Let’s get to the point: we call earnings season “propaganda” season because Wall Street insiders make up their own numbers to help them sell more stock because selling stock is how they make big money.

It’s time to protect your portfolio.

Rather than rely on flawed GAAP or Street Earnings, we use FinSights, our AI agent built by Google Cloud, to find companies most likely to miss consensus earnings. Like all of our research, FinSights is fueled by the proprietary data from our Robo-Analyst AI, which analyzes the footnotes and MD&A of financial filings to calculate Core Earnings, a proven superior measure of earnings.

We’ve crunched the numbers and identified 5 stocks most likely to miss their numbers next quarter. In our latest report, we show:

- the prevalence and magnitude of overstated GAAP Earnings in the S&P 500,

- that Street Earnings (and GAAP earnings) are flawed and misleading,

- how Core Earnings generate novel alpha, and

- the five S&P 500 companies most likely to miss calendar 4Q25 earnings.

To give you a sense of just how much our research can help you, we present a large excerpt from the report published this week to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the tickers from this report, but we are happy to share our hard work because we want you to see how good our research is.

GAAP Earnings Overstate Core Earnings for Over 1/3 of the S&P 500

In the trailing-twelve-months (TTM) as of 1/4/26, 35% of the companies in the S&P 500 reported GAAP Earnings that are higher than Core Earnings. The 176 companies with overstated GAAP Earnings make up 44% of the market cap of the S&P 500 as of January 4, 2026.

The median amount that GAAP Earnings overstate Core Earnings is 7%, per Figure 1.

Figure 1: Median S&P 500 GAAP Earnings Overstated by 7%

Sources: New Constructs, LLC and company filings.

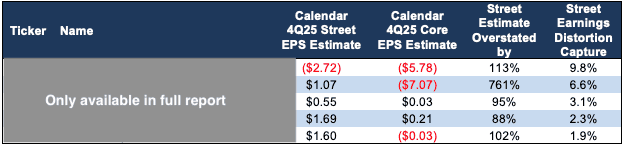

S&P 500 Companies Most Likely to Miss Calendar 4Q25 Earnings

Figure 3 in the full report shows the S&P 500 companies with an Unattractive or Very Unattractive Stock Rating that are likely to miss calendar 4Q25 earnings because their Street EPS estimates are too high.

Figure 3: S&P 500 Companies Likely to Miss Calendar 4Q25 EPS Estimates

Sources: New Constructs, LLC, company filings, and Yahoo Finance

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all our Earnings Preview reports.

Interested in starting your membership to get access to all our research? Get more details here.