When discussing the stock market, much of the attention is often directed toward identifying the right stocks to buy. However, avoiding poor investments is equally critical to growing wealth. We leverage our Robo-Analyst, the best AI Agent for investing, to identify a company’s true profits, as well as the expectations for future profit growth baked into its stock price. With these proprietary insights, we can determine the true risk/reward of any stock.

Chasing market hype and blindly following momentum without conducting due diligence is akin to purchasing a used car without checking under the hood. A polished exterior may conceal serious underlying issues, and without a thorough inspection, investors risk owning a financial lemon.

This week’s Danger Zone pick is a lemon of a stock. The company’s insiders are cashing out while its valuation continues to balloon – an alarming disconnect compounded by numerous shady related party transactions.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing the name of the company because that’s for our paying clients. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and warnings.

We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on:

- dependency on a single third-party financier,

- poor underwriting process and growing exposure to low-quality loans,

- insiders cashing out, and

- a stock valuation that implies this company will grow from one of the smallest to one of the largest companies in its industry in the world.

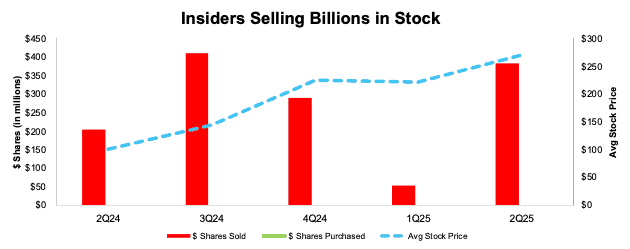

Insiders are Cashing Out While Stock Price is High

Perhaps, the largest red flag is the pace at which this company’s insiders are selling their shares while the company reports how strong the business is and how its growth trajectory is so positive.

Over the last five quarters, this company’s insiders sold a total of $1.3 billion worth of shares (equal to 2% of current market cap). Insiders sold $382 million worth of shares in 2Q25 alone so far. See Figure 4.

One important note, there have been no purchases over the same time, which is why the green bar in Figure 4 is absent.

Heavy insider selling is, historically, a signal that insiders believe their stock is significantly overvalued.

Figure 1: Shares Sold by Insiders: 2Q24 – 2Q25

Sources: New Constructs, LLC, company filings, and MarketBeat

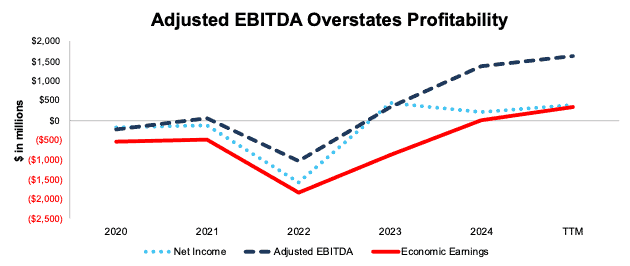

Misleading Performance Metrics

This company’s management provides an overstated view of the company’s profitability when it reports “Adjusted” EBITDA. From 2020 to the trailing-twelve-months (TTM), the company’s Adjusted EBITDA improved from -$222 million to $1.6 billion. Similarly, the company’s GAAP net income rose from -$171 million in 2020 to $398 million in the TTM.

Over the same time, the company’s economic earnings, the true cash flows of the business, rose from -$540 million to just $332 million. See Figure 2.

While economic earnings are improving, the gap between Adjusted EBITDA and economic earnings now sits at $1.3 billion in the TTM, up from just $318 million in 2020. It is a big red flag when the company’s preferred non-GAAP, or even GAAP metrics, are rising much faster than its economic earnings. We further detail the problems with Adjusted EBITDA on our website.

Figure 2: Adjusted EBITDA vs. Net Income vs. Economic Earnings: 2020 – TTM ended 1Q25

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

I’ll keep sending information on low quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this Danger Zone pick to underperform.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.