This week’s Long Idea features a company with a strong hub-and-spoke network, single-plane fleet strategy, and industry-leading operations. These competitive advantages position the company to meet growing demand and profit from a supply/demand imbalance across the broader industry.

Despite these advantages and the firm’s history of profit growth, the stock price implies a permanent decline in profits. The best opportunities arise when strong profits and growth prospects collide with low expectations.

Below, we provide an excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is. Always let us know how we can provide more value to you.

This stock presents quality Risk/Reward based on the company’s:

- strategically located international hub,

- ultra‑low‑cost operating structure with full‑service economics,

- industry‑leading on‑time performance and profitability,

- consistent profit growth,

- attractive capital return potential, and

- cheap stock valuation that implies a permanent profit decline.

Growing Appetite for Air Travel

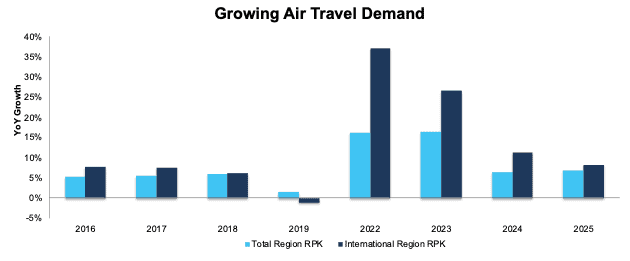

This region’s international revenue passenger kilometers (RPKs), a measure of passenger demand, grew by an average of 5.1% per year between 2016 and 2019, while total regional RPKs grew by an average of 4.5% per year over the same time.

From 2022-2025, after the global COVID-19 shut downs, international RPKs and total regional RPKs have grown by an average of 20.8% and 11.4%, respectively. See Figure 1.

Figure 1: Year-Over-Year Regional RPK Growth: 2016-2025 – Excluding COVID (2020-2021)

Sources: IATA

*We exclude COVID’s impact in 2020 and 2021 on air travel for visualization purposes. For reference, this region’s total RPK fell 57% and 23% YoY in 2020 and 2021, respectively while the region’s international RPK fell 76% and 40% YoY over the same time.

Leading Profitability and Strong Growth

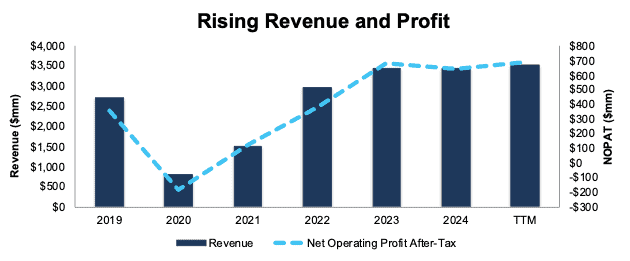

With its central location, international focus, and optimized fleet, this company has a long history of profit growth.

Since the COVID-19 induced low of 2020, the company has grown revenue 37% compounded annually through the trailing-twelve-months (TTM) ended 3Q25. Over the same time, the company improved its net operating profit after-tax (NOPAT) from -$179 million to $689 million.

The company’s NOPAT margin increased from -22% in 2020 to 20% in the TTM ended 3Q25, while invested capital turns improved from 0.3 to 0.8 over the same time. Rising margins and IC turns drives the company’s return on invested capital (ROIC) from -6% in 2020 to 16% over the TTM ended 3Q25.

Longer term, the company has grown both revenue and NOPAT by 5% compounded annually since 2011.

Figure 4: Revenue and NOPAT: 2019-TTM ended 3Q25

Sources: New Constructs, LLC and company filings

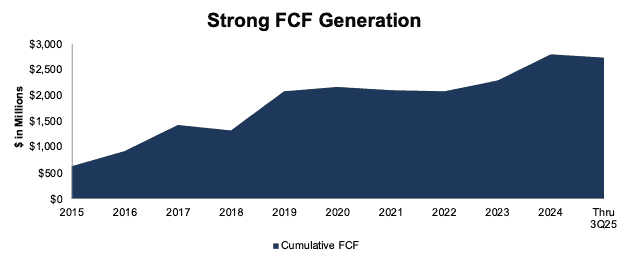

Consistent Cash Flow Generation

Since 2015, the company has generated $2.7 billion (36% of enterprise value) in cumulative free cash flow (FCF). Over the TTM, the company generated $73 million in FCF.

Figure 6: Cumulative Free Cash Flow Since 2015

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

I’ll keep sending information on quality sectors, industries, or specific companies until you’re ready to start your membership.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.