Earnings season is well underway, with major companies giving us the latest insight into the direction of the economy. Tesla (TSLA) posted one of its weakest quarters in history, while Alphabet (GOOGL) delivered strong results, with double digit growth rates in Search, YouTube, and Cloud revenue.

Earnings season is primetime for speculative behavior. In some cases, companies report disappointing results, yet their stock prices soar, as they’re driven more by hype than fundamentals. Meme stocks and short-term momentum plays generate quick profits for some, even without any earnings release. However, they also carry significant downside risk. Don’t forget how Gamestop (GME) crashed down after it went on its miracle run back in 2021.

In this environment, it’s important to stay diligent and avoid the landmines that can blow up your portfolio. We highlight the riskiest and most dangerous stocks in our Danger Zone reports.

This week’s Danger Zone pick is also on the Zombie Stock list, which means the company has less than 24 months of runway before it goes bankrupt or needs more capital. Apart from burning cash at a high rate, the company’s debt is ballooning, it hasn’t generated any profits since going public, and the stock price is very expensive.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing the name of the company because that’s for our paying clients. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and warnings.

We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on:

- consistently high cash burn and a short cash runway,

- rising debt levels,

- consistently high expenses relative to revenue,

- a stock valuation that implies drastic margin improvement while also growing at 2.5x its peers.

Zombie Stocks Are Inherently Risky

Unprofitable companies with fast-depleting cash reserves are risky investments in any market. These risks are higher when the cost of raising capital is higher. This company’s weighted average cost of capital (WACC) has increased from 11.4% in 2017 to 12.4% in the TTM.

When we first named this company a Zombie Stock in September 2022, we noted it could sustain its cash burn for just two months.

The company has prolonged its runway by taking on more debt, a practice that is increasingly needed to fund the cash-burning business model (installing solar equipment for little to no payment and collecting fees over 20-30 years). The additional debt helped grow the customer base but did nothing to fix the cash-burning operations.

Massive Cash Burn Continues

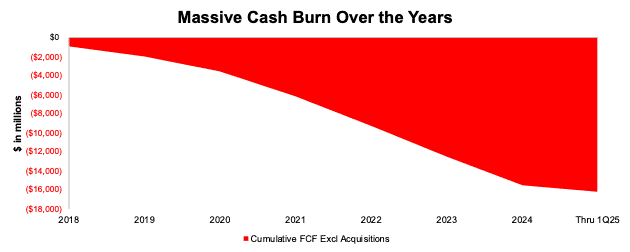

This company’s free cash flow (FCF) has been negative on an annual basis in every year of our model (since 2018). On a quarterly basis, the company generated a positive FCF in just one (4Q24) out of 25 quarters.

Since 2018, the company has burned through a cumulative $16.2 billion (93% of enterprise value) in FCF excluding acquisitions. In the TTM, the company’s cash burn sits at $2.5 billion.

Figure 1: Cumulative Free Cash Flow: 2018 Through 2Q24

Sources: New Constructs, LLC and company filings

Profitless Revenue Generation

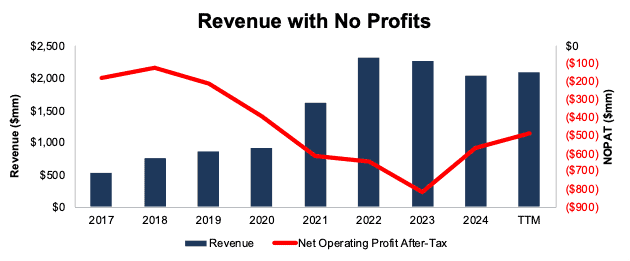

This company’s net operating profit after tax (NOPAT) has been negative in every year in our model as well. The company’s NOPAT fell from -$180 in 2017 to -$490 in the TTM, while its revenue increased from $533 million to $2.1 billion over the same time.

In the TTM ended 1Q25, the company generated a -24% NOPAT margin and a -2% return on invested capital (ROIC).

Figure 2: Revenue and NOPAT: 2017 – TTM

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

I’ll keep sending information on low quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this Danger Zone pick to underperform.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.