Joseph Pacelli, Associate Professor at Harvard Business School hosted CEO David Trainer along with Braden Dennis (Fiscal.ai) and Ken Sena (Aiera) for a panel discussion on the impact of AI on the investing business. Key topics:

- AI will replace many analysts and portfolio managers,

- How much the market is understating how fast AI is coming,

- High quality data is absolutely essential to building reliable AI,

- and more.

David shared detailed perspectives on what it takes to build an AI platform that delivers truly actionable investment insights based on his experience building FinSights, our AI agent built on and by Google Cloud.

“Having worked closely with Google for several months to create FinSights, I can tell you the AI wave is moving fast and will hit the investing business like a tsunami,“ said David Trainer. “AI is learning the same way as a human analyst, but doing so at a much faster pace.” See Figure 1, below, from David’s slide deck.

Figure 1: AI Will Follow the Same Evolutionary Path as Human Analysts and Portfolio Managers

Sources: New Constructs, LLC

For real-time evidence of the importance of superior fundamental data and how it can teach machines to generate novel alpha, see the strong outperformance of the Bloomberg indices powered by our superior data.

The Bloomberg New Constructs Core Earnings Leaders Index, which allocates based on Earnings Capture and Core Earnings, beat the S&P 500 by over 35% over the past five years. The Index (ticker: BCORET:IND) was up 117% while the S&P 500 was up 81%.

Figure 2: Bloomberg New Constructs Core Earnings Leaders Index Outperforms S&P 500: Last 5 Years

Sources: Bloomberg as of November 21, 2025

Note: Past performance is no guarantee of future results.

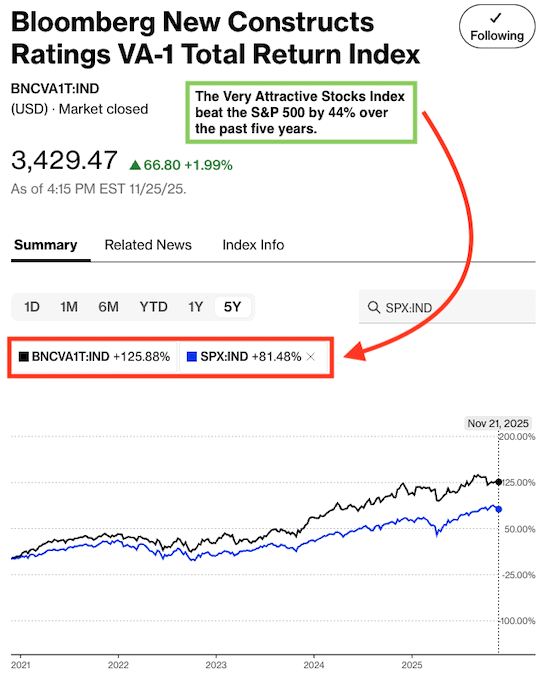

The “Very Attractive Stocks” Index, which allocates to stocks that get a Very Attractive rating, beat the S&P 500 by 44% over the last five years. Bloomberg’s official name for the index is Bloomberg New Constructs Ratings VA-1Index (ticker: BNCVAT1T:IND). Figure 3 shows it was up 126% while the S&P 500 was up 81%.

Figure 3: Very Attractive-Rated Stocks Strongly Outperform the S&P 500: Last Five Years

Sources: Bloomberg as of November 21, 2025

Note: Past performance is no guarantee of future results.

Our “Core-Earnings Weighted S&P 500” Index, which weights the largest 500 U.S. companies by Core Earnings instead of market cap, beat the S&P 500 by 27% over the past five years. Bloomberg’s official name for the index is Bloomberg New Constructs 500 Total Return Index (ticker: B500NCT:IND). Figure 4 shows it was up 108% while the S&P 500 was up 81%.

Figure 4: Bloomberg New Constructs 500 Index Strongly Outperforms the S&P 500: Last Five Years

Sources: Bloomberg as of November 21, 2025

Note: Past performance is no guarantee of future results.

This article was originally published on November 26, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.