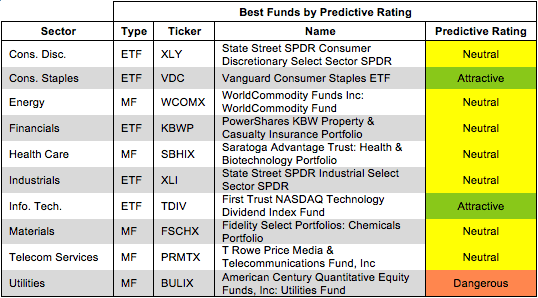

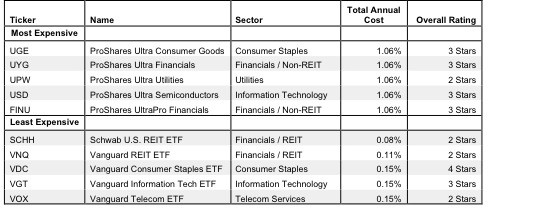

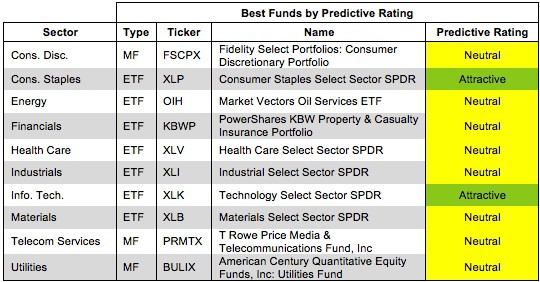

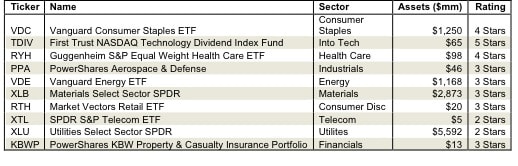

Rating Breakdown: Best & Worst ETFs & Mutual Funds by Sector (October 2013)

This report focuses on my top picks and pans for all sector funds for October 2013. I will follow this summary with a detailed report on each sector.

David Trainer, Founder & CEO