How about a great day for the market? It is about time.

The market jumped after learning tariffs will be more targeted than originally feared. Investors appear hopeful a global trade war can be avoided. Between then and now, we’ll get an update on The Fed’s preferred inflation gauge on March 28, which could be the next catalyst in determining the direction of the market.

Momentum and hype trading may pick back up, but we’re here to help you not fall back into that trap. Even with the market’s terrible YTD performance, many stocks are still overvalued.

Our Danger Zone picks specifically identify stocks you must avoid. These are companies with poor fundamentals and overvalued stock prices, recipes for disaster.

This week’s Danger Zone pick is no exception. This company is one of the very few unprofitable companies in a profitable industry, yet its stock price implies it will reverse years of negative profits and become one of the biggest companies in the industry. We believe the downside risk at current prices could be 100%.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. You can buy the full report a la carte here.

We’re not sharing the name of the company because that’s for our paying clients. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and the smartest warnings.

We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

Since adding this stock to the Zombie Stock list in November 2022, it has outperformed as a short by 62%, falling 20% while the S&P 500 is up 42%.

Given the company’s consistent unprofitability and dwindling customer base, we remain steadfast in our belief that the company cannot come close to meeting the future cash flow expectations baked into its stock price.

What’s Working

After missing EPS estimates in its 4Q24 earnings release, there were few positives for this company’s business. One of them was the company’s ability to cut costs in 2024. Specifically, the company’s cost of goods sold, customer service and merchant fees, and selling, operations, technology, general and administrative costs each decreased YoY in 2024. As a result, total operating expenses plus cost of goods sold fell from 107% of revenue in 2023 to 104% of revenue in 2024.

It’s worth noting that the company’s total costs are still greater than the company’s revenue, so the slight cost improvements are not enough to turn this company into a profitable company.

What’s Not Working

Despite cutting costs, this company’s top-line actually fell 1% YoY in 2024. The company’s fundamentals still look very poor, and the company can’t sustain its current cash burn for much longer, as we’ll show below.

Ongoing Cash Burn

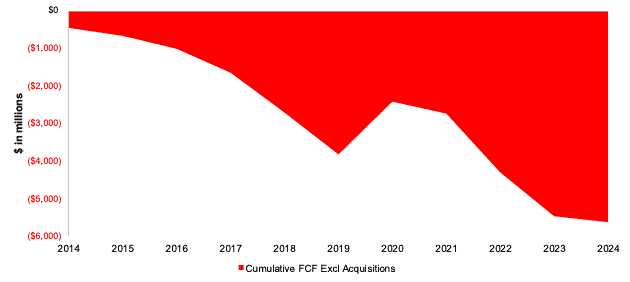

As noted above, the company has slowed its cash burn. But make no mistake, it is still burning cash. The company’s FCF has been negative on an annual basis every year except one since 2014. The one year of positive FCF was 2020, when the company benefited from a COVID-induced boom in 2020. From 2014 through 2024, the company has burned through a cumulative $5.6 billion (67% of enterprise value) in FCF excluding acquisitions. See Figure 3.

Figure 3: Cumulative Free Cash Flow: 2014 Through 2024

Sources: New Constructs, LLC and company filings

Continues to Lose Customers

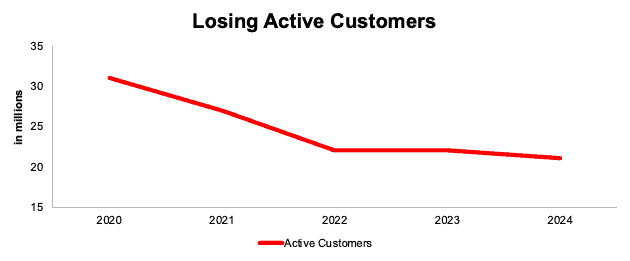

This company’s active customers, which is the total number of individuals who have purchased at least once during the last 12 months, decreased from 31 million in 2020 to 21 million in 2024. See Figure 4.

Figure 4: Active Customer Base: 2020 – 2024

Sources: New Constructs, LLC and company filings

Additionally, the company’s number of orders delivered fell from 61 million in 2020 to 40 million in 2024. Not only is the company unable to retain and attract more customers, but their customers are also ordering fewer times.

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.