Earnings season is here again.

We call it “propaganda” season because GAAP earnings, non-GAAP earnings, whisper numbers, and Street Earnings – whatever you want to call them – are misleading.

Companies and Wall Street Analysts manipulate earnings estimates either by hiding one-time gains and losses or by exploiting accounting loopholes.

We have a solution to this problem. And, a way for you to make money from it, now.

Rather than rely on flawed numbers from people trying to sell you stock, we leverage our Robo-Analyst AI Agent to scour the footnotes and MD&A of financial filings to calculate Core Earnings, a proven superior measure of earnings.

We’ve crunched the numbers, and in our latest report, we show:

- the prevalence and magnitude of understated GAAP Earnings in the S&P 500,

- that Street Earnings (and GAAP earnings) are flawed and misleading,

- how Core Earnings generate novel alpha, and

- the five S&P 500 companies most likely to beat 3Q25 earnings.

To give you a sense of just how much our research can help you, we present a large excerpt from the report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the tickers from this report but we are happy to share our hard work because we want you to see how good our research is.

GAAP Earnings Understate Core Earnings for Over Half of the S&P 500

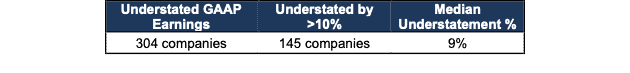

In the trailing-twelve-months (TTM) as of 10/2/25, 61% of the companies in the S&P 500 reported GAAP Earnings that are lower than Core Earnings. The 304 companies with understated GAAP Earnings make up 57% of the market cap of the S&P 500 as of October 2, 2025.

The median amount that GAAP Earnings understate Core Earnings is 9%, per Figure 1.

Figure 1: Median S&P 500 GAAP Earnings Understated by 9%

Sources: New Constructs, LLC and company filings.

S&P 500 Companies Most Likely to Beat This Quarter

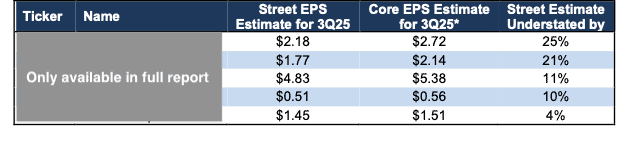

Figure 4 in the full report shows the S&P 500 companies with an Attractive or Very Attractive Stock Rating that are likely to beat calendar 3Q25 earnings because their Street EPS estimates are understated. Because investors and analysts tend to anchor their earnings projections to historical results, errors in historical Street EPS lead to errors in Street EPS estimates.

Figure 4: S&P 500 Companies Likely to Beat 3Q25 EPS Estimates

Sources: New Constructs, LLC, company filings, and SeekingAlpha

*Assumes Street Distortion as a percentage of Core EPS is the same in 3Q25 as the TTM ended 2Q25.

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all our Earnings Preview reports.

Interested in starting your membership to get access to all our research? Get more details here.