In this week’s Long Idea, we feature a midstream operator that holds long-term contracts in the Permian and DJ Basins, among others. With limited commodity exposure and a strong asset base, this company is well-positioned to benefit from sustained U.S. energy production.

Best of all, this stock’s valuation gives the company no credit for its highly predictable cash flows and generous capital return history.

Below, we provide an excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is. Always let us know how we can provide more value to you.

This stock presents quality Risk/Reward based on the company’s:

- expanded gathering, processing, and water-handling capacity,

- strong cash flows supported by fee-based contracts,

- superior capital return versus peers, and

- cheap valuation.

Strong Demand for Oil and Gas

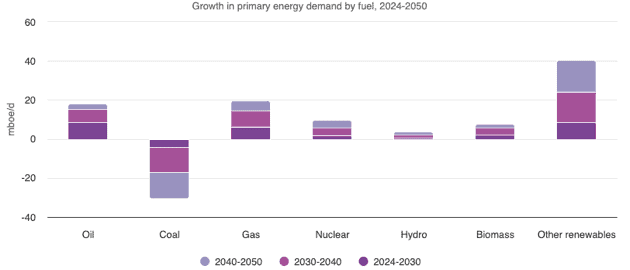

OPEC’s World Oil Outlook projects global primary energy demand will rise from 308 million barrels of oil equivalent per day (mboe/d) in 2024 to 378 mboe/d by 2050, or an increase of 23%.

This growth is spread across all fuel types, except coal, which is the only fuel type projected to see a drop in demand through 2050. Oil demand is expected to rise by 18 mboe/d and natural gas demand is expected to grow by 20 mboe/d through 2050. See Figure 1.

Figure 1: Growth in Global Energy Demand by Fuel Type: 2024 – 2050

Sources: OPEC

Stable Cash Flows Secured by Fee-Based Contracts

We’ve mentioned the key advantage of a “toll-taking” business model several times before, and that advantage is on full display in this company’s operations.

95% of the company’s wellhead natural-gas volume and 100% of crude oil and produced-water throughput are serviced under fee-based contracts, where fixed and variable fees are received based on the volume or thermal content of the natural gas and on the volume of NGLs, crude oil, and produced water the company gathers, processes, treats, transports, or disposes.

These fee-based contracts provide commodity price protection, as fees are based on volume, not oil or gas prices.

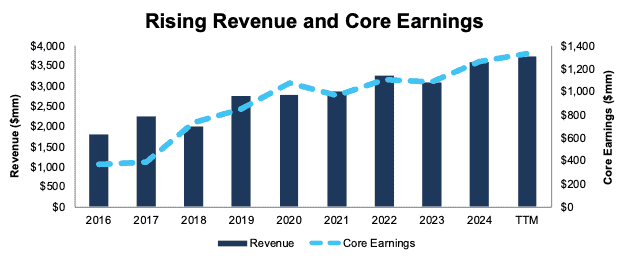

Quality Fundamentals

The fee-based contracts result in a resilient business model. The company has grown revenue and Core Earnings by 9% and 16% compounded annually from 2016 through the trailing-twelve-months (TTM) ended 3Q25. See Figure 3. The company’s net operating profit after-tax (NOPAT) margin increased from 40% in 2016 to 47% in the TTM ended 3Q25, while invested capital turns improved slightly from 0.25 to 0.29 over the same time. Rising margins and IC turns drives the company’s return on invested capital (ROIC) from 10% in 2016 to 14% over the TTM ended 3Q25.

Figure 3: Revenue and Core Earnings: 2016 – TTM ended 3Q25

Sources: New Constructs, LLC and company filings

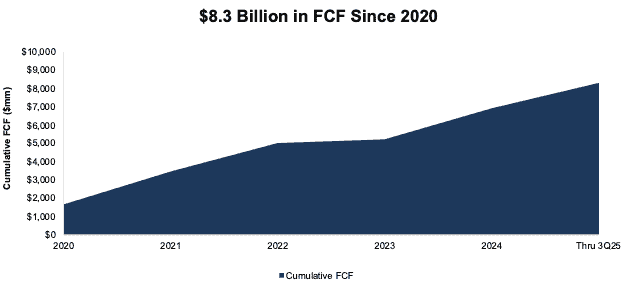

Strong Cash Flows Support Distributions

The company paid out $6.2 billion in distributions and repurchases from 2020 through 3Q25. Over the same time, the company generated a cumulative $8.3 billion (35% of enterprise value) in free cash flow (FCF), or more than enough to cover the distributions. See Figure 6.

Figure 6: Cumulative Free Cash Flow Since 2020

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

I’ll keep sending information on quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this pick to outperform.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.