We hope you’re having a great week.

As the latest earnings season wraps up, markets are dissecting every beat, miss, and guidance update. According to FactSet, through May 16, 78% of S&P 500 companies reported a positive EPS surprise and 62% of companies reported a positive revenue surprise. Despite S&P 500 companies reporting strong earnings growth for 1Q25, volatility remains elevated as investors try to decipher strong past performance amidst an uncertain economic cycle going forward.

In an uncertain time, with headlines changing rapidly, staying informed is increasingly difficult. Noise often obscures insight, and discerning the true valuation and fundamentals of businesses can be challenging.

Our mission is to provide clear, accessible, and fundamentally sound research to help you cut through the noise. We take pride in the rigor and transparency of our work.

Our consistent track record demonstrates that our research, a.k.a. diligence, delivers alpha, regardless of market conditions.

And today, we’re delivering an example of our research for you to review for free so you can see what we offer before you buy. This Long Idea is a market leader across many segments, benefits from growth tailwinds in its industry, has a long track record of revenue and profit growth, and its stock remains cheap.

Below, we present a large excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is.

This stock offers favorable Risk/Reward based on the company’s:

- leading market share across many segments,

- rising data usage,

- global transition to 5G technologies,

- strong revenue and profits growth,

- high shareholder return, and

- cheap stock valuation.

5G Is Becoming the Mainstream

In recent years, legacy mobile access technologies like 2G/3G, GSM, and the relatively new LTE are on the decline. Meanwhile, 5G usage is on the rise because it allows people to get data faster.

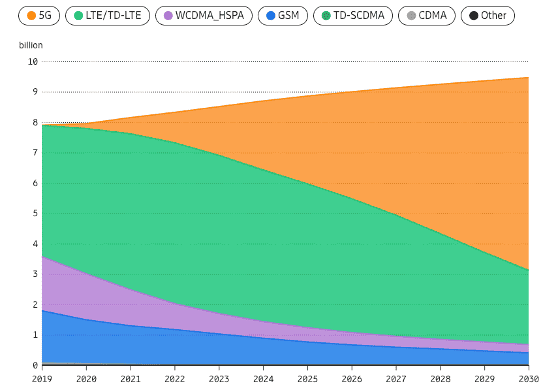

Measured by mobile subscriptions, 5G usage is forecast to rise from 2.3 billion in 2024 to 6.3 billion in 2030, while the usage of the next best mobile access technology, LTE, is forecast to decline from 5.0 billion to 2.4 billion over the same time. 5G subscriptions are expected to make up 67% of total subscriptions in 2030, which is up from 26% in 2024. See Figure 3.

With its comprehensive and differentiated products and services built to transition to 5G networks and then monetize those networks, this company is in a prime position to turn this demand into long-term profit growth.

Figure 2: Mobile Subscriptions by Technology: 2019 – 2030

Sources: Ericsson 2024 Mobility Report

Quality Fundamentals Across Decades

This company has capitalized on the rising usage and demand for data and has grown its top- and bottom-line for more than two decades.

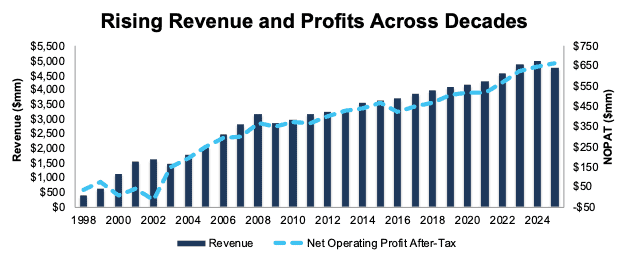

The company has grown revenue and net operating profit after-tax (NOPAT) by 10% and 12% compounded annually since fiscal 1998, respectively. See Figure 3.

More recently, the company improved its NOPAT margin from 12.3% in fiscal 2014 to 14.0% in the TTM while invested capital turns fell from 1.0 to 0.9 over the same time. Rising NOPAT margins are enough to offset falling invested capital turns though, and drive return on invested capital (ROIC) from 11.8% in fiscal 2014 to 12.3% in the TTM.

Additionally, the company’s Core Earnings grew 4% compounded annually from $431 million in fiscal 2014 to $641 million in the TTM.

Figure 3: Revenue and NOPAT Since Fiscal 1998

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

I’ll keep sending information on quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this pick to outperform.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.