We published an update on this Long Idea on October 29, 2025. A copy of the associated report is here.

After years of falling just short, the Florida Panthers have clawed their way into hockey history, winning back-to-back Stanley Cups. Their success didn’t come overnight, it was the result of grit, discipline, patient team building, and a relentless focus on fundamentals. In many ways, their journey mirrors what it takes to be a successful long-term investor.

Like the Panthers, smart investors aren’t chasing quick wins or getting swept up in market hype. They commit to a well-conceived process, do deep research, tune out the noise, and stay disciplined even when the market gets choppy. That diligence is what separates fleeting trades from lasting returns.

In today’s market, shaped by inflation concerns, geopolitical risks, and an uncertain Fed, the need for sound, fundamentals-driven investing is as strong as ever. Just as the Panthers stuck to their game plan through setbacks, investors should focus on the true cash flows of businesses rather than narratives.

Long-term success belongs to those who stay focused on and committed a sound process.

Our latest Long Idea is taking market share in its core market, has strong fundamentals, superior profitability, returns significant capital to shareholders, yet its stock trades at a steep discount.

Below, we present a large excerpt from this week’s Long Idea report, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is.

This stock offers favorable Risk/Reward based on the company’s:

- position to benefit from rising vehicle demand,

- rising market share in core market,

- quality fundamentals,

- superior profitability compared to peers,

- strong cash flow generation and shareholder return, and

- cheap stock price.

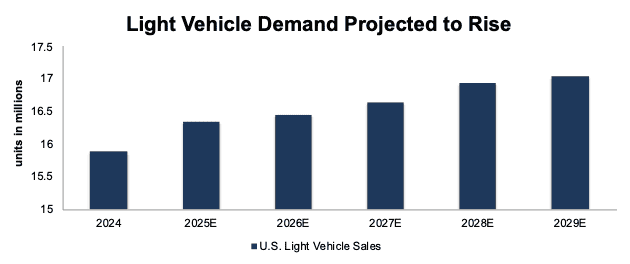

Demand for New Vehicles Forecasted to Grow in the U.S.

Despite the ongoing challenges posed by rising prices, high interest rates, and the uncertain effects of tariffs, light-vehicle demand in the U.S. is projected to experience consistent year-over-year (YoY) growth over the next five years. Per Morningstar’s Motors and Markets 2025: United States report, light duty vehicle sales are projected to grow 3% year-over-year in 2025, followed by ~1-2% YoY growth between 2026 and 2029, which would result in ~17.1 million vehicles sold in 2029. See Figure 1.

Given that 75% of the company’s wholesale vehicle sales in the first three months of 2025 were in the U.S., this company is in a great position to take advantage of this positive trend.

Figure 1: Projected Global Light-Duty Vehicle Demand: 2024 – 2029E

Sources: New Constructs, LLC and Morningstar

Potential for 10%+ Yield

After suspending its dividend during COVID-19, the company reinstated a dividend of $0.09/share in 3Q22. Since then, the company increased its dividend to $0.15/share in 2Q25. When annualized, this dividend provides investors a 1.2% yield. Since 2022, the company paid $1.8 billion (4% of market cap) in cumulative dividends.

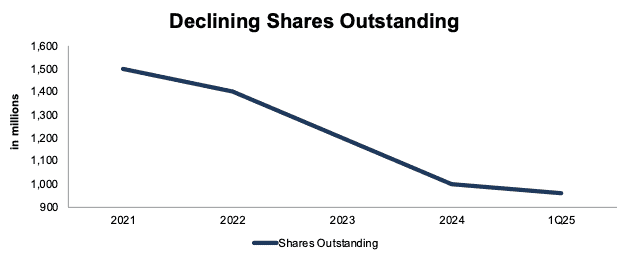

The company also returns capital to shareholders through share repurchases. From 2022 through 1Q25, the company repurchased $22.7 billion (48% of market cap) worth of shares.

In February 2025, the company increased the capacity under its existing share repurchase program by $6 billion, to an aggregate $6.3 billion worth of shares. Additionally, the company approved an accelerated share repurchase (ASR) program of $2 billion. As of March 31, 2025, the company is authorized to repurchase up to $4.3 billion worth of shares.

Should it repurchase shares at its 3-year average repurchase rate, it would deplete its remaining repurchase authorization, $4.3 billion, in 2025. $4.3 billion equals 9.1% of the current market cap.

When combined, the dividend and share repurchase yield could theoretically reach 10.3%.

The company’s repurchases have also meaningfully reduced its shares outstanding from 1.5 billion in 2021 to 961.4 million at the end of 1Q25. See Figure 2.

Figure 2: Shares Outstanding: 2021 – 1Q25

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

I’ll keep sending information on quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this pick to outperform.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.