In this week’s Long Idea, we feature an industry leader with a long track record of profits, a healthy balance sheet, and high returns on invested capital. The company also leads in addressing the affordability crisis in the U.S. housing market.

It’s hard to find companies this good with cheap stock valuations in this market. But, we did. The market expects the company’s profits to grow just 10% from TTM levels over the remaining life of the company. This expectation seems overly pessimistic given that the company has grown NOPAT by 7%, 15%, and 4% compounded annually over the last five, ten, and twenty years, respectively.

Below, we provide an excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is. Always let us know how we can provide more value to you.

This stock presents quality Risk/Reward based on the company’s:

- leading market share,

- geographic diversification,

- focus on more affordable homes,

- strong capital return and free cash flow (FCF), and

- cheap stock valuation.

Focused on Affordability

As we noted in a recent Long Idea report, new homes have rarely been this unaffordable.

This company aims to help this problem with a focus on cheaper entry-level homes. The company profitably builds homes that are cheaper than the national average. In the quarter ended December 31, 2025, the company’s average sales price was 27% below the national average.

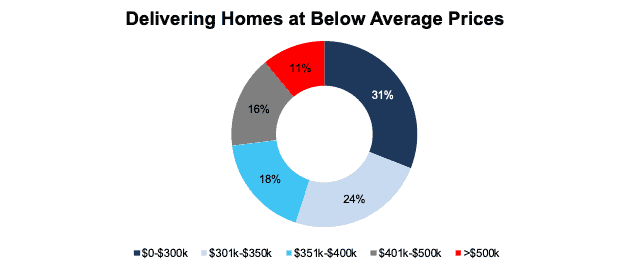

In calendar 2025, 73% of the company’s homes closed were priced below $400,000. See Figure 2.

For reference, the average sales price of new homes sold in the U.S. in October 2025 was $498,000.

Figure 2: Homes Closed by Average Home Sales Price: Calendar 2025

Sources: New Constructs, LLC and company presentation

Significant Cash Flow Generation

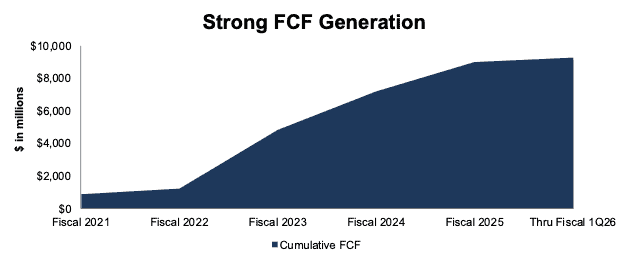

Since fiscal 2021, the company has generated $9.3 billion (21% of enterprise value) in cumulative free cash flow (FCF). Over the TTM, the company generated $3.6 billion in FCF.

Figure 5: Cumulative Free Cash Flow Since Fiscal 2021

Sources: New Constructs, LLC and company filings

Strong Balance Sheet and Credit Rating

The company maintains its industry leading position throughout economic cycles in part due to its strong balance sheet.

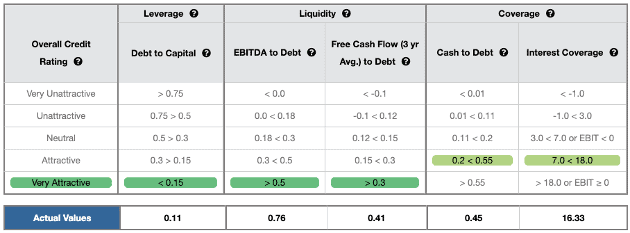

It earns a Very Attractive Overall Credit Rating, which is driven by Very Attractive ratings in the Debt to Capital, EBITDA to Debt, and Free Cash Flow (3 yr Avg.) to Debt metrics that make up our overall Credit Rating.

The company also earns an Attractive rating in Cash to Debt and Interest Coverage, the other two metrics that make up our Credit Ratings. Even if economic conditions deteriorate, the company’s strong financial footing secures its operations for the foreseeable future.

Figure 7: Credit Rating Details

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

I’ll keep sending information on quality sectors, industries, or specific companies until you’re ready to start your membership.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.