft, Meta, and Amazon recently guided for $650 billion (at midpoint of estimates) in capital expenditures on AI in 2026.

These companies can’t keep up this massive spending forever, and this report will show you exactly which of these tech emperors lack the cash to stay in the race.

Exposing The Devil in the Footnotes

We’ll reveal the big losers in the AI race in the full report, but first let us explain how we reversed a new accounting trick to uncover the truth. We had to go beyond reported earnings, income statements, balance sheets, and cash flow statements to find monstrously high hidden costs.

You won’t find research like this from other firms. Most of them do not want you to know or even think about balance sheets and FCF. They want you to just keep buying; so they keep dancing to the same bullish beat that’s dominated headlines for years. Investors only looking at reported earnings are victim of the accounting tricks that Wall Street uses to support the bullish narratives.

But, a look under the hood reveals the devil is in the balance sheet details.

Each of the companies mentioned in the report reported billions in earnings in 2025. Their debt levels look normal, under control. So, what’s the big deal? Reported earnings and balance sheets overlook a new accounting trick that adds ~$427 billion in capex hidden in off-balance sheet debt in 2025 alone.

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

I’ll keep sending information on low quality sectors, industries, or specific companies until you’re ready to start your membership.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.