The Consumer Staples sector ranks first out of the ten sectors as detailed in my sector rankings for ETFs and mutual funds. It gets my Attractive rating, which is based on an aggregation of the ratings of 9 ETFs and 9 mutual funds in the Consumer Staples sector as of October 9, 2012. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

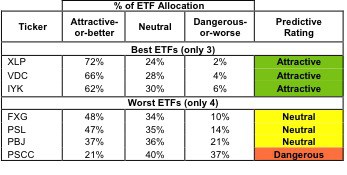

Figures 1 and 2 rank the seven ETFs and eight mutual funds in the sector that meet our ranking and liquidity standards. Not all Consumer Staples sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 23 to 120), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Consumer Staples sector, investors need a predictive rating based on (1) stock ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the Consumer Staples sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

See ratings and reports on all ETFs and mutual funds in this sector on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Rydex S&P Equal Weight Consumer Staples ETF (RHS) is excluded from Figure 1 because its total net assets (TNA) are below $100 million and does not meet our liquidity standards.

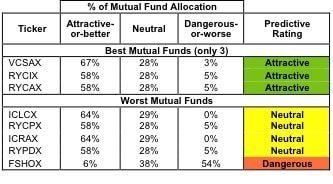

Figure 2: Mutual Funds with the Best & Worst Ratings

* Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

* Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

ICON Funds: ICON Consumer Staples Fund (ICLEX) is excluded from Figure 2 because its total net assets (TNA) are below $100 million and does not meet our liquidity standards.

Consumer Staples Select Sector SPDR (XLP) is my top-rated Consumer Staples ETF and Vanguard World Funds: Vanguard Consumer Staples Index Fund (VCSAX) is my top-rated Consumer Staples mutual fund. Both earn my Attractive rating.

PowerShares S&P SmallCap Consumer Staples Portfolio (PSCC) is my worst-rated Consumer Staples ETF and Fidelity Select Portfolios: Construction & Housing Portfolio (FSHOX) is my worst-rated Consumer Staples mutual fund. Both earn my Dangerous rating.

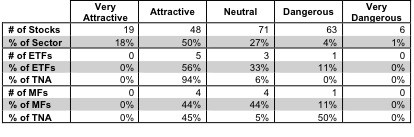

Figure 3 shows that 67 out of the 207 stocks (over 68% of the total net assets) held by Consumer Staples ETFs and mutual funds get an Attractive-or-better rating. Five out of nine Consumer Staples ETFs (94% of total net assets) and four out of nine Consumer Staples mutual funds (45% of total net assets) get an Attractive-or-better rating.

The takeaway is: there are Attractive stocks in the Consumer Staples sector, and investors should focus on the ETFs and mutual funds that hold them.

Figure 3: Consumer Staples Sector Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Consumer Staples ETFs and mutual funds. Although Consumer Staples is an Attractive sector right now, only 50% of Consumer Staples ETFs and mutual funds are Attractive. Five ETFs and four mutual funds in the Consumer Staples sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating.

Phillip Morris international (PM) is one of my favorite stocks held by Consumer Staples ETFs and mutual funds and earns my Very Attractive rating. When Phillip Morris International split off from Altria Group in 2008, many analysts noted that the international market for cigarettes is likely to grow more quickly than the domestic market. Phillip Morris International has not disappointed. The company has enjoyed growth in revenue and operating margins every year since 2009. The best part about Phillip Morris’ growth NOPAT is growing faster than invested capital, which means that the company’s operations over the last three years have grown even more efficient and profitable. This is a company that is truly generating value for shareholders. Yet, its current valuation of $92.20 implies that Phillip Morris’s after-tax profits will decline permanently by 3% and never grow again. That pessimistic valuation does not seem warranted for a company with a dominant worldwide brands, an addictive product, and consistent profitability. You may have concerns about the health risks of cigarettes, but the risk vs. reward balance for Phillip Morris makes PM a Very Attractive stock buy.

Snyder’s-Lance, Inc. (LNCE) is one of my least favorite stocks held by Consumer Staples ETFs and mutual funds and earns my Very Dangerous rating. Lance acquired Snyder’s of Hanover near the end of 2010. The merger ballooned invested capital by $842.6 million, nearly 200% of its pre-merger level. Was this a profitable allocation of shareholder capital? The answer is a resounding no. On top of the price paid to acquire intangible assets such as trade names and distribution routes, the purchase price included $283.3 million allocated to Goodwill, in other words, a premium on which the acquisition must generate a return if it is to create value for shareholders. Investors demand a return on invested capital (ROIC) that exceeds the company’s cost of capital; however, in the first full year of combined operations, LNCE generated operating profit growth of only $16.5 million, or 44.2% higher than before the acquisition took place. $16.5 million of new operating profits on an $842.6 million investment equates to a measly 1.9% incremental return. Such a substantial misallocation of capital means that LNCE has destroyed shareholder value, and is one of the reasons the company gets my Very Dangerous rating. The post-merger company has a ROIC of only 4.1%, down from 6.9% before the merger. LNCE’s profitability went from mediocre to value-destructive in one fell swoop. LNCE is a stock to avoid until management becomes a better steward of shareholder capital.

122 stocks of the 3000+ I cover are classified as Consumer Staples stocks, but due to style drift, Consumer Staples ETFs and mutual funds hold 207 stocks.

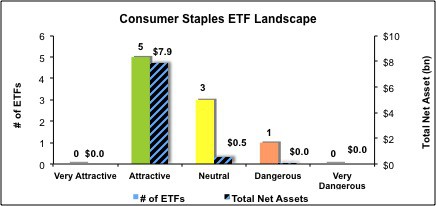

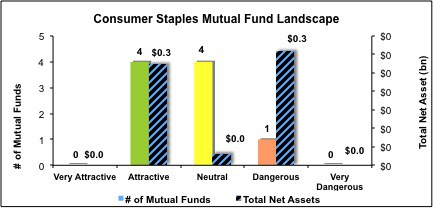

Figures 4 and 5 show the rating landscape of all Consumer Staples ETFs and mutual funds.

Our Sector Rankings for ETFs and Mutual Funds report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Review my full list of ratings and rankings along with reports on all nine ETFs and nine mutual funds in the Consumer Staples sector.

Disclosure: I own PM. I receive no compensation to write about any specific stock, sector or theme.