Earnings season kicks off in full force next week.

I’ll get right to the point: we call it “propaganda” season because Wall Street insiders make up their own numbers to help them sell more stock because selling stock is how they make money.

Whether they call them “non-GAAP earnings”, “adjusted” earnings, whisper numbers, or Street Earnings, they are all a smoke screen for the truth.

We’ve done the homework to clear the smoke and get you the right numbers.

In our latest report, we show:

- the prevalence and magnitude of overstated GAAP Earnings in the S&P 500,

- that Street Earnings (and GAAP earnings) are flawed and misleading,

- how Core Earnings generate novel alpha, and

- the five S&P 500 companies most likely to miss 3Q25 earnings.

To give you a sense of just how powerful our research is for you, we present a large excerpt from this report, which is available to Pro and Institutional members. You can buy the full report a la carte here.

GAAP Earnings Overstate Core Earnings for Over 1/3 of the S&P 500

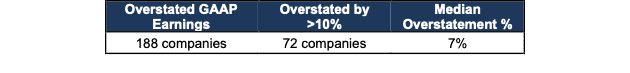

In the trailing-twelve-months (TTM) as of October 2, 2025, 38% of the companies in the S&P 500 reported GAAP Earnings that are higher than Core Earnings. The 188 companies with overstated GAAP Earnings make up 42% of the market cap of the S&P 500 as of October 2, 2025.

The median amount that GAAP Earnings overstate Core Earnings is 7%, per Figure 1.

Figure 1: Median S&P 500 GAAP Earnings Overstated by 7%

Sources: New Constructs, LLC and company filings.

S&P 500 Companies Most Likely to Miss This Quarter

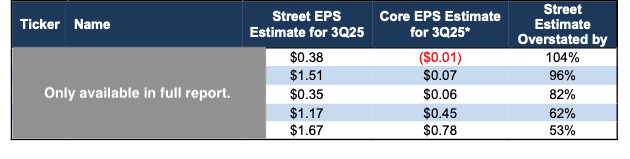

Figure 4 in the full report shows the S&P 500 companies with an Unattractive or Very Unattractive Stock Rating that are likely to miss calendar 3Q25 earnings because their Street EPS estimates are overstated. Because investors and analysts tend to anchor their earnings projections to historical results, errors in historical Street EPS lead to errors in Street EPS estimates.

Figure 4: S&P 500 Companies Likely to Miss 3Q25 EPS Estimates

Sources: New Constructs, LLC, company filings, and SeekingAlpha

*Assumes Street Distortion as a percentage of Core EPS is the same in 3Q25 as the TTM ended 2Q25.

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all our Earnings Preview reports.

Interested in starting your membership to get access to all our research? Get more details here.